Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

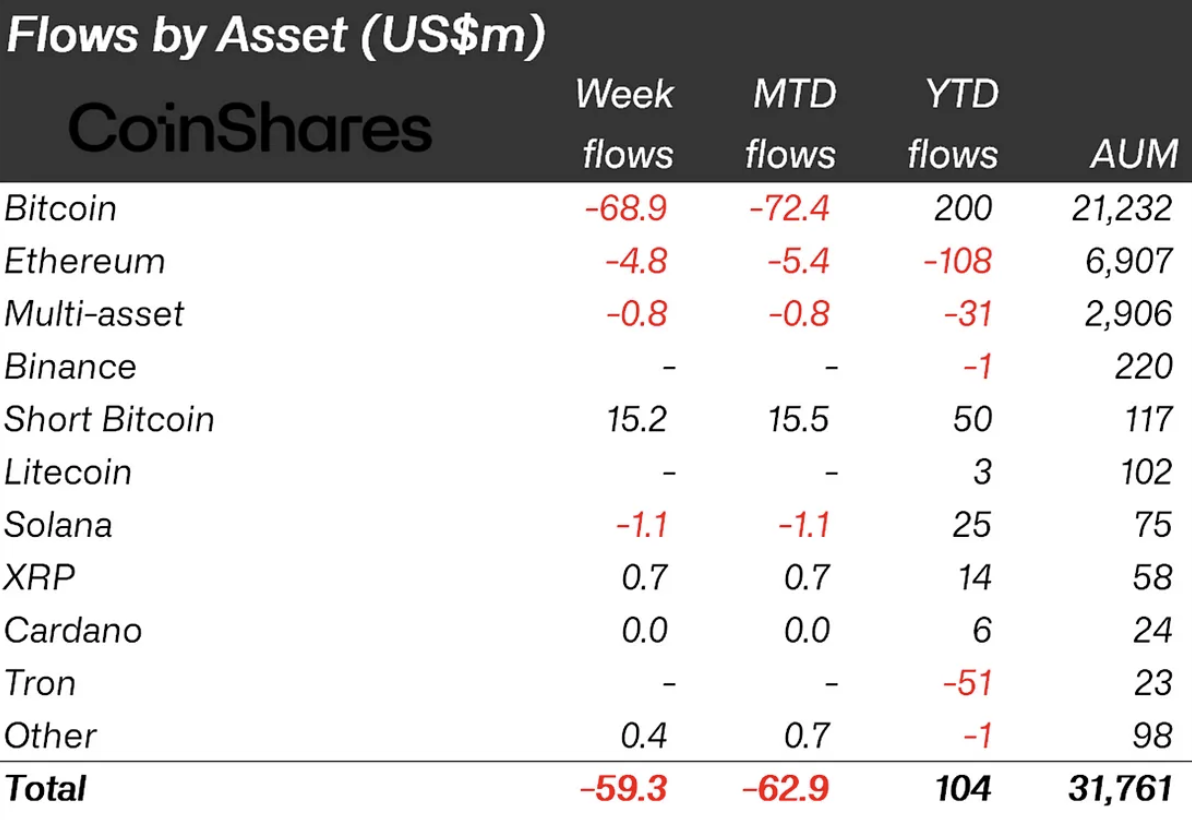

In a recent development, XRP-focused investment products have witnessed a resurgence in investor interest, as highlighted in the latest weekly report from CoinShares. Over the past week, these XRP-oriented products attracted a substantial influx of more than $700,000, marking a stark contrast to the previous week's stagnation, when no funds flowed into these assets at all.

The cumulative inflow into XRP-focused ETPs since the beginning of the year now surpasses an impressive $14 million. This achievement underscores XRP's enduring popularity among traditional investors, with the token yielding the top places in the crypto investment landscape only to Bitcoin, Short Bitcoin and Solana (SOL).

Despite XRP's resurgent appeal, the broader digital asset investment market has been grappling with a series of outflows, totaling $59 million in the past week. This marks the fourth consecutive week of capital flight, bringing the year-to-date outflows to a staggering $293 million. Investors have shown caution, with inflows primarily seen in short investment products, indicative of prevailing bearish sentiment.

Same old story

James Butterfill, an analyst at CoinShares, attributes these ongoing outflows to concerns over regulatory uncertainty surrounding the crypto market and the recent strength of the U.S. dollar. Among cryptocurrencies, Bitcoin bore the brunt of these outflows, shedding $69 million last week, while Short Bitcoin experienced its most substantial week of inflows since March 2023, amassing a total of $15 million.

The return of bullish sentiment to XRP-focused products stands as a notable anomaly amid the broader market's challenges, suggesting that investors remain cautiously optimistic about the token's future prospects despite the headwinds it currently faces.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov