Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

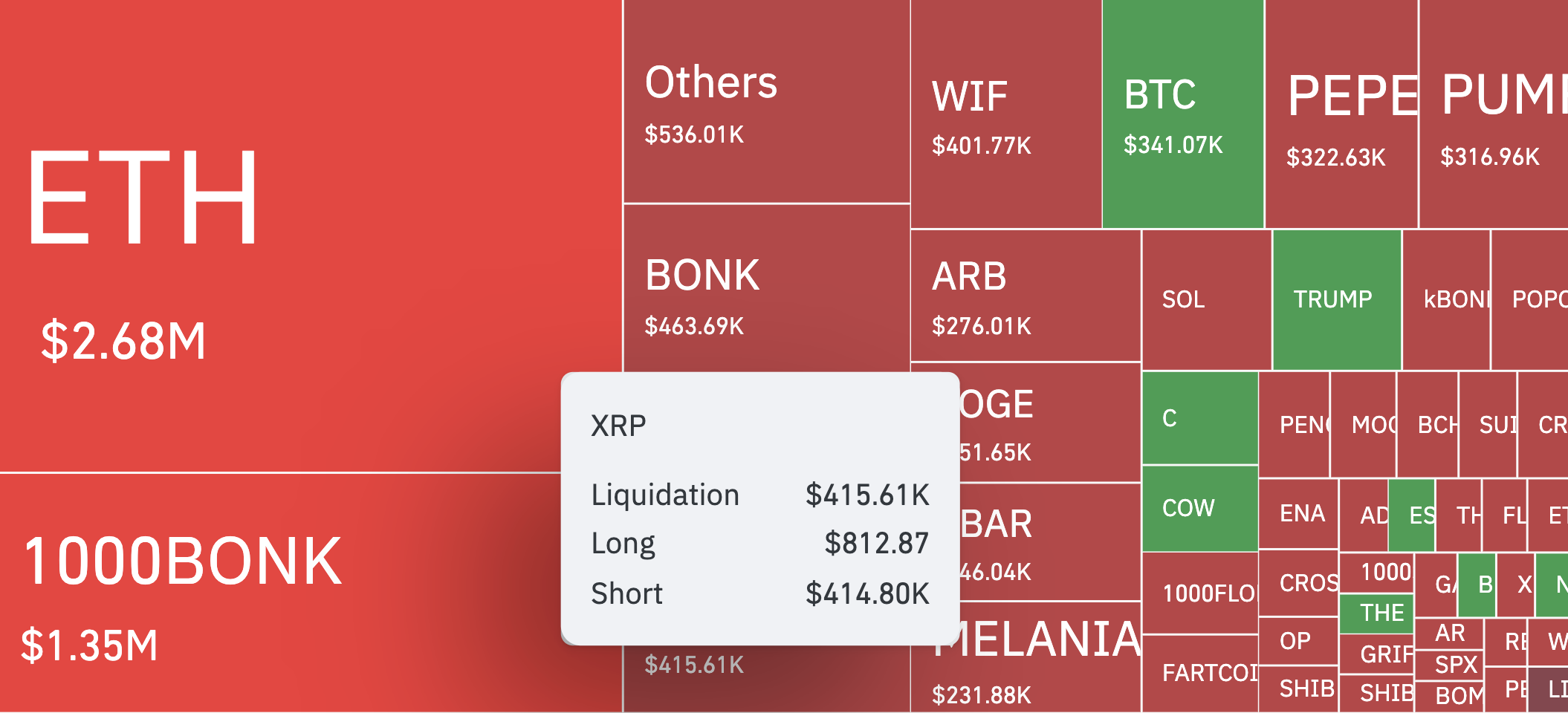

Something unusual just happened on crypto derivatives platforms, and XRP is at the center of it. Recently, the market saw over $337 million in liquidations, according to CoinGlass, but XRP stood out with a liquidation footprint of $415,610 in the last hour. That alone would not be surprising, but the split behind that number would.

According to real-time data, almost the entire XRP liquidation volume was concentrated on the short side. Longs were almost untouched at just $812.87, while short positions lost a shocking $414,800 - a ratio that translates to a liquidation imbalance of over 51,209%.

While shorts were being wiped out, the XRP price climbed higher, reclaiming the $2.98 level after rebounding from a local dip under $2.95. The spot chart shows a sharp but calculated climb, with barely any slippage on the way up.

This kind of liquidation profile usually means forced exits at price points that cannot be defended, suggesting that many expected a breakdown that never came. Instead, XRP shot up, probably causing a chain reaction of stops. With everyone's attention on Bitcoin and Ethereum, XRP's move was pretty under the radar - but that might not last.

The liquidation heatmap shows that most other assets - including ETH and BONK - experienced more balanced or even opposite flows. Ethereum, for example, saw $2.68 million in total liquidations, but they were split more evenly between long and short.

For XRP, the imbalance raises concerns. Either way, it is a clean technical reset, and with the price now under $3.00, the chart could be setting up for something bigger than just a bounce.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov