A whole year. That is how long Solana (SOL) has gone without a single outage. For a blockchain that used to be the punchline of every downtime joke in the crypto space, that is not just progress - it is a turning point.

Solana had a rough reputation. Block production halts, hours-long outages, critics calling it a centralized mess - it all weighed down not just the technology but also the SOL token’s price performance. The last major disruption lasted 4 hours and 46 minutes, which, for a blockchain, is an eternity. It was not even the worst one. In an industry where reliability is everything, that kind of track record is hard to shake off.

Yet, here we are. One year without an outage, and Solana did not just sit still - it grew. A lot. Total value locked (TVL) in the network skyrocketed by 548%, hitting a peak of $14.25 billion.

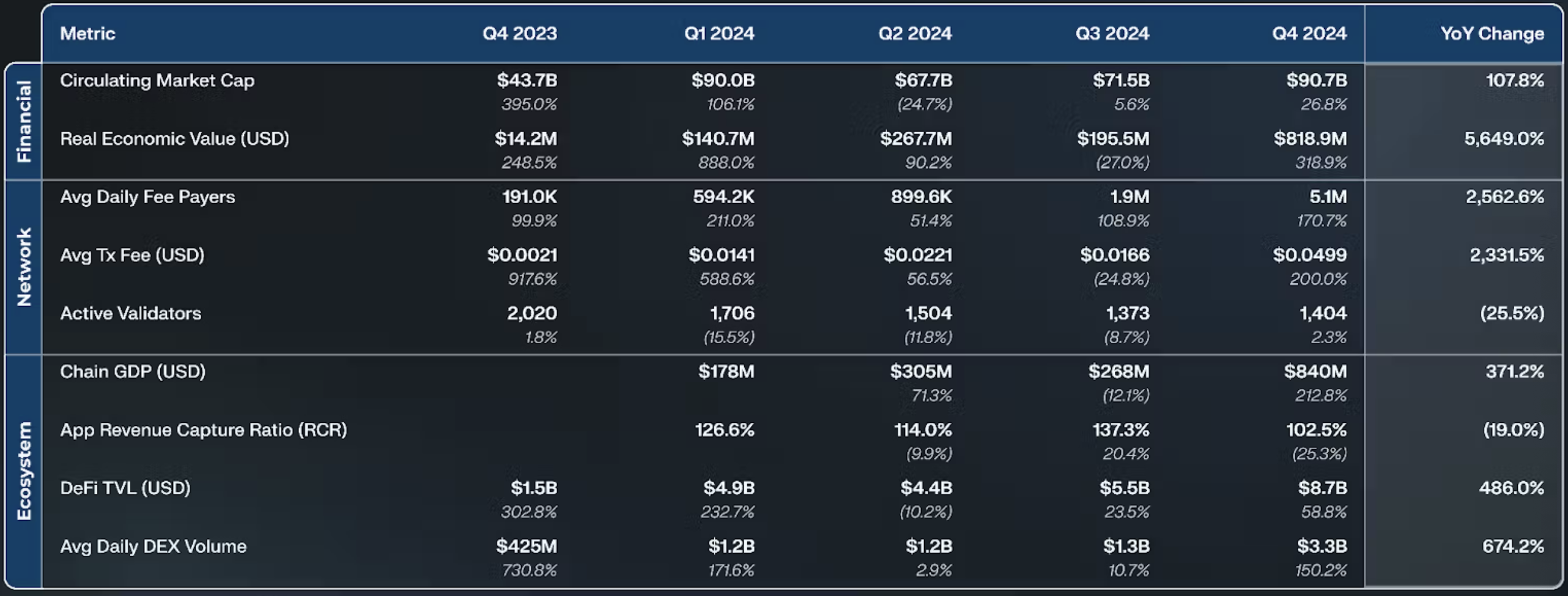

Messari’s data paints an even clearer picture: total application revenue on Solana jumped by 213% in the last quarter of 2024, from $268 million to $840 million. November alone pulled in $367 million for applications running on the blockchain.

Not just about numbers

SOL has now outpaced some of its biggest competitors in key areas. For three quarters straight, applications on the network have generated more revenue than its Real Economic Value (REV), hitting $840 million against $819 million.

It climbed to the number two spot in DeFi TVL, closing the quarter at $8.6 billion - an increase of 213% in the last three months. Liquid staking is growing too, with 11.2% of SOL now in liquid staking.

So, what’s next? A year of stability is great, but expectations are higher than ever. If Solana can maintain this momentum, it might just shake off its old reputation for good. But in crypto, nothing stays the same for long.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov