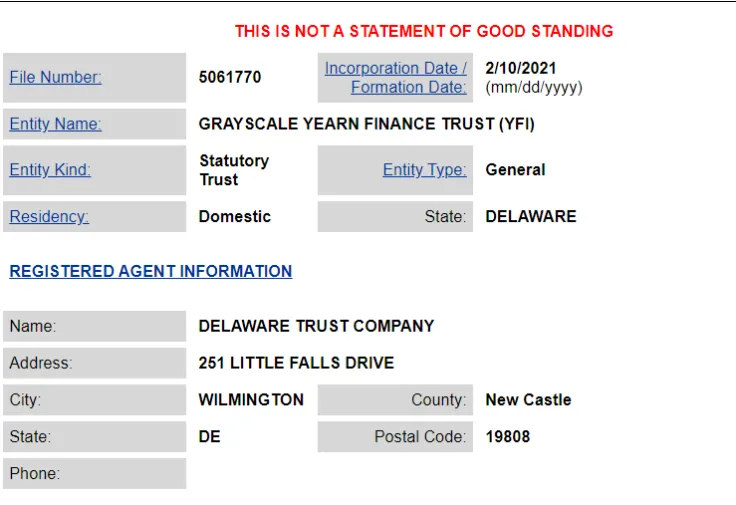

Leading cryptocurrency asset manager Grayscale could potentially launch a new trust for Yearn.Finance (YFI).

Delaware Trust Company, the company’s statutory trustee, recently registered the above-mentioned product, according to its Feb. 10 filing.

Last month, Grayscale also formed a slew of trusts for such cryptocurrencies as Chainlink (LINK), Tezos (XTZ), Cardano (ADA),

However, the asset manager noted that these products would not necessarily be brought to market:

Occasionally, we will make reservation filings, though a filing does not mean we will bring a product to market. Grayscale has and will continue to announce when new products are made available to investors.

Crypto Market Review: Shiba Inu Price Momentum Returns In New Uptrend, Is Ethereum (ETH) Stuck in the Mud? Bitcoin Isn't Giving Up on $70,000 Ripple Secures Major Partnership With Deutsche Bank, XRP Price Breaks Key Support, Binance’s CZ Reveals His Role In UAE’s Bitcoin Mining Milestone — Crypto News Digest

As per its most recent update, Grayscale currently has $36.2 billion worth of assets under management, with its Bitcoin trust accounting for $29.7 billion of the aforementioned sum.

The firm’s XRP trust was terminated in January after Ripple Labs got sued by the U.S. Securities and Exchange Commission.

Yearn.Finance’s governance tokens hits an all-time high

Yearn.Finance's YFI token is currently among the best-performing cryptocurrencies over the past 24 hours.

Earlier today, the token surpassed the $45,000 level for the first time in history, reaching a new all-time high of $45,895 on FTX.

The token—which was originally deemed to be completely valueless— swiftly became a fixture in the decentralized finance industry together with Andre Cronje, the founder of the Yearn.Finance protocol.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin