Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

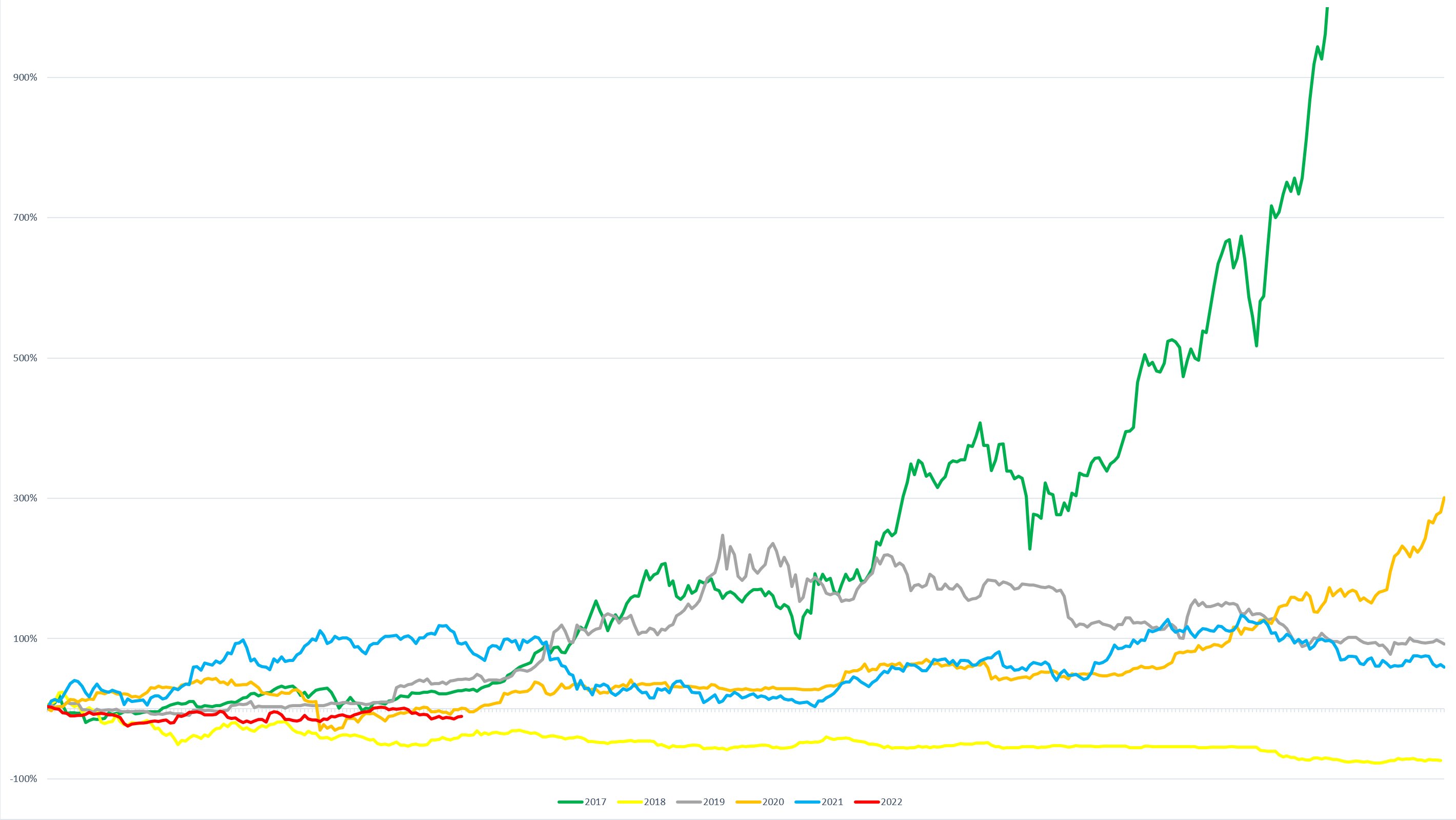

As noted by trader Luke Martin, Bitcoin, the flagship cryptocurrency, has now spent the longest number of days below the yearly open since the 2018 bear market, with bulls struggling to regain momentum.

Notably, Bitcoin spent less than a month below the early open four out of five years over the period from 2017 to 2022.

The bellwether cryptocurrency is currently trading at $41,384 on the Bitstamp exchange. It is down 13.30% year-to-date, underperforming the S&P 500 index and gold.

As reported by U.Today, Bitcoin briefly turned positive for the year in late March and surged to a new 2022 peak of $48,189 on the Bitstamp exchange. The widely-tracked crypto "fear and greed index" also flashed greed for the first time in months due to improving market sentiment.

However, the recovery ended up being short-lived. On Apr. 18, Bitcoin plunged to $38,536, the lowest level since mid-March. The Federal Reserve’s increasing pace of interest hikes is currently the main concern for investors since a hawkish monetary policy stance is unlikely to bode well for risk assets such as Bitcoin.

The largest cryptocurrency is down a whopping 40.05% since hitting its current all-time peak of over $69,000. Yet, according to recent data provided by Glassode, roughly 75% of all Bitcoin addresses remain in profit despite the significant market correction. For comparison, only 50% were in profit in March 2020 after a massive pandemic-induced crash. Hence, it seems like the current bear market cycle is not as brutal as the previous ones.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin