Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

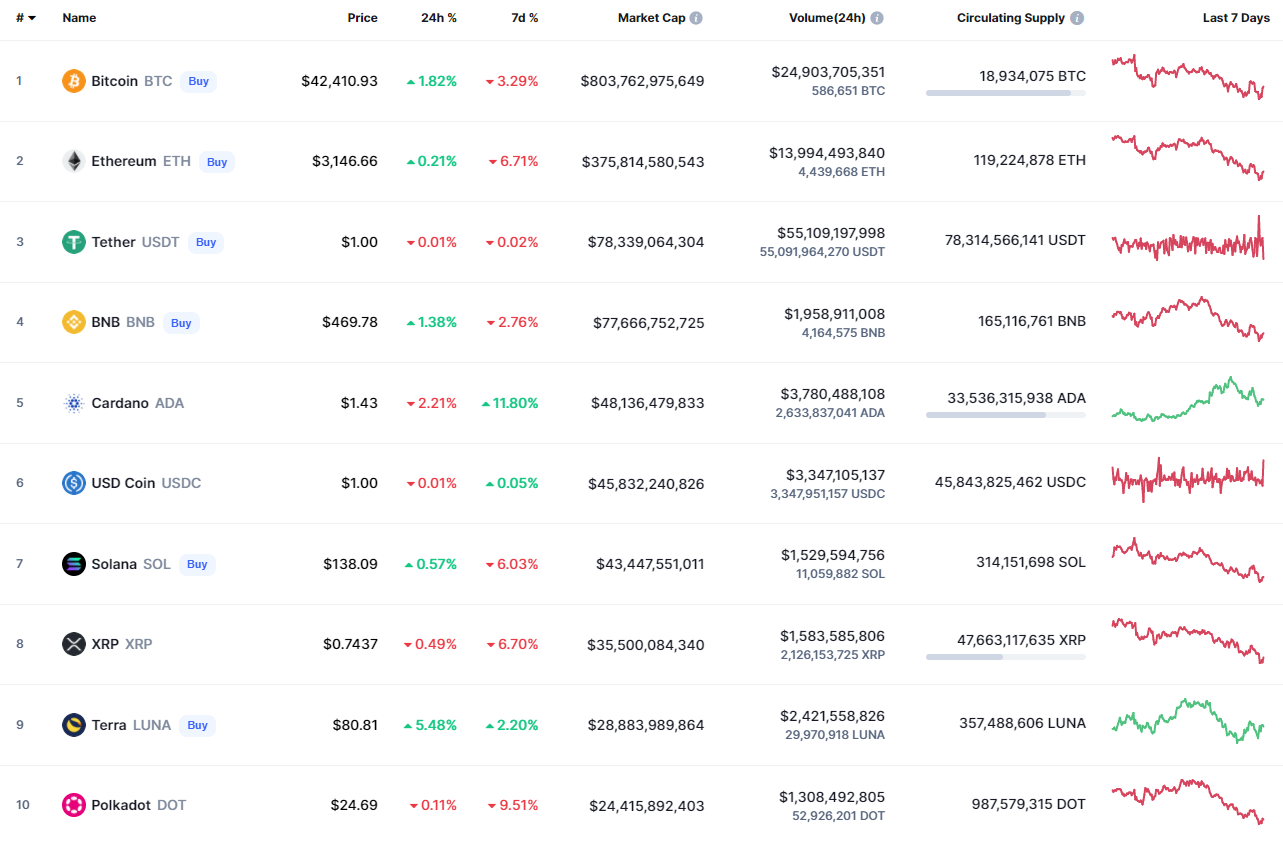

Buyers are trying to seize the initiative as some coins have come back to the green zone.

BTC/USD

Despite the fall at the beginning of the day, Bitcoin (BTC) has managed to recover, rising by 1.82%.

On the daily chart, Bitcoin (BTC) keeps trading within the wide channel between the support at $39,573 and the resistance at $45,478. At the moment, neither bulls nor bears are dominating, which is also confirmed by the low trading volume.

If buyers can approach $43,000 and fix above it, there is a good chance of seeing slight growth to $45,000.

Bitcoin is trading at $42,342 at press time.

ETH/USD

Ethereum (ETH) has gained less than Bitcoin (BTC) as the main altcoin price has risen by 0.32%.

Until Ethereum (ETH) is trading above the support at $2,987, there is nothing to worry about even though the selling volume has increased. However, if the price of the second most popular crypto falls below $3,000 and fixes there, bears might seize the initiative and continue the drop to the area around $2,800-$2,900.

Ethereum is trading at $3,134 at press time.

ADA/USD

Cardano (ADA) is the biggest loser today as its rate has gone down by 3% since yesterday.

Despite the fall, the mid-term picture is neither bullish nor bearish as the price remains above the $1.4 mark. Thus, the fall has been accompanied by increased selling trading volumes, which means that traders may have fixed their short positions.

If such a scenario comes true, there is a probability to see a bounceback to the zone around $1.5 soon.

ADA is trading at $1.411 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin