Anyswap is a decentralized cross-chain swap protocol that provides automatic pricing and liquidity systems. Anyswap has been in operation since its launch in July, 2020. It has its own governance and utility token “ANY”. This decentralized exchange is built on Fusion Blockchain, which allows Anyswap to benefit from low network fees and to leverage Fusion’s DCRM technology as a cross-chain solution.

All these technical words might be confusing for some of you, so let’s break this definition down and explain all these features in a more simple and understable way:

-

Swap protocol: Anyswap protocol allows users to immediately swap from one coin to another with a click of a button. It can be considered as a decentralized exchange, however, it doesn’t have an order book. Therefore, users can swap and immediately get coins at the price of the currency they are swapping to, without going through the hassle of creating orders and waiting for them to be filled.

-

Decentralized: Anyswap uses Anyswap Working Nodes (AWN) to ensure the decentralization of Anyswap. These nodes will be elected by the holders of ANY token, and will be responsible for funds custody. Therefore, Anyswap company will have no control over users’ funds.

-

Cross-chain Bridges: Anyswap uses Fusion’s DCRM technology as a cross-chain solution. Anyswap users can deposit any coin to the protocol, mint wrapped tokens in a fully decentralized way and swap assets from different blockchains.

-

Automated Pricing and Liquidity: Liquidity providers can add or withdraw liquidity into swap pairs. Prices will be automated according to the liquidity provided.

Anyswap was launched a few months ago, it has witnessed since then some of the most impressive adoption statistics. However, even with a live and fully functioning technology, ANY is still around a market cap of $ 7 Millions, which makes it an incredible investment opportunity compared to some competitors. Trustswap for example has a market cap of $ 50 Millions with only a whitepaper that is currently available.

The daily volume of the exchange is around $ 10 Million, therefore, users will not have any major issue related to liquidity or price slippage. In addition to FSN coin and ANY token, Anyswap has also listed USDT and ETH to become the first ever cross-chain swap protocol.

Many coins will be added very soon, which will bring more liquidity and adoption to Anyswap.

Getting Started With Anyswap

Currently, Anyswap supports Metamask and Ledger wallets. Users can easily connect to these wallets and deposit their assets into Anyswap protocol. More wallets will be integrated in the future, as Anyswap protocol could be integrated to any wallet.

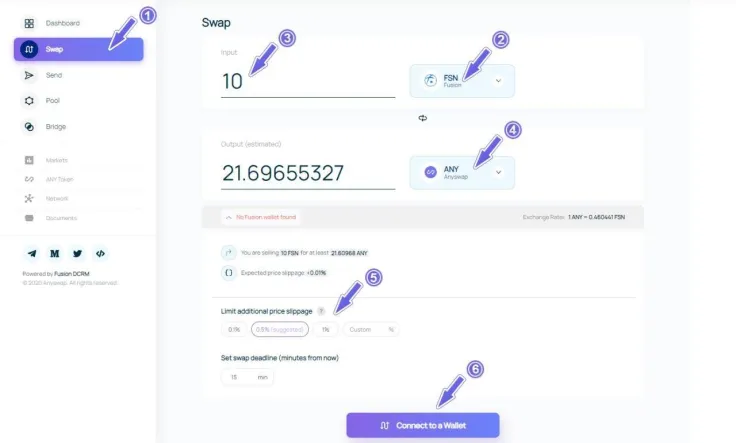

Trading and exchanging coins has never been easier. Once you connect your wallet, you will notice that Anyswap has a very user-friendly interface, all you have to do is to click on the “Swap” tab on your left and start swapping with a click of a button. If you’re curious about what’s happening in the background, you can click on “markets” and access various metrics such as charts, prices and daily volumes.

Adding Liquidity To Anyswap Pools

Liquidity pools are Similar to trading pairs in centralized and decentralized exchanges, they supply liquidity for buyers and sellers. Users that add liquidity to a pool are called liquidity providers, by doing so, they provide liquidity to swap traders. In return, they will share the fees paid by swap traders proportionally to the amount they provided to the pool.

Let’s say you want to provide liquidity for the pool FSN/aETH (aETH is the minted Ether you get after depositing ETH). In order to do that, you need to provide the same value in USD for both coins. If you want to add $ 500 to this pool, you need to add $ 250 worth of ETH and $ 250 worth of FSN. If ETH= $ 500 and FSN = $ 0.5, this would mean that you need to add 0.5 ETH and 500 FSN to the pool.

Liquidity providers rewards come from the 0.3% trading fee paid by swap traders of this pool. For example, if the daily volume of the pool FSN/aETH is $ 500k, then liquidity providers will share 0.3%, which is the equivalent of $ 1500 proportionally to the amount of liquidity provided to the pool.

The Governance And Utility Token “ANY”

Anyswap introduced its governance token “ANY”. The token was issued on Fusion blockchain without any pre-sale or fund raising.

The total supply of ANY is 100 million tokens. The initial supply was 15 million ANY, from which 5 million were initially added to the pool FSN/ANY, and 10 million ANY to community and ecosystem growth.

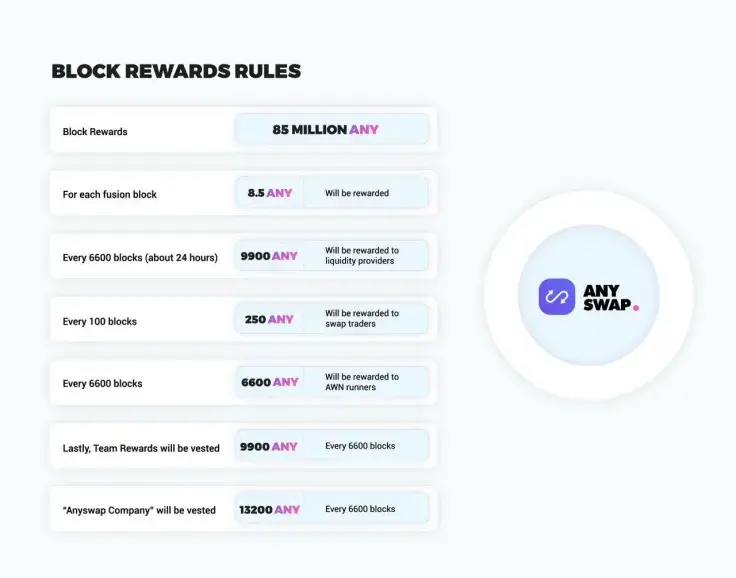

The remaining 85 million ANY will be distributed along with Fusion network blocks during approximately 4 years as follows:

-

50 million ANY are allocated to reward the different user activities (swapping, providing liquidity, running Anyswape Nodes)

-

35 million ANY (35% of the total supply) are allocated to Anyswap team and project shareholders. The fact that this allocation will be distributed along with Fusion Network blocks avoids any market manipulation or misbehaviour by team members.

ANY has different use cases:

-

As a utility token, ANY will be used to reward Anyswap users with substantial amounts of ANY. Liquidity providers, Anyswap nodes and even traders will share rewards based on Fusion blocks.

-

As a governance token, ANY holders will have the opportunity to vote on coin listings, Anyswap working nodes, changing governance rules proposals and many other important decisions related to the future of the platform.

How To Earn Passive Income With Anyswap:

Cryptocurrency traders and investors have been using centralized and decentralized exchanges to access more liquidity and coins. With Anyswap, you can do that in a fully secured and decentralized way. But that’s not all! You can use Anyswap to earn rewards and passive income, whether you provide liquidity, run a node or just trade coins and tokens. Let’s take a look at the activities you

-

Providing Liquidity: As explained earlier, when you provide liquidity to a certain pool on Anyswap, you will share the 0.3% fee charged to swap traders. It’s pretty much the same as similar protocols like Uniswap. Well, ..not exactly. Anyswap liquidity providers get additional rewards in ANY token. They share 9900 ANY on a daily basis according to each provider’s portion.

-

Run a Node: Anyswap Working Nodes (AWN) are elected through a voting process by ANY holders. After their election, they can set up their node and receive “cross-chain DCRM node” rewards, Anyswap nodes will share 6600 ANY daily.

-

Trading coins: Surprisingly, you can also earn passive income while trading and buying your favorite coins. It is true that you are charged a 0.4% fee on your swaps (from which 0.3% goes to liquidity providers and 0.1% to Anyswap team), but you need to keep in mind that 25% of the total supply of ANY is allocated for trading rewards. Swap traders will share 250 ANY for every 100 Fusion blocks (approximately every 22 minutes) proportionally to their trading volume during this period.

Why Is Anyswap Expected To Become The Best Swap Protocol In The Near Future?

Despite the impressive statistics and the unique technology behind the exchange, Anyswap is still flying under the radar. When it comes to market recognition and community adoption, it is fair to say that this swap protocol is undervalued. Here are the main reasons why Anyswap could become the most adopted swap protocol in the market:

- Cross-chain: Being powered by Fusion’s DCRM technology, the cross-chain feature of Anyswap is undoubtedly the main feature of the protocol. While other famous swap protocols such as Ethereum’s Uniswap and Tron’s Justswap are limited to their native blockchains, Anyswap goes further and allows swaps between different blockchains using the ability of DCRM to integrate any EcdSa and EdDSA blockchains, which represents almost all the blockchains of the market.

- Network Fees: Another important aspect where Anyswap stands out from other competitors is network fees. During the current DeFi boom, we have witnessed how the congestion of the Ethereum network led to ridiculously high fees. In comparison to Ethereum, Fusion network fees are 100k lower, which is obviously way more convenient for users.

- Security and decentralization: In addition to the two previous aspects that are specific to Anyswap, security is also important. Anyswap uses DCRM technology to ensure a safe and decentralized custody of users’ funds. To add another layer of security, Anyswap will use the governance token ANY to let token holders to decide on which coins should be added to the platform. This will avoid listing fake and scam tokens like what is of Uniswap.

- More Rewards: Anyswap is the only swap protocol where all the users earn passive income, including swap traders rewards. Anyswap working nodes earn substantial rewards in ANY token, while liquidity providers receive double rewards coming from swap trading fees, and ANY liquidity rewards.

Conclusion

Anyswap is therefore an incredible investment opportunity for early adopters to make huge profits through holding ANY, earning passive income, and more importantly, access different blockchains in a fully decentralized and secure way.

Disclaimer: This is sponsored content. The information on this page is not endorsed or supported by U.Today, and U.Today is not responsible or liable for any inaccuracies, poor quality, advertising, products or other materials found within the publication. Readers should do their own research before taking any actions related to the company. U.Today is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov