The S&P 500 rose by 0.5 percent on Oct. 25, which was enough to set a new all-time high. This recent uptick was triggered by trade talks between the US and China and recently announced corporate earnings.

The broad index has surpassed its record close of 3,025, which was set back in January.

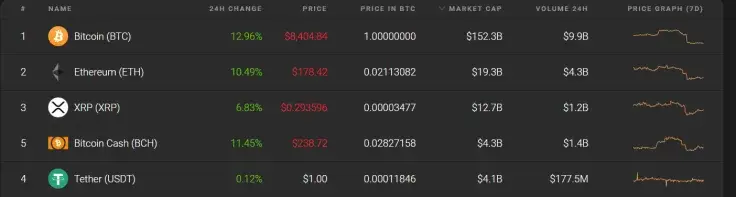

Meanwhile, the Bitcoin price has suddenly surged to $8,500. The top coin is currency up by more than 10 percent, according to CoinStats data. After a massive pump, the coin consolidated in the $8,400 region where it is changing hands at the time of writing.

Notably, this enormous green candle came right after BTC printed its first death cross since March 2018. Bloomberg predicted that Bitcoin could be eyeing more pain after this bearish signal, thus repeating the 2018 scenario.

However, as reported by U.Today, this is a lagging indicator, which could mark the end of the massive correction. Now, it turns out that it indeed turned out to be a massive bear trap.

watching $BTC pump never gets old no matter how many times you've seen it before pic.twitter.com/LoL7rQRcnd

— Luke Martin (@VentureCoinist) October 25, 2019

Meanwhile, Fundstrat's co-founder Tom Lee says that the recent price pump confirms his controversial theory that Bitcoin is correlated with the US equities market.

+12% rally in #Bitcoin coinciding with strong equity day as S&P 500 nearing all-time highs...

- a reminder of the 'unpopular' opinion that the bitcoin performs best when S&P 500 rallies.

- best years Bitcoin when S&P 500 return >15%.$BTC mostly retail, thus, mostly 'risk-on'— Thomas Lee (@fundstrat) October 25, 2019

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov