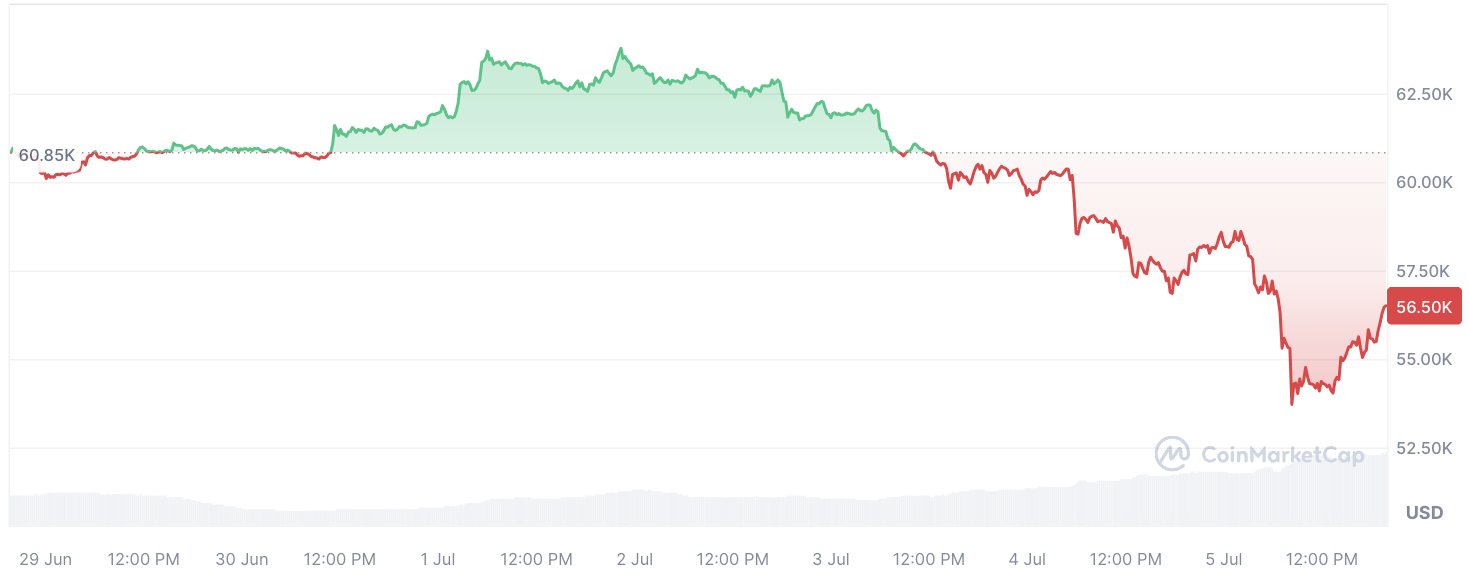

The crypto market has experienced its second largest liquidation event of all time today, with almost $700 million in long orders wiped out overnight. This occurred as Bitcoin's price plunged below $54,000, leading to a cascade effect that has further destabilized the market.

Large liquidations like these not only depress prices but also trigger investor panic, exacerbating the sell-off and leading to even more liquidations. The current market situation appears grim, with experts predicting a slower recovery compared to the past.

In the midst of this mess, a jaw-dropping transfer has raised eyebrows, as a transaction involving 11,302 BTC, equivalent to $624 million, was detected moving between unknown wallets. This large-scale transfer has added to the unease among investors, already jittery from the market's wild ride.

The timing of this transfer also coincided with the FUD surrounding large-scale sales by entities such as Mt. Gox paybacks and the German and U.S. governments. The movement of such a substantial amount of Bitcoin in this climate has only fueled speculation about the intentions behind the transfer and its potential impact on market stability.

However, in a surprising twist, Arkham has identified these wallets as belonging to BitMEX, one of the leading and oldest crypto exchanges.

As the market navigates such a chaotic timeline, the actions of major players and the perception of investors will be critical in determining the trajectory of cryptocurrency prices in the near future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov