Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

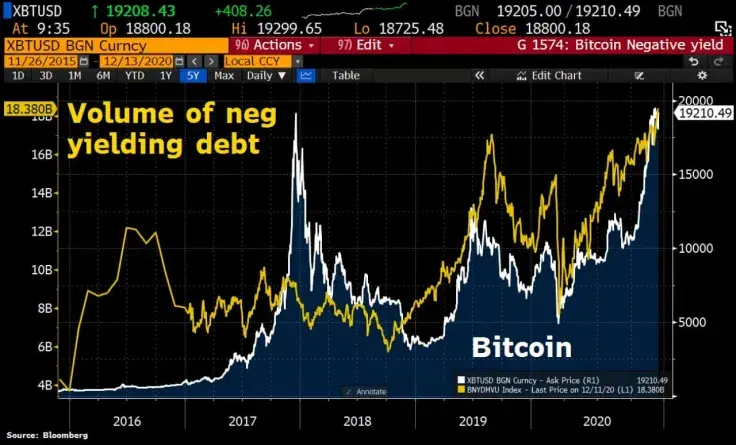

The price of Bitcoin (BTC) surpassed $19,000 again after a major weekend relief rally. Coincidentally, the volume of negative-yielding debt achieved an all-time high at $18.4 trillion.

In recent months, institutions and high-net-worth investors have increasingly invested in Bitcoin as an inflation hedge. Considering this trend, macro and market analysts are pinpointing the record-high global debt as a catalyst for BTC.

Bitcoin is Surging Despite the Dollar’s Recovery

There are three key macro factors that could have a direct impact on the price of Bitcoin in the short term. They are U.S. stimulus, the U.S. Dollar Index (DXY), and the negative-yielding global debt.

If the U.S. approves a new stimulus package in the near term, it would cause risk-on assets to rally, which could benefit Bitcoin.

But, the DXY has been rallying due to the optimism surrounding vaccines and the decline in election risk.

When the DXY surges, alternative stores of value, such as gold and Bitcoin, risk seeing a pullback as markets price assets against the dollar. Hence, if the value of the dollar itself rises, the value of Bitcoin and gold against the dollar would naturally decrease.

In the past several days, Bitcoin has been increasing in spite of the dollar’s recovery. This trend indicates that positive macro factors, like the growth in negative-yielding debt, are outweighing potential risks.

Holger Zschaepitz, a market analyst at Welt, emphasized that the institutional interest in Bitcoin is rising as a result of the negative-yielding debt’s growth. He wrote:

“Bitcoin rallies >$19k again as institutional interest grows as the global volume of negative-yielding debt hit fresh ATH of $18.4tn. Life insurance giant MassMutual has announced it has already invested $100mn in Bitcoin for its general fund.”

The increase in institutional demand for Bitcoin has been evident across various markets. For instance, the open interest of the CME Bitcoin futures market overtook Binance to become the second-largest in the global market.

Since the CME Bitcoin futures market primarily tailors to accredited and institutional investors, it indicates that the trading activity of institutions in the Bitcoin market is growing.

What’s Next?

Bitcoin is at a critical point where it would need to breach its all-time high at around $20,000 to see a broader rally.

Throughout November to December, there were large sell orders near $20,000, which continuously caused BTC to reject the all-time high.

In the near term, the key for Bitcoin is to surpass $20,000 with strong volume and break past the stacked sell-side pressure. If it does, the probability of a larger rally increases, as whales that previously bid the $20,000 resistance level would look to bid elsewhere.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin