Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin (BTC) is showing true leadership in the digital currency ecosystem amid its soaring price. Current market data pegs the price of BTC at $99,399.18, up by 1.6% in the past 24 hours. For Bitcoin, growth since the start of the year remains linearly bullish, with a lot volatility to match.

Bitcoin price beating history

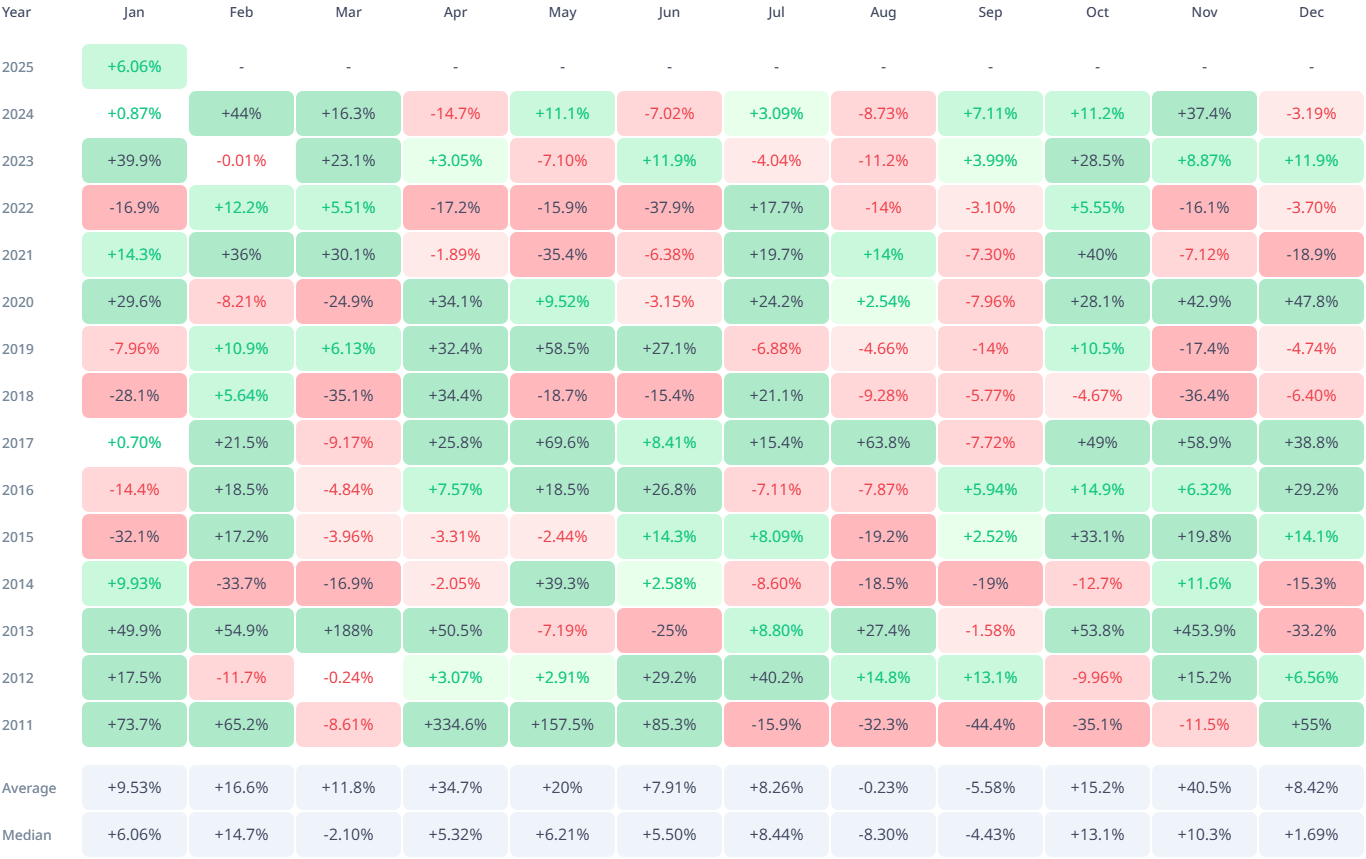

Data from Cryptorank showcases what this month holds for the price of Bitcoin. Historically, January remains a mildly bullish month for the coin. Bitcoin's price had an average growth rate of 9.55% in January.

Just six days into the month, Bitcoin has already jumped by 6.32%, setting a bullish pace. If this momentum is sustained, chances are the coin might hit a historic high, as last seen in January 2023, when it jumped 39%.

The growth of BTC is tied to many factors, including the level of adoption of spot Bitcoin ETF products and the impact of Bitcoin whales. Thus far, both classes of buyers have taken cautious approaches to the coin, as the coin keeps flashing the overbought signal.

While firms like MicroStrategy have intentions to keep buying Bitcoin, creating a natural demand amid the limited daily supply, some pessimists remain who believe the coin’s price might slip soon.

Meanwhile, this pessimistic view is not reflected in the coin's current price as it brandishes 5.76% growth week-to-date (WTD).

Profitability remains major factor

The price of BTC maintains strong resilience despite the intense volatility that masks its growth.

While traders remain unsure about the short-term prospects of the coin, 94.82% of all BTC addresses, or 51.21 million wallets are in profit, making the prospects of a sell-off low. The cautious sentiment might remain as the coin confronts a mild sell wall around the $100,000 price.

If Bitcoin records a positive daily close around this range, it might reclaim its $108,000 all-time high (ATH).

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov