In a recent post, Robert Kiyosaki, known best for his "Rich Dad Poor Dad" book predicted the weakening of the dollar in the coming months. He insists a weaker dollar is needed for the U.S. to begin exporting more than importing. With a weaker dollar, jobs will come back and assets will go up in price, says Kiyosaki.

According to Kiyosaki, this economic adjustment will not only enhance export growth but also drive up the prices of gold, silver, Bitcoin, stocks and real estate. He forecasts that gold will rise from $2,400 to $3,300 an ounce, silver from $29 to $79 an ounce and Bitcoin from $67,400 to $105,000 per coin by August 2025.

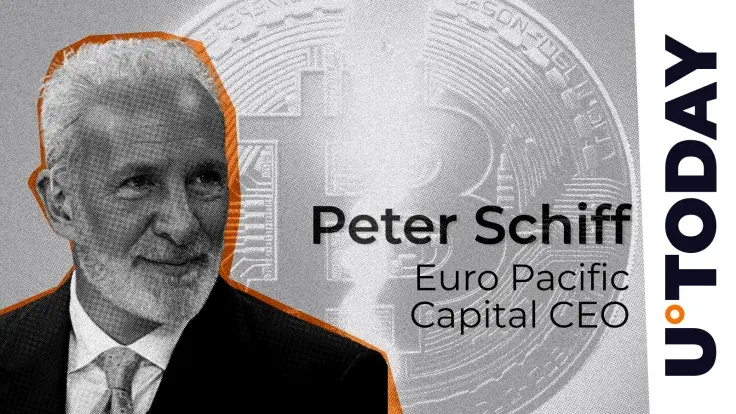

Peter Schiff, a well-known critic of cryptocurrencies, has responded to Kiyosaki’s predictions with skepticism. Schiff contends that while a weaker dollar might benefit some Americans financially, it could ultimately make the country poorer.

He anticipates that such a shift would lead to higher oil prices, despite an increase in domestic drilling. He also suggests that while gold and silver might surpass Kiyosaki’s forecasts, Bitcoin could potentially decline in value.

The debate between Kiyosaki and Schiff raises significant questions about the future of the U.S. economy and the role of cryptocurrencies.

Will a weaker dollar indeed stimulate job growth and increase asset prices, as Kiyosaki suggests? Or could it lead to broader economic challenges and higher costs, as Schiff warns?

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov