According to data from CoinMarketCap, Ripple USD (RLUSD) — the stablecoin developed by San Francisco crypto company Ripple — has lost over 50% of its trading volume in the last 24 hours.

The logical question is, what's going on? There is an interesting perspective on the answer.

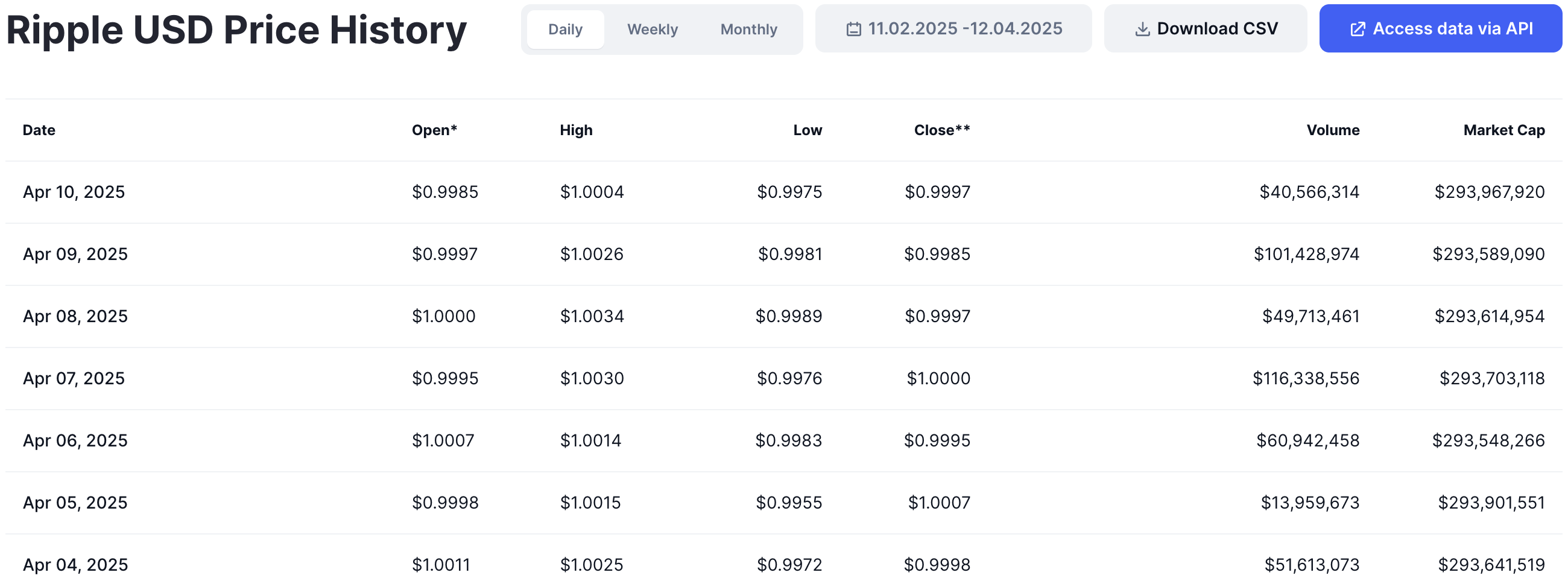

As things stand, the Ripple stablecoin's market capitalization remains at $294 million, while its current trading volume is $35.8 million — and that is after a 56% drop from the previous day.

Before that, it was at $101.43 million, which is about a third of the stablecoin's total market cap, a significant amount. When the market cap to volume ratio is around 30%, that is a lot. What's more, even now this ratio remains at 12.7%, which is also a sign of increased activity with the asset.

In this light, the over 50% decline in the stablecoin is more of a decline from the peak of activity, rather than an overall abandonment of the asset.

Interestingly, analyzing the historical volume data of RLUSD reveals that the stablecoin is indeed capable of such volume spikes. For example, just three days ago, the daily volume was $49.7 million, and three days before that it was just $13 million.

Ripple USD got a significant boost after major U.S. cryptocurrency exchange Kraken announced its listing last week. With only it and Bitstamp among the top centralized platforms offering RLUSD trading, the stablecoin still has a massive listing trigger on its way to further boost both market cap and volume.

Not to mention that $100 million in daily volume is already a lot.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov