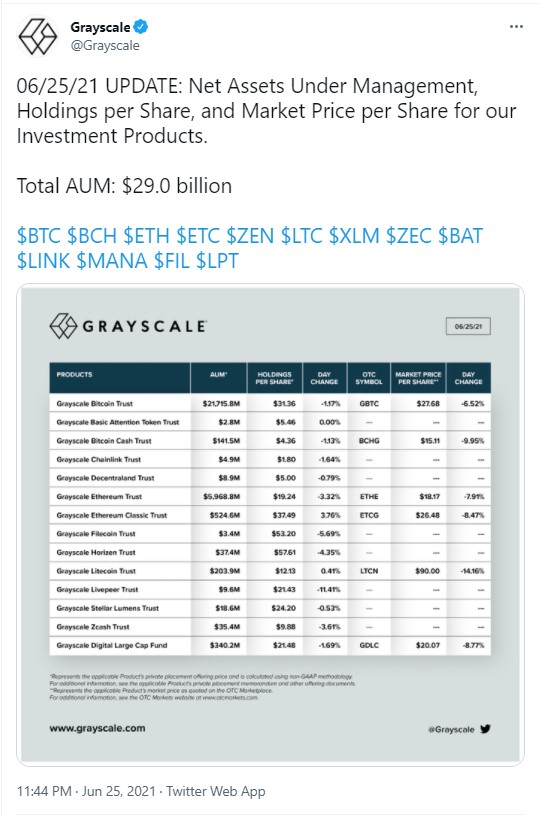

Largest cryptocurrency fund Grayscale Investments, a subsidiary of Barry Silbert’s Digital Currency Group, announced that its crypto holdings had shrunk by another half-a-billion US dollars on June 25 compared to $29.5 billion a day earlier.

Grayscale sees more outflows

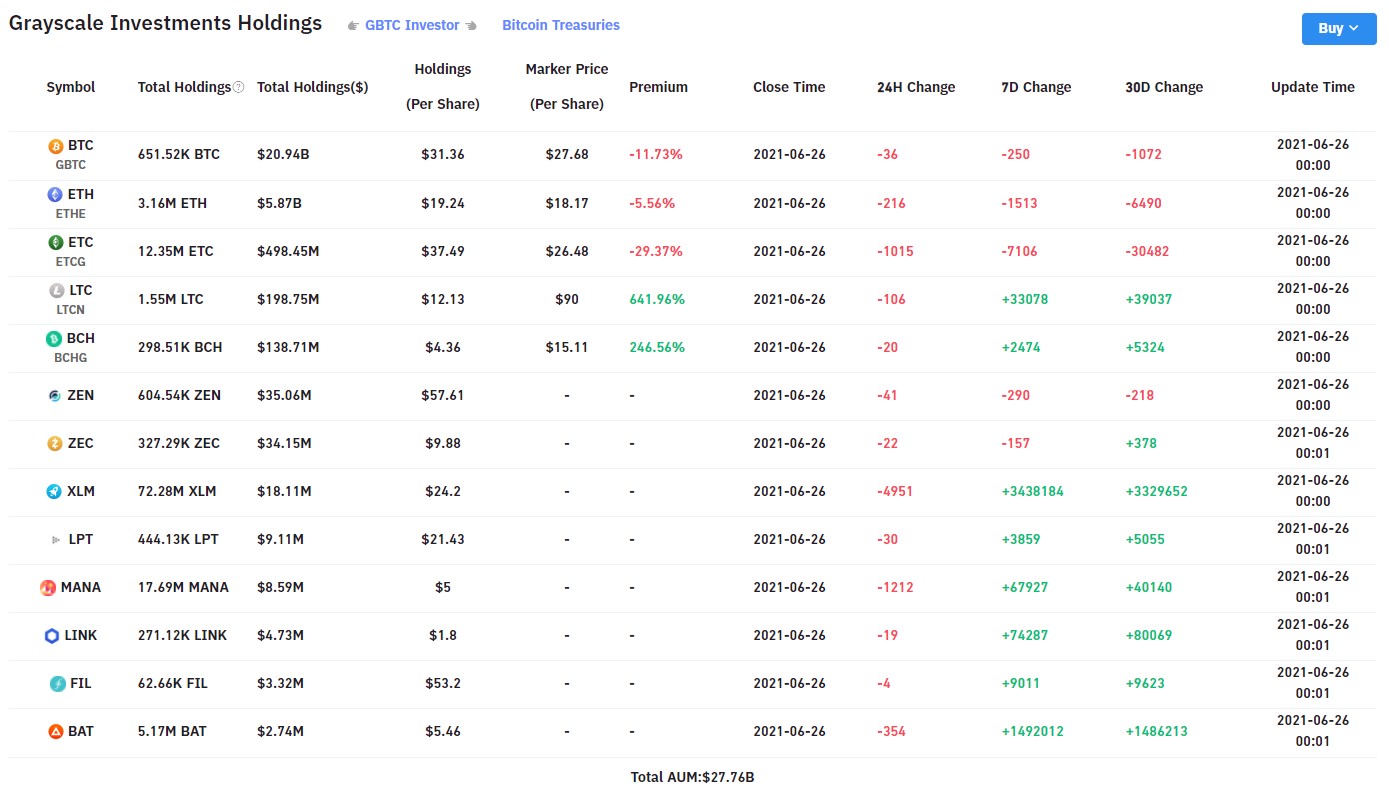

The company’s crypto holdings are declining as outflows from its cryptocurrency trusts continue, according to the data provided by Bybt.

In particular, that is true about Bitcoin Trust, Ethereum Trust and ETC Trust, whose shares are trading at a discount.

However, inflows into altcoin trusts of the company continue on the weekly and monthly basis.

Company considers expanding its presence in altcoin market

As reported by U.Today earlier this month, the largest crypto asset management firm Grayscale announced that it was considering setting up more trusts based on new altcoins.

Among the coins considered are 1 INCH, Bancor (BNT), Curve (CRV), Internet Computer (ICP), Kava (KAVA), Kyber Network (KNC), Polygon (MATIC), Ren (REN), Solana (SOL), etc.

Bitcoin price drops to $30,000 but is recovering

Today, the flagship cryptocurrency, BTC, lost another 7 percent, dropping from the $32,000 area to $30,000. On Friday, Bitcoin was trading in the $35,000 zone.

By now, Bitcoin has recovered some of today’s losses and is sitting at $31,158.

Ethereum is trading at $1,769 per coin.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov