Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Vitalik Buterin, the cofounder of Ethereum, recently delved back into the topic of Plasma—a blockchain scaling solution. His latest article dissects the complexities and potential of Plasma, which has garnered attention from industry leaders, including Charles Hoskinson, who responded with a contemplative Kermit the Frog GIF.

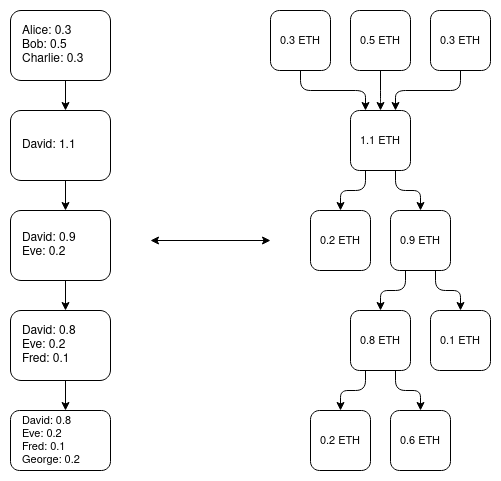

Plasma, first introduced in 2017, was designed to enhance blockchain scalability by handling data and computations off-chain, except for essential elements like deposits, withdrawals and Merkle roots. It promised significant scalability improvements but has been largely overshadowed by rollups due to its limitations, such as high data storage costs on the client side and difficulties extending beyond simple payment solutions.

Buterin's thesis revolves around the rejuvenation of Plasma, propelled by advancements in validity proofs (like ZK-SNARKs). These technological strides could potentially address Plasma's primary challenges, making it more efficient, especially for payments. However, he notes that while a vast amount of assets could be secured through Plasma, it is not a one-size-fits-all solution, particularly for complex applications.

The Plasma chain has an operator responsible for publishing new blocks and sending users the Merkle branches for their coins. The inherent risk lies in the operator's misconduct, which necessitates users to be vigilant and exit their assets promptly if anomalies are detected.

Buterin elaborates on generalizing Plasma to accommodate fungible tokens like ETH and USDC, discussing technical and economic hurdles. He also touches on the intricacies of adapting Plasma to Ethereum's Virtual Machine (EVM).

The key takeaway from Buterin's article would be a refreshed perspective on Plasma, considering recent breakthroughs that could revitalize its utility in the blockchain ecosystem. It invites developers and enthusiasts to revisit this once-celebrated solution, which, despite its limitations, still holds promise for certain applications.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov