Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

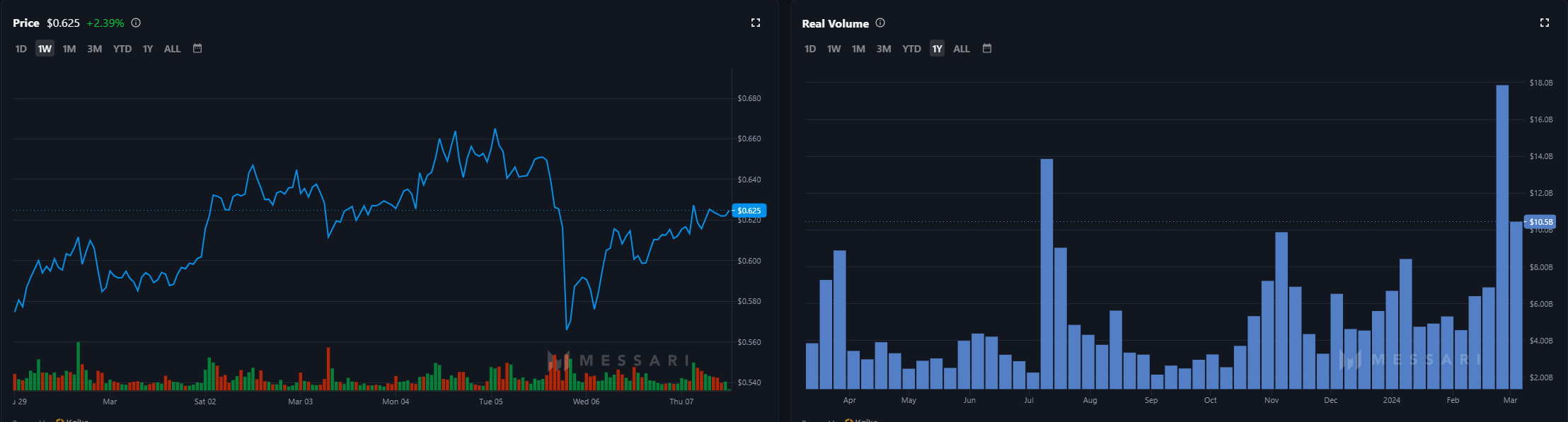

One crucial metric for Ripple's XRP has recently seen a substantial surge, reaching the $10 billion mark.

This uptick in the "Real Volume" metric, which indicates the actual amount of trading activity, underscores a renewed interest in XRP among traders and could have a pronounced effect on its price.

Despite XRP's overall underperformance on the cryptocurrency market compared to other assets, this substantial increase in real volume suggests that investors are once again turning their attention to XRP. This shift is critical to note, especially when considering that volume is often a precursor to price movements; a high real volume indicates strong trader commitment and could hint at more significant price changes on the horizon.

The data on the circulating market cap of XRP further complements the picture of a currency regaining its momentum. The market cap has shown robust recovery, approaching a valuation of $35 billion, a metric that conveys the market's valuation of the total circulating supply of the token.

Analyzing the price chart, XRP has experienced a series of bullish and bearish cycles, as illustrated by the moving averages. The crossover of the short-term moving averages above the longer-term ones points to a possible bullish sentiment in the short term. Nevertheless, given the historical price patterns and current market behavior, one must approach predictions with caution.

For the foreseeable future, the thesis for XRP could revolve around cautious optimism. The swell in real volume could be a harbinger of increasing liquidity and heightened activity, which, when coupled with the considerable circulating market cap, offers a foundation for potential price appreciation.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov