Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

OpenLeverage, a decentralized protocol designed to allow crypto traders to open leveraged shorts and longs on various markets, shares the details of its tokenomic design and its technical development.

Introducing OpenLeverage, a new-gen multi-chain DeFi platform

Since its first mainnet launch on Ethereum (ETH) in Q4, 2021, OpenLeverage platform advances decentralized lending and margin trading in multi-chain systems. To ensure the stability of its economic design, the protocol issued OLE, a core native cryptocurrency.

So, what is special about OpenLeverage protocol and its OLE token?

- OpenLeverage is one of the first multi-chain DeFi protocols in margin trading; it allows interoperability between Ethereum (ETH), BNB Chain (BNB) and KuCoin Community Chain (KCC), three mainstream EVM-compatible blockchains;

- The protocol allows opening short and long positions on assets listed on every major DEX: new coins can be added without OpenLeverage’s consent;

- OpenLeverage supports straightforward deployment of “yield farms”; adding new liquidity pool to its ecosystem is as easy as adding new token;

- OpenLeverage is backed by a clutch of high-profile VC heavyweights, including the likes of Signum Capital, LD Capital, and, most recently, Binance Labs.

- Only 7.35% of aggregated OLE supply (73,500,000 tokens) were airdropped; it is set to reaffirm OpenLeverage’s commitment to achieving maximum scarcity of the asset.

That said, OpenLeverage is set to unlock new opportunities for DeFi enthusiasts with various levels of expertise in crypto and blockchain.

What is margin trading?

Margin trading should be considered a practice of using borrowed money when trading stocks, indexes or cryptocurrencies. In margin trading, traders can borrow money from their brokers, use it to purchase this or that asset and repay the loan later (normally, with a small commission).

Margin trading becomes increasingly popular in crypto markets: it allows traders to “enlarge” their deposit in a number of clicks. Operating bug deposits makes trading more interesting and profitable.

At the same time, bigger risks come with bigger deposits: margin trading cannot be recommended to crypto newbies. Also, interfaces of margin trading dashboards have far more sophisticated UX/UI compared to spot ones.

Why does Web3 need a multi-chain system?

Multi-chain cryptocurrency systems are designed to allow crypto traders and liquidity providers to leverage their liquidity stored on various blockchains without leaving a single technical “endpoint” (exchange, DeFi protocol, wallet and so on).

Using multi-chain systems makes the DeFi experience more streamlined: it removes the need to transfer liquidity from one blockchain to another through cross-chain bridges or centralized intermediaries.

Also, in DeFi protocols, using multi-chain systems allows traders to access deeper liquidity as they aggregate orders from a wide range of protocols.

OpenLeverage changes the narrative in margin trading; Here’s how

OpenLeverage protocol launched in 2021 to introduce the best margin trading practices to noncustodial crypto markets. Furthermore, it unified the largest EVM-compatible blockchains - Ethereum, BNB Chain and KuCoin Community Chain (KCC) - into a seamless ecosystem and supercharged the system with native coin OLE.

Basics

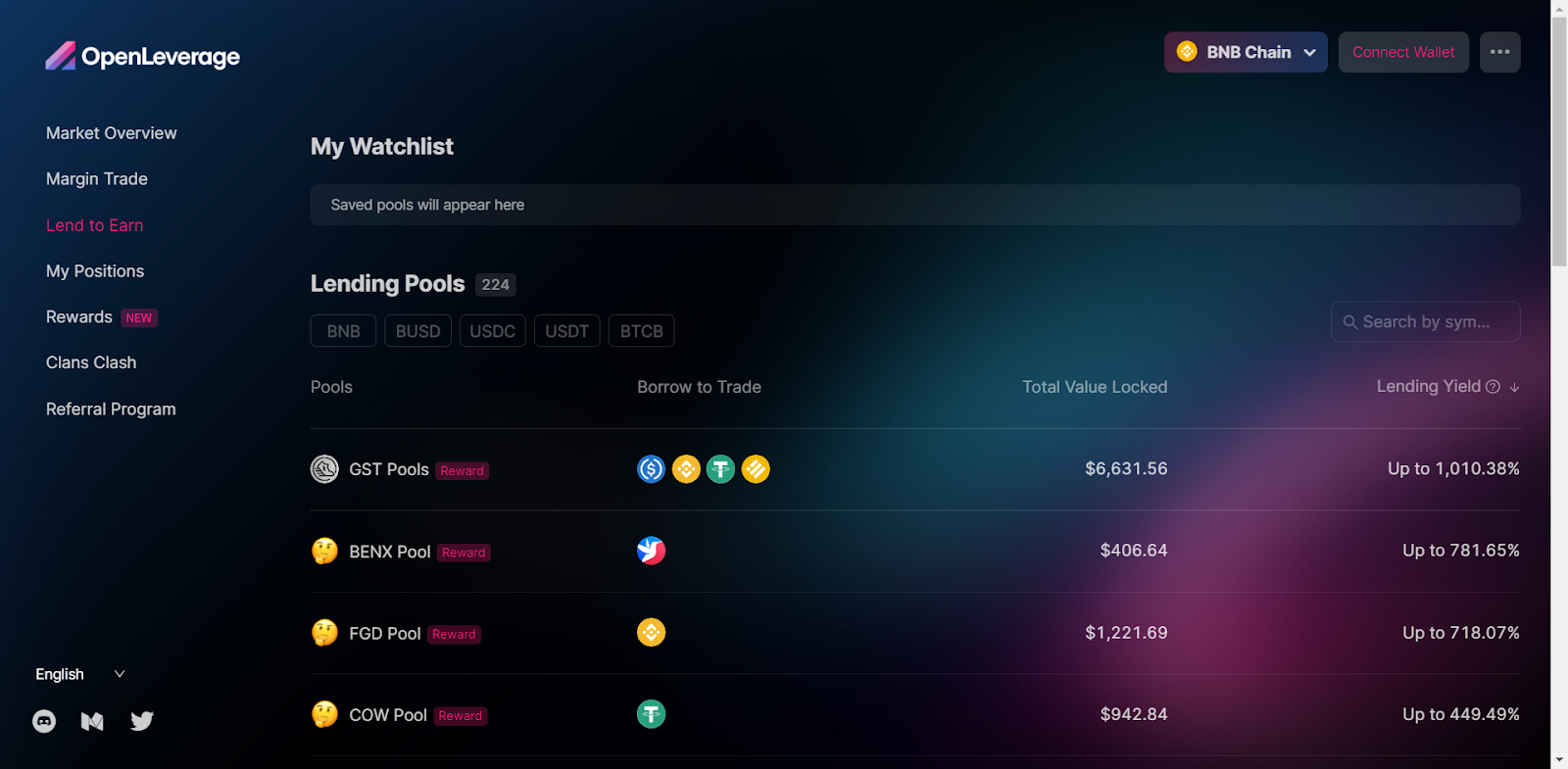

OpenLeverage is a multi-chain permissionless lending and margin trading protocol. By Q3, 2022, it has been deployed to Ethereum (ETH), BNB Chain (BNB), and KuCoin Community Chain (KCC), while more EVM-based chains are in focus starting with Polygon (MATIC). This allows crypto holders to launch leverage trading pairs on various markets, accessing liquidity from a number of DeFis.

In terms of crypto businesses, OpenLeverage instruments are useful for emerging crypto products: they can launch margin trading on their tokens immediately upon launch. Also, it allows traders and projects to access liquidity from multiple leading DeFi protocols: for instance, when OpenLeverage was deployed on BNB Chain, its core protocols, such as PancakeSwap, MDEX and BabySwap, became accessible to OpenLeverage clients.

OpenLeverage addresses major bottlenecks of margin crypto trading and the DeFi segment as a whole:

- Short range of assets available: typically, protocols of that type support 20-30 pairs while OpenLeverage allows everyone to add his/her own assets;

- Mediocre liquidity: seamless integration with various high-profile DeFis unlocks amazing opportunities for traders, lenders and liquidity providers;

- Price slippages: as traders/lenders work with increased liquidity, the possibility of dangerous price fluctuations is almost removed with OpenLeverage.

Tokenomics

To make the trading/lending experience on OpenLeverage more comfortable and profitable and to introduce its opportunities to a wide crypto audience, the OpenLeverage team launched OLE, a core native cryptocurrency token. It will also be used in on-chain governance mechanisms.

The token’s aggregate supply is capped at 1 billion; this number cannot be voluntarily increased by either the team or the community. This supply is set to be distributed as following:

- 47% will be stored in the DAO treasury for various community incentives (retrospective rewards, trading, lending, xOLE holder rewards, campaigns and marketing campaigns);

- 8.6% will supercharge an ecosystem development treasury;

- 28.4% will be distributed between past investors of the OpenLeverage Foundation;

- 16% will be used to compensate founders, employees and advisors;

- Last but not least, 7.35% of OLE tokens will be shared between airdrop participants (those who participated in its key operations - margin trading, lending, market creation and liquidation facilitation), according to the screenshot taken on June 30, 2022, at 12:00 p.m. UTC.

The protocol has a solid investment background. In July 2021, it raised $1.8 million during a seed round. Signum Capital and LD Capital co-led the round, while FBG Capital, Continue Capital and YBB Foundation also backed the start-up in its fundraising efforts.

Most recently, in July 2022, it secured funding from Binance Labs in its Incubation Program Season 4.

In the last year, OpenLeverage amassed over $13.2 million in TVL and processed $691.6 million in trading volume. Its closest competitor Beta Finance has a TVL of $10.2 million; based on TVL’s comparison, OpenLeverage capitalization has room for growth.

Compared to other majors of the segment (dYdX, Perpetual and ApolloX), OpenLeverage protocol and its token OLE also look undervalued. As per the estimations of its team, OpenLeverage can reach $4.5-5 million in yearly revenue whilst its closest competitors (Perpetual) registered $7 million in yearly revenue.

Opportunities

In its progress, OpenLeverage implemented various eccentric technical features that make it outstanding among competitors’ designs. It also addresses the needs of various categories of DeFi market participants.

For lenders, it guarantees periodic rewards on their locked cryptocurrency riches without the necessity to move them out of the initial blockchain. Otherwise, borrowers and traders can experiment with emerging tokens accessing unmatched liquidity pools.

In terms of B2B operations, OpenLeverage is a reliable partner for project owners interested in boosting the audience of their tokens, DEXes that are seeking a liquidity supply (and seeking to onboard new clients) and liquidity farmers focused on low-risk earning opportunities.

Closing Thoughts

OpenLeverage is a noncustodial DeFi protocol for lending and margin trading. Its multi-chain mechanisms are deployed to major EVM-compatible blockchains Ethereum (ETH), BNB Chain (BSC) and KuCoin Community Chain (KCC).

OpenLeverage is designed to allow crypto holders to trade with leverage in a noncustodial manner. It indexes major DEXes on all supported chains and allows traders to launch their own trading pairs and liquidity pools. In all, over 300 markets are available for its clients as of Q3, 2022.

OpenLeverage issued its own core native asset OLE; 7.35% of its supply is distributed between early users of OpenLeverage.

Godfrey Benjamin

Godfrey Benjamin Yuri Molchan

Yuri Molchan Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan