Huobi, one of the largest cryptocurrency derivatives exchanges, will extend the promotion period of its Tether-margined swaps transaction fee until the end of January to celebrate the success of its recently introduced product.

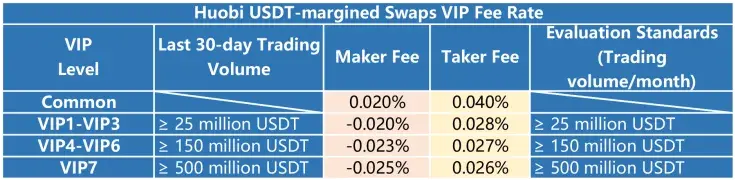

Its VIP users will be able to enjoy preferential rates that are shown in the table below.

Tier-7 traders (as displayed above) will be able to have a maker fee of just -0.025 percent coupled with a 0.026 percent take fee.

All VIP market makers are charged negative fees, while normal makes and take fees are 0.02 and 0.04 percent, respectively.

Lowering the VIP threshold

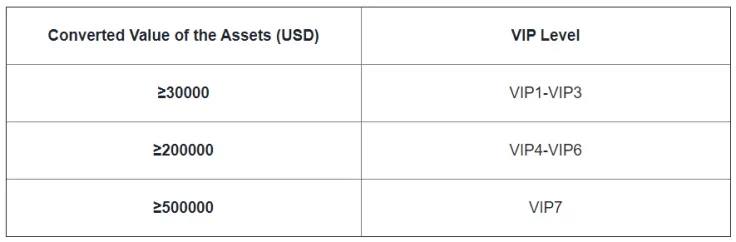

With the launch of USDT-margined swaps, Huobi has significantly lowered the threshold for qualifying as a VIP user.

All qualified participants who trade Tether-margined swaps can join the lowest tiers with only $30,000 worth as assets in their account. It worth mentioning that Huobi users have independent accounts for futures, swaps, and options trading.

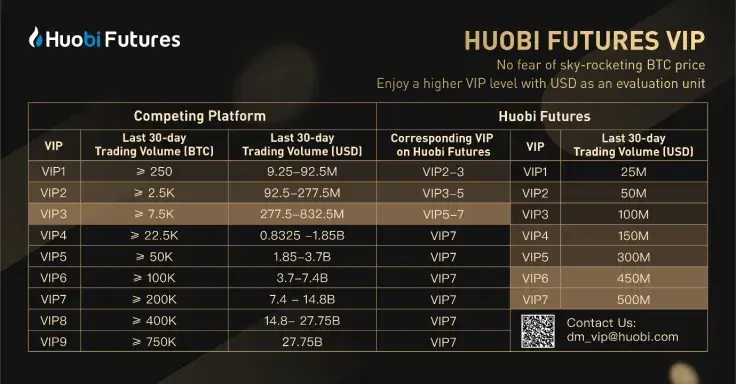

Unlike competing platforms that require a trading volume of up to 250 BTC (around $95 million) to get VIP status, Huobi only requires 25 million, which is much more friendly in this bull market. Achieving the highest level (VIP 7) will only require $0.5 billion worth of 30-day trading volume.

Trading on another exchange? You can still become a VIP trader on Huobi

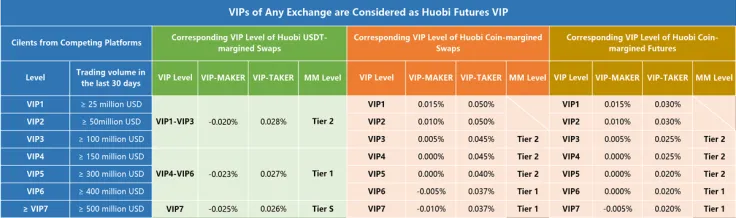

There is also another way to get a preferential fee rate. Huobi Futures now allows VIP traders from competing platforms to enjoy lower fee rates by providing certificates of VIP level from other exchanges.

For instance, if a certain trader’s VIP level on a rivaling exchange is 5, he or she can get a level of VIP 4-6 on Huobi Futures and enjoy a maker fee rebate up to 0.023%.

Becoming a VIP to enjoy excellent liquidity and services

As a flagship product of Huobi Futures, coin-margined futures is launched in December 2018 and its trading volume has sustainably ranked first in the derivative market in only eight months. At present, it has included 13 major crypto assets with a unilateral trading volume of $1.32 trillion in 2020.

Back in March, Huobi launched coin-margined swaps that are denominated and settled in cryptocurrencies. It made such a move later compared to BitMEX, the largest coin-margined swaps exchange at that time. In spite of its late entry, it quickly managed to race ahead of other exchanges in terms of its 24-hour trading volume.

Huobi rolled out its USDT-margined swaps back in October to capitalize on the growing demand for stablecoin-margined derivatives. Launched on Oct. 26, its trading volume has grown rapidly with its cumulative trading amount exceeding $177.8 billion in just two months.

Apart from its high trading volume, Huobi has a robust risk-control system and the platform holds a record of zero clawback for 760 days since its launch. In version V6.3.0., the system has a throughput of 10W+, the response speed of placing and canceling orders is within 6ms, and the link delay is within 25ms.

There are also lots of innovative functions provided such as locked margin mechanism, take-profit and stop-loss, real-time settlement, daily settlement, Follow a Maker & Taker, etc. Being a VIP on Huobi Futures means that you can enjoy this excellent liquidity and all its high-quality services at a very low cost, even get a rebate if you trade as a Maker.

How can you apply?

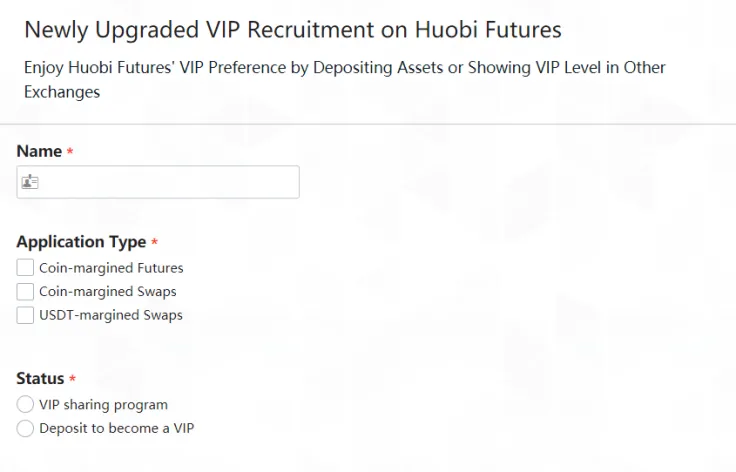

In order to become a VIP trader, one has to fill out an application form, specifying his or her personal details such as name, user ID, phone, and country. One also has to choose the application type and the path to become a VIP member (either through the VIP Sharing Program or through Deposit to Become a VIP Program).

These promotion stands will last until the end of February.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin