Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Zhu Su, a founder of the infamous Three Arrows Capital hedge fund, recently highlighted the performance of the Grayscale Solana Trust, suggesting it could imply the future value of Solana to $1,000 per SOL.

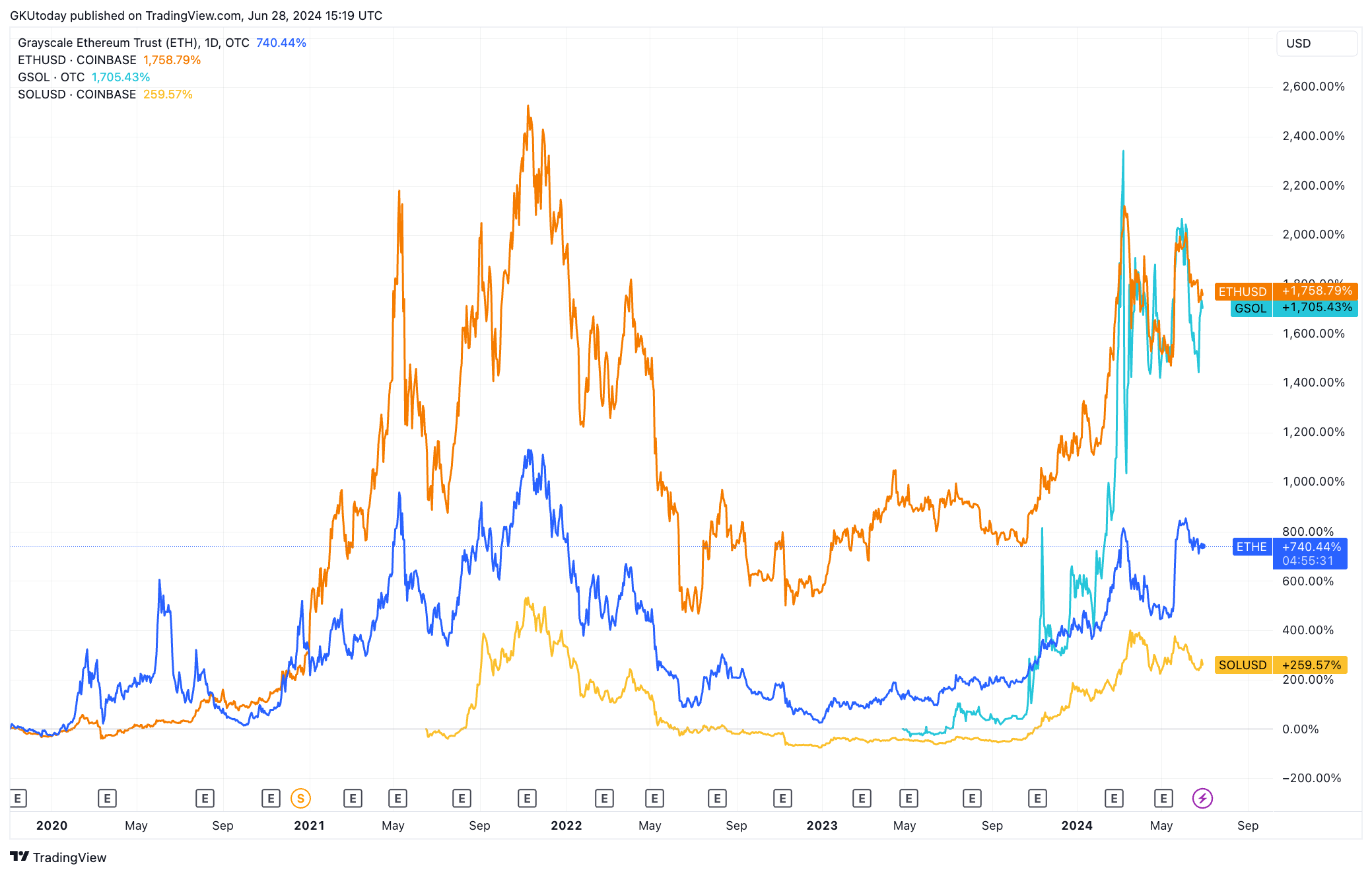

This projection is based on a comparison with the historical performance of Ethereum and the Grayscale Ethereum Trust (ETHE), used as a benchmark.

Grayscale's trusts work by allowing investors to gain exposure to digital currencies through a traditional investment vehicle without the challenges of buying, storing and safekeeping digital assets directly.

Each share of the trust represents a fraction of the cryptocurrency held by the trust, and the value of the shares can trade at a premium or discount to the underlying asset's market value.

"Every four years..."

Thus, four years ago, when Ethereum was trading at around $200, the Grayscale Ethereum Trust implied a value of $1,000 per ETH. This significant premium indicated strong investor confidence and future price expectations.

Ethereum's price eventually caught up with these projections, experiencing substantial growth in subsequent years. This pattern suggests a potential roadmap for Solana.

The comparison of Solana to Ethereum's early days, when it was also emerging as a significant platform, is noteworthy. If SOL follows a similar trajectory, the implied value suggested by the Grayscale Solana Trust could be realized.

While past performance is not a guarantee of future results, the historical context offers a compelling narrative of Solana's growth prospects, making the $1,000 target a topic of interest in the community.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin