Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The Bitcoin Fear and Greed Index invented by the team of alternative.me portal shows that today, on September 3, the cryptocurrency market feels “extreme fear”. The index shows 21.

Until September 1, this index drifted between 30 and slightly above 20.

Bitcoin pushed into “extreme fear” zone

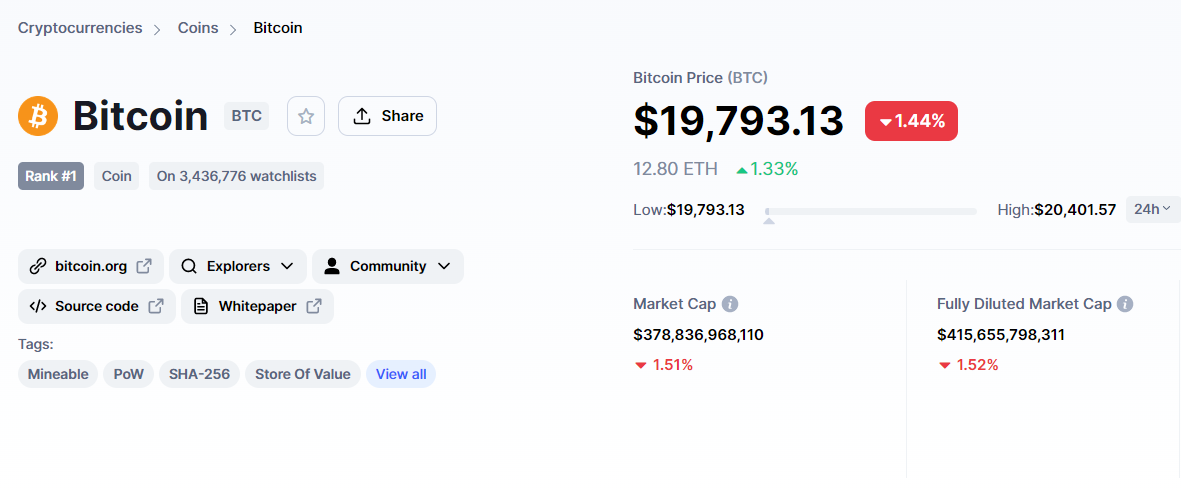

On Friday, August 2, the leading digital currency dropped from the $20,000 level it had managed to hold for a while and slumped a little, hitting the $19,800 area. It had made several attempts to regain $20,000 but Bitcoin failed to get fixed on that price line.

Prior to that, the regular jobs report came out with US unemployment data. Figures in it proved to be higher than expected – 3.7 percent versus 3.5 percent, which hit the stock market and cryptocurrency one along with it.

However, the non-farm payrolls showed 317,000 of added payrolls versus the 350,000 expected. This indicates that the Fed Reserve will hardly make a pivot from its current hawkish strategy.

The Fed chairman Jerome Powell spread the word about the continuation of the hawkish policy of the US central bank on August 26 in his speech to bankers. On that day, Bitcoin began its current slide and fell below the $21,000+ level.

Even though, the aforementioned index shows a low value, the team of the website warns that the time of “extreme fear” on the market can present a good buying opportunity for the asset.

Bitcoin Fear and Greed Index is 21 - Extreme Fear

— Bitcoin Fear and Greed Index (@BitcoinFear) September 3, 2022

Current price: $19,991 pic.twitter.com/3BjxqhnPCn

Will Bitcoin be pushed to $15,000?

As covered by U.Today earlier, chief investment officer of the AlphaTrAI fund Max Gokhman believes that the hard jobs unemployment report might cause a deeper Bitcoin decrease and BTC may fall as low as $15,000.

He also mentioned that the stronger than expected figures in the jobs report is likely to show that the Fed will continue its tight monetary policy, which is likely to kick Bitcoin harder down the price ladder.

Peter Schiff’s survey predicts deeper fall

Roughly a week ago, vocal Bitcoin critic, economist and fund manager, Peter Schiff launched a pall on his Twitter page to ask his army of followers if they expect Bitcoin to recover above $20,000.

However, he put it in the form of two questions – if Bitcoin will sooner run out buyers or will it run out of sellers. The majority of voices there believed that BTC would run out of buyers. Therefore, Schiff used this outcome to support his bearish expectation that the flagship cryptocurrency will keep declining.

Earlier this year, he tweeted that BTC is likely to test support below the $10,000 level.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov