Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

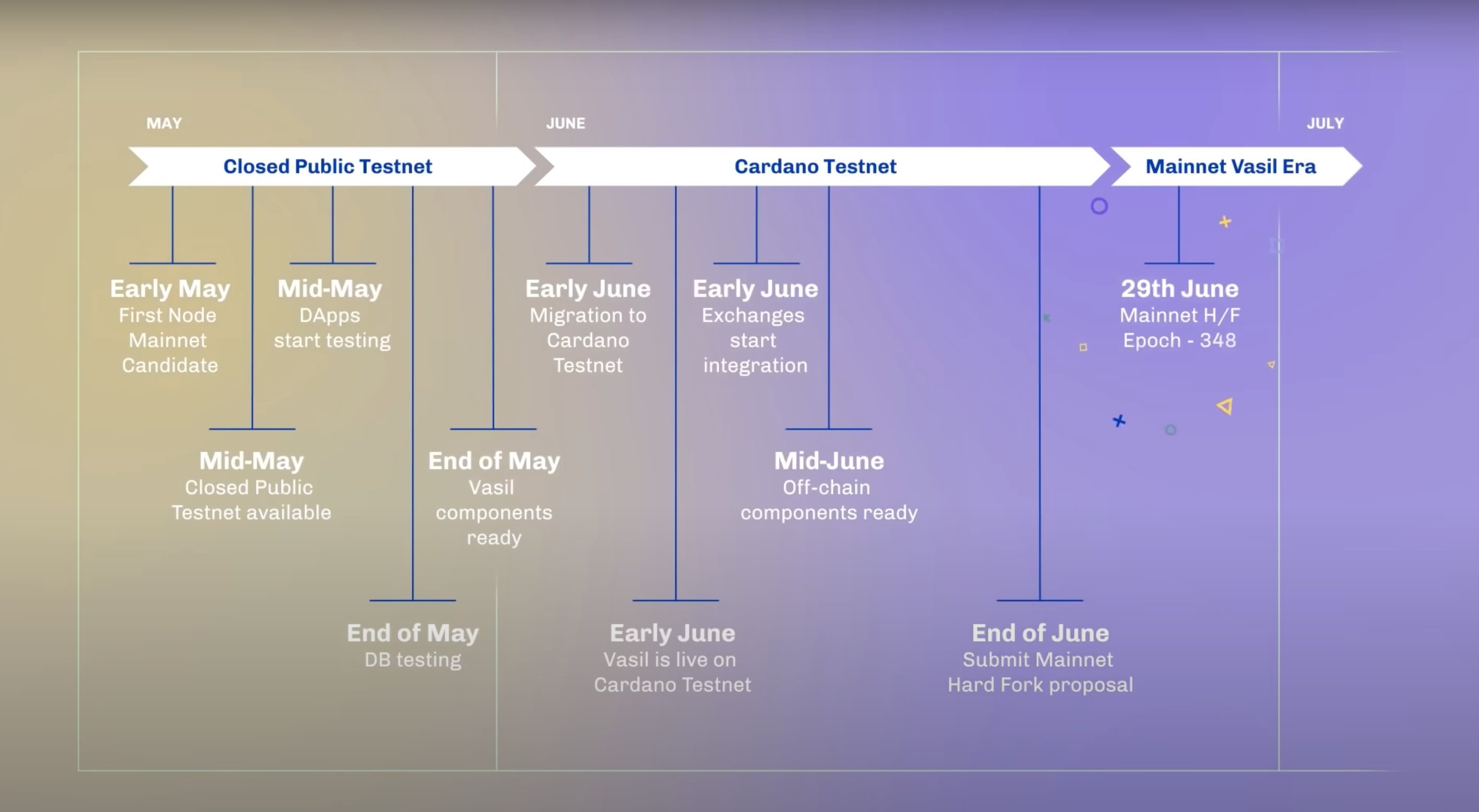

According to glneto, a developer at Mutant NFTs, an NFT platform based on Cardano, the upcoming Vasil Hard Fork might be available on the public testnet by June 2, with the mainnet launch slated for June 29.

The suggested road map provided earlier by Cardano's parent company, IOHK, gives the end of May for the closed public testnet phase, and Vasil is expected to launch on the Cardano testnet in early June. Also, the mainnet hard fork proposal deadline has been set for June 29.

Meanwhile, Cardano inventor Charles Hoskinson assures the community that the anticipated Vasil upgrade should take place as planned.

Upcoming Vasil update to introduce CIPs

The upcoming Vasil update will introduce four different CIPs: CIP-31 (Reference Inputs), CIP-32 (Inline Datums), CIP-33 (Reference Scripts) and CIP-40 (Collateral Outputs), as shared by IOHK.

Reference inputs allow multiple dApps to be able to read from the same datum at the same time, thus improving concurrency. Multiple dApps can read from the same datum at the same time thanks to reference inputs, which improves concurrency. Inline data allows data to be saved on-chain instead of merely a hash, as Cardano does now. Developers can interact with the script more easily because they do not have to incorporate the data.

On the other hand, the goal of reference scripts is to lower transaction costs. Currently, new scripts need to be included in each transaction. Scripts can be interacted with using reference scripts, which pushes them into the chain. As a result, smart contracts interaction is reduced to a bare minimum.

Meanwhile, the purpose of collateral outputs is to improve the transaction validation process. The collateral set up for such instances is now forfeited if a transaction fails validation.

Amid recent market declines, ADA is currently trading at $0.518, down 3.54% in the last 24 hours and down 10.44% over the past week.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov