Mark Yusko, the founder of Morgan Creek Capital Management and one of the most ardent Bitcoin proponents, has become part of the mania around special purpose acquisition companies (SPACs) that are taking over Wall Street.

After joining forces with Credit Suisse CEO Brady Dougan, Yusko is launching an exchange-traded fund for SPACs, The Wall Street Journal reports.

This is already the third ETF that is specifically focused on listings of blank check companies.

The big SPAC explosion

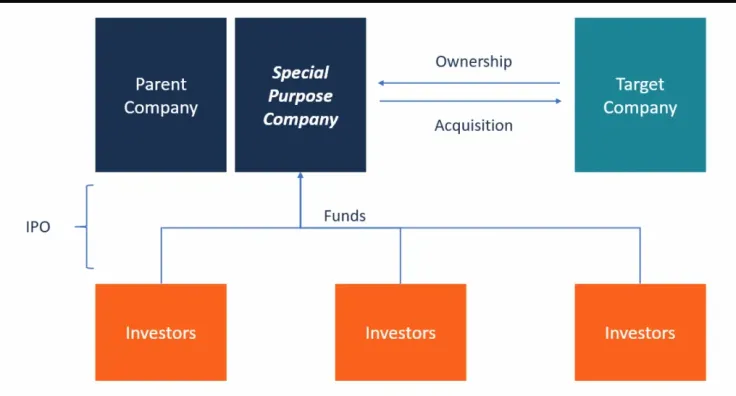

SPACs are shell corporations whose sole purpose is to raise capital and acquire companies that have already gone public. As such, they do not have to deal with all the fuss associated with traditional IPOs.

After experiencing a huge boom in 2020 with $79 billion worth of raised funds, SPAC remains red hot this year. They have managed to rake in $15 billion this January alone.

The mania is seeping into crypto as well. ICE-owned crypto exchange Bakkt is going public on the New York Stock Exchange (NYSE) later this year via—you guessed it—a SPAC.

Are SPACs sustainable?

Like mania, SPACs also attract skeptics. During his appearance on CNBC, American billionaire Barry Sternlicht compared SPACs to Bitcoin:

There are companies that are trading like Bitcoin…There is a group of people in the SPAC universe of sponsors that really don't care what they are paying for a company...and promote the hell out of their stocks—that is like a bucket shop operator.

Goldman Sachs CEO David Solomon opined that rapid growth blank check lists were not "sustainable":

While I think these activity levels continue to be very robust and that they do continue as we head into 2021...I do not think this is sustainable in the medium term.

Advertisement

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov