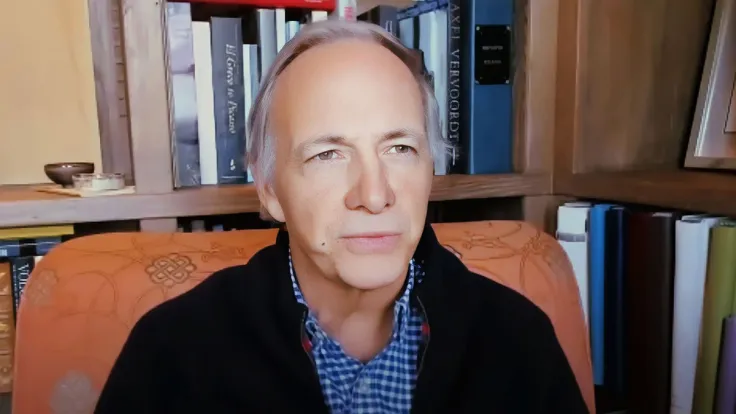

During a recent appearance on William Green's "We Study Billionaires" podcast, hedge fund legend Ray Dalio expressed his thoughts on the hype surrounding cryptocurrencies, specifically Bitcoin.

The uber-succesful investor stated that he believes there is a distinction between blockchain technology and digital currencies. While the former is an excellent technology, the latter is not a good bet for investors, according to the billionaire.

Dalio commented that digital currencies do not replicate anything, which makes them an ineffective store of wealth.

He also pointed out that Bitcoin's total value is a fraction of Microsoft's stock. Hence, in Dalio's view, it is a preoccupation by people that is disproportionate to its true reality.

Dalio is convinced that in time, there will be better digital currencies, such as those that provide the equivalent of inflation and buying power. He noted that most currencies are debt instruments that offer poor returns relative to inflation, but a good digital currency is yet to be created.

The legendary investor acknowledged the technology behind cryptocurrencies, he believes that the hype surrounding them is disproportionate to their true value. As an experienced investor, he emphasizes the importance of looking for effective stores of wealth and being cautious when investing in digital currencies.

The hedge fund manager also spoke about the current economic environment, saying that creating debt and money is becoming increasingly problematic.

He commented that people will need to look for alternative stores of wealth, and he believes that understanding the five key forces of the economy, including money and credit, can help investors navigate difficult situations.

Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide