Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

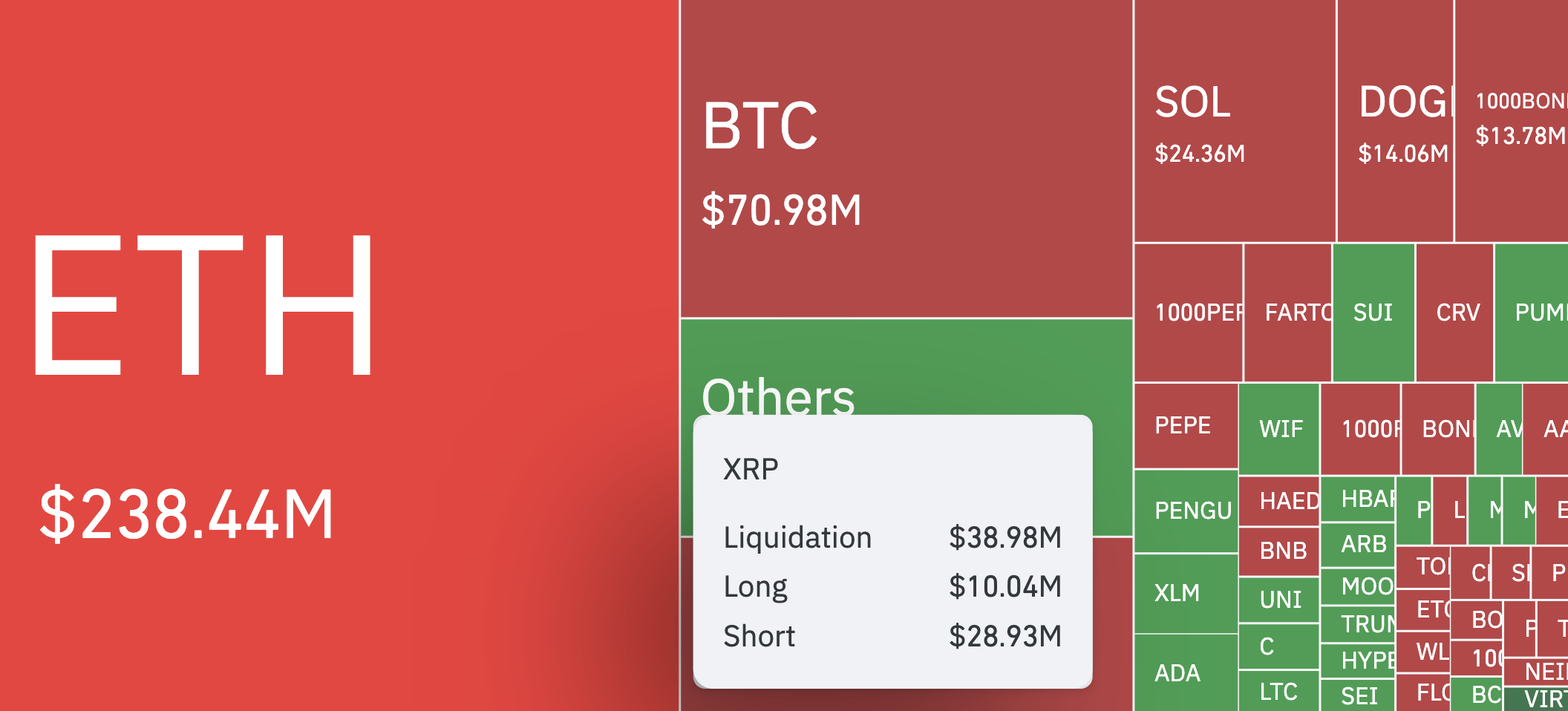

XRP had a major liquidation imbalance over the last 24 hours as short positions were hit with $28.93 million in forced closures, compared to just $10.04 million on the long side, per CoinGlass. This created a $18.89 million gap - one of the bigger ones on the market.

This happened after a big jump in XRP's price, which went up from around $2.92 to over $3.30 during the day before settling around $3.24. In hindsight, it was a pretty obvious setup: a build-up through the Asian session, then a breakout move into the early U.S. hours that quickly pushed the asset into levels it had not been at since its recent consolidation range.

In terms of liquidation, XRP ranked just below Bitcoin and Ethereum for total volume, but what made the event unusual was how one-sided it was. In just four hours, short liquidations added up to $15.36 million - more than 10 times the value of longs taken out during the same period.

Usually, this kind of difference is a sign that your position is a bit off or you are taking a big risk on the downside without quickly adjusting to the price change.

The liquidation heatmap showed a clear shift: a total of $38.98 million in positions were closed on XRP, mostly from short exposure. At the same time, Ethereum led the market with $238.44 million in liquidations overall, followed by Bitcoin at $70.98 million. For all the assets, the total hit $557.7 million, and almost 148,000 positions were wiped out.

While the market's still active, XRP's price chart stood out, not just for the price increase but for the impact it had on overexposed derivatives positions. The move was not erratic; it followed a clean trend and caught a significant number of short positions leaning the wrong way.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov