Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Amid increasing regulatory pressure and macroeconomic uncertainty, a new generation of cryptocurrency users are seeking secure and predictable opportunities to generate yield on their deposits.

Crypto staking might be a smart bet in 2023. Almost all major altcoins are running on this type of blockchain consensus. CryptoStake platform lowers the barrier to entry for staking newbies and makes crypto staking rewards "antifragile."

What is proof of stake?

Proof of stake (typically abbreviated as PoS) is a consensus mechanism in blockchain networks that enables the validation of transactions and the creation of new blocks. Unlike proof of work (PoW), which relies on miners solving complex mathematical puzzles to validate transactions, PoS operates differently.

In a PoS system, validators are chosen to create new blocks and confirm transactions based on the amount of cryptocurrency they "stake," or lock up as collateral. This means that participants who hold a larger amount of the network's native cryptocurrency have a higher chance of being selected as validators and earning rewards. Small players can also "delegate" their holdings in favor of this or that validator, and earn a share in their rewards.

Ethereum (ETH) and Cardano (ADA) are the two largest proof-of-stake (PoS) networks. In general, this type of consensus is a "gold standard" in Web3 as of 2023.

Introducing CryptoStake, one-stop crypto staking machine

CryptoStake, a multiasset protocol for cryptocurrency staking, offers a secure, resource-efficient and flexible gateway to the crypto staking sphere. Its low-fee service works in a more staker-oriented manner compared to its main competitors.

CryptoStake introduces one-stop crypto staking app for top PoS coins: Highlights

CryptoStake platform was among the first products to offer a non-custodial wallet for cryptos. Now, it has evolved into a multi-blockchain ecosystem of staking offerings.

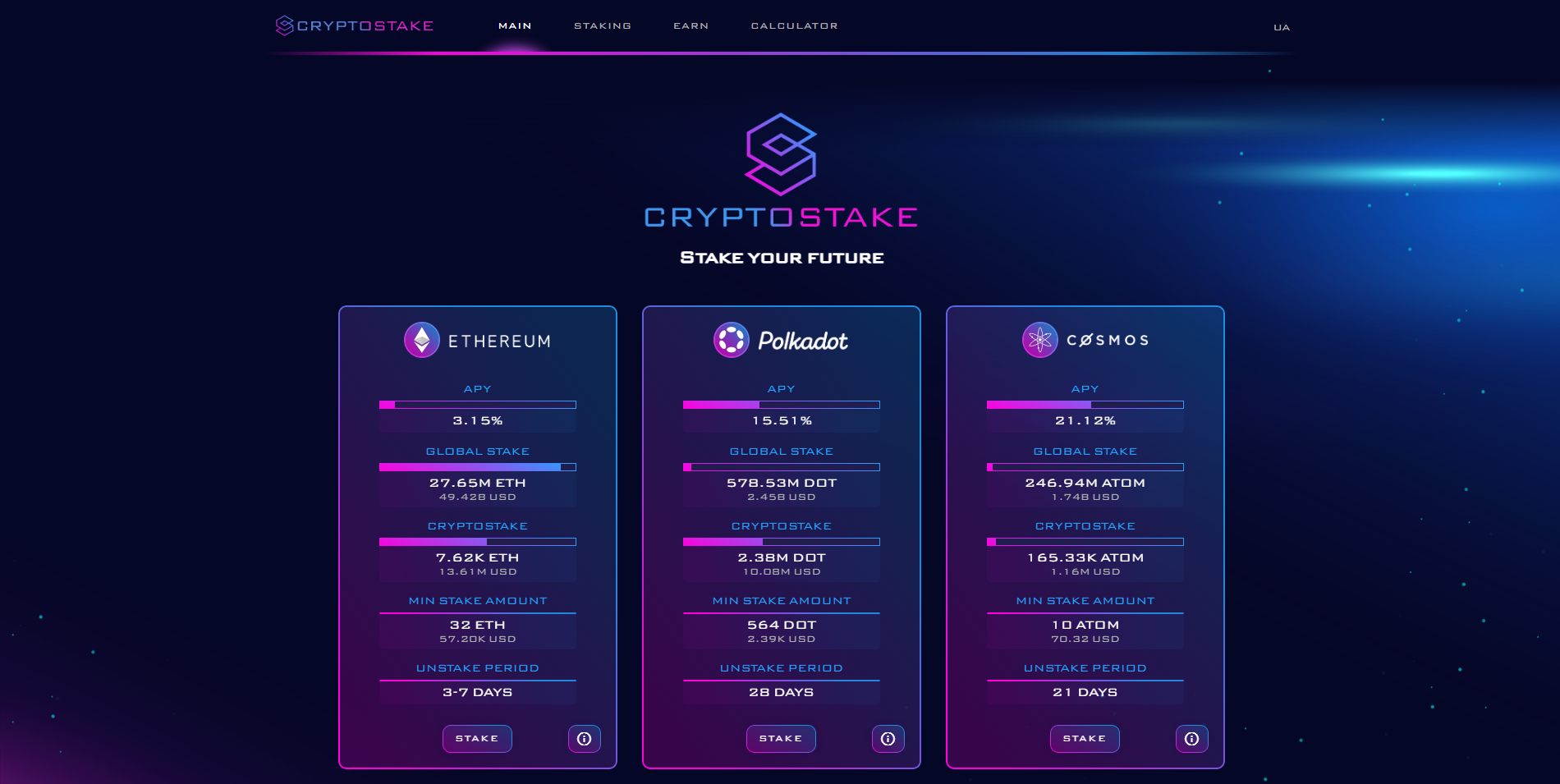

- CryptoStake platform is a multiasset staking dashboard that supports staking of Ethereum (ETH), Cosmos (ATOM), Polkadot (DOT) and is set to introduce Bitcoin-centric solutions.

- It ensures cryptographically encrypted staking procedures for major altcoins acting as a noncustodial wallet with earn functions.

- Unlike mainstream liquid staking platforms, CryptoStake pays rewards in the same token its customers stake: Ethereum (ETH) stakers get rewards in ETH, and so on.

- Thanks to above mentioned feature, CryptoStake offers more predictable rewards strategies, instead of offering lucrative APY rates in shady, low-liquidity tokens.

- CryptoStake users access validator nodes themselves, so the platform does not have control over user funds.

In a nutshell, the platform allows crypto holders to easily become validators of all major PoS blockchains with no need to lock funds to get unpredictable rewards.

CryptoStake: Basics

Swiss-incorporated cryptocurrency staking service CryptoStake is a newcomer-friendly platform for staking assets on PoS blockchains. It allows cryptocurrency users to deposit and stake Ethereum (ETH), Polkadot (DOT) and Cosmos (ATOM) tokens in order to receive periodic rewards.

CryptoStake leverages its own on-chain wallet: the system has no custody over users' assets at any stage of the staking procedure. Users can lock their assets for flexible periods with fixed unstaking limits. For their operations, CryptoStake charges users with fixed 3% fees.

Besides that, the platform prioritizes regulatory-compliant and transparent operations. The platform is designed for customers who require proof of ownership to meet regulatory requirements and for taxation purposes in their jurisdictions. CryptoStake offers a complete reward allocation history for the entire staking period, along with statements suitable for the taxation watchdogs of various countries.

It works with stakers with various portfolios and staking strategies: there is no need to have a significant stake to join the staking operations on the platform. At the same time, the platform offers comprehensive tooling for large-scale ETH holders. While working with CryptoStake, they can enjoy asset protection during the entire process of staking, the ability to retrieve assets from the wallet without intermediary assistance and consulting support in dealing with tax-related matters.

CryptoStake: Why is this better than liquid staking?

From the onset of its operations, CryptoStake prioritizes the security and flexibility of its operations over whopping APY rates some providers are offering. Also, it champions a transparent and sustainable yield strategy; every user gets rewarded in the same cryptocurrency he or she deposits.

In this regard, its product is more reliable than that of mainstream liquid staking protocols. Some liquid staking protocols reward contributors in their "brand" assets, which are actually low-cap altcoins subject to super-high volatility. Say you lock ETH in some liquid staking protocol, XYZ, receive "liquid" synthetic Ethers xyzETH, and get rewarded in XYZCoins. While APY rates can be really impressive, all rewards can lose value during periods of market volatility.

Ethereum (ETH), Cosmos (ATOM) and Polkadot (DOT) are among the largest altcoins: rewards from CryptoStake are much more sustainable and protected from instability.

Also, staking with CryptoStake is more secure and attack resistant than locking coins in centralized staking dashboards. Working with such services, users can lose both their stakes and rewards generated as a result of theft or market manipulation. In such services, platforms can also control the keys of the crypto wallets of users.

CryptoStake: Tech, validators and APY rates

Technically, CryptoStake just provides its customers with uninterrupted access to the validator node on a designated server and ensures control over their crypto funds stored in their respective wallets. In other words, the platform is constantly "renting" a portion of its validation resources to customers in exchange for small fixed fees.

As a result, the platform has no control over user funds, passphrases or private keys: users retain full responsibility over their share in the validation process. Every user-driven validator can be restored with only a validator number and user credentials.

Blockchain | Ethereum | Polkadot | Cosmos |

Ticker | ETH | DOT | ATOM |

APY, % | 3.34 | 16.15 | 21.08 |

Net staked, B USD | 43.5 | 2.14 | 1.58 |

Staked by CryptoStake, M USD | 12 | 8.71 | 1.25 |

Unstaking period, days | 3-7 | 28 | 21 |

Due to its transparent nature and sustainable yield-generating model, it cannot offer APYs higher than those offered by blockchains themselves.

The platform relies on its own server infrastructure in New York, Frankfurt and Toronto. All servers used for staking demonstrate availability of 99.9% and higher. Users can operate their stakes via mobile applications that can be downloaded in App Store and Google Play marketplaces.

CryptoStake: Crypto staking rewards calculator, extra offerings and future plans

Besides easy-to-join staking portals and mobile applications, CryptoStake released a clear and convenient staking rewards calculator. It is designed for all types of investors interested in making their strategies predictable and flexible.

With CryptoStake rewards calculator, potential stakers can find out the ideal size of the stake and token locking period. In the future, the platform is going to roll out staking functions for Bitcoin (BTC) holders. Also, the support for the U.S. Dollar Tether (USDT) on Tron (TRC-20) and Tron (TRX) will be added in the wallet while Cardano’s ADA is expected to land in the staking module by the end of this year.

This will unlock staking for the community of a $553 billion cryptocurrency and bring fresh inflows of liquidity into the staking sphere. Also, in the near future, the company is going to advance its cold storage solution and start providing a professional licensed custody service.

Bottom line

CryptoStake is a next-gen staking platform for holders of Ethereum (ETH), Polkadot (DOT) and Cosmos (ATOM), i.e., the largest PoS coins. Here users borrow shares of its validation power and can get "native" rewards instead of payouts in obscure altcoins offered by some services or liquid staking.

The platform works with fixed performance fees and offers an average APY of over 13%. Periods of unstaking may vary between 3 and 28 days. The platform is fully noncustodial and holds no control over users' funds or credentials.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov