Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

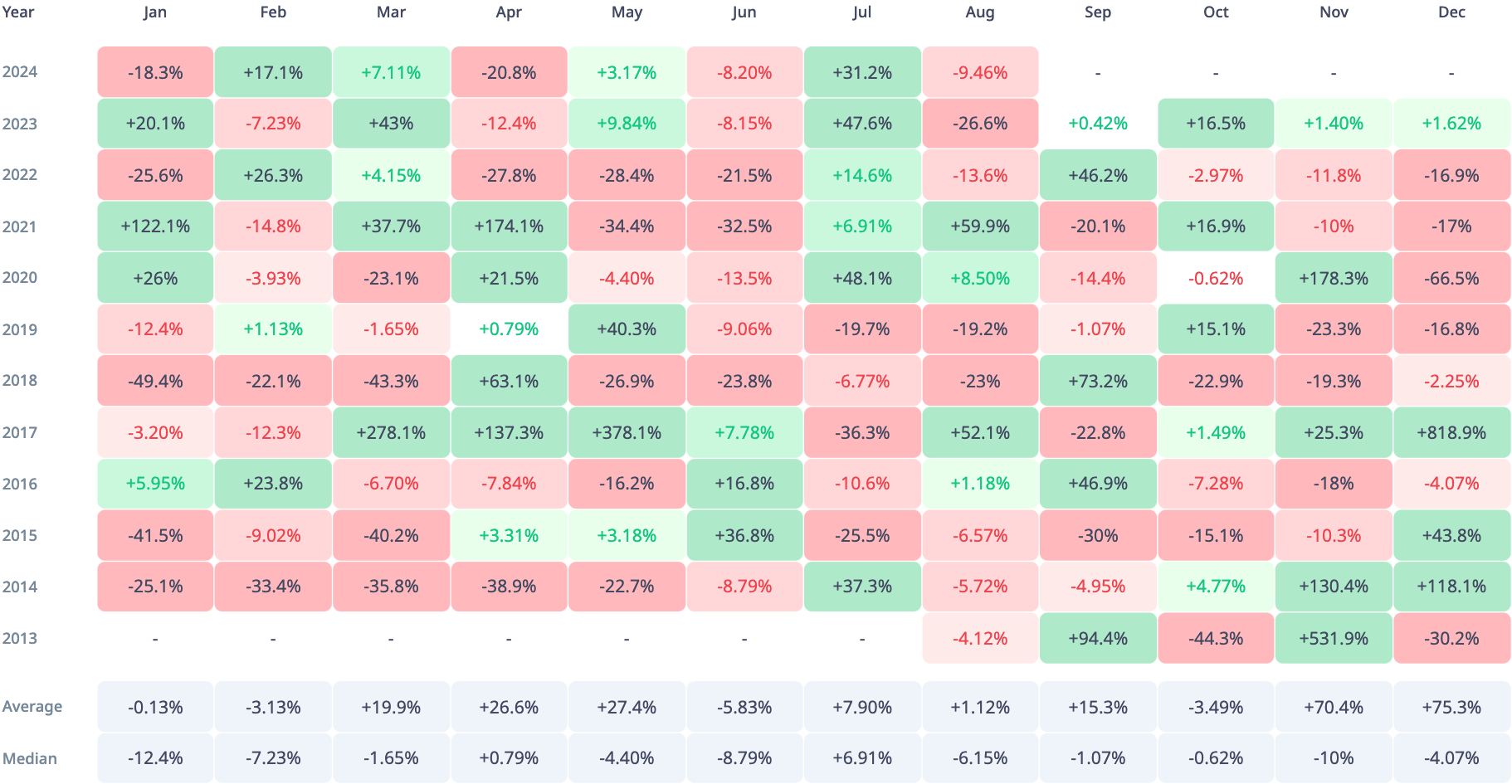

Popular cryptocurrency and currently the seventh largest by market cap, XRP, may see a bullish knockout for its quotes, starting from September. The average profitability for XRP for the ninth month of the year stands at 15.3%, according to data from CryptoRank.

This could be just the beginning of a bull run for the popular crypto, though, as November and December provide further gains, with average monthly gains of 70.4% and 75.3%, respectively.

Yes, there is an October in between, which is historically a negative month for XRP, but for the crypto market in general, it is also historically a positive month, so perhaps the broader trend will favor XRP this year as well.

Going back to the September stats, you may notice how the last two of them ended on a bullish note. Even though the coin only saw a 0.42% gain in 2023, it saw a 46.2% gain in 2022, which is the third best monthly result for the cryptocurrency in the last three years.

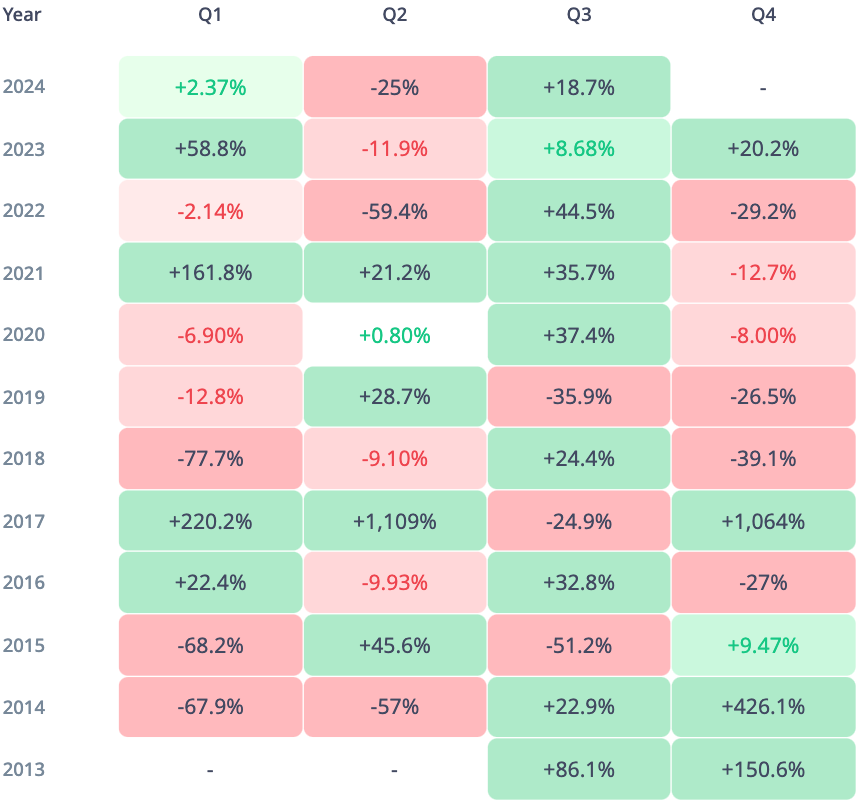

Quarterly gains on way for XRP

September is also the last month of the third quarter of the year, and it is a historically bullish period for XRP. Since 2013, there have only been three times when the third quarter did not end with a profit for the token.

As of now, the quarterly result signals a gain of almost 19%, and barring any unexpected negative events, we can expect this number to grow even more for XRP.

The crypto market remains a place where nothing can be set in stone. However, being a more than 10-year-old asset, XRP's historical performance may offer a hopeful outlook for investors willing to capitalize on its potential.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin