Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

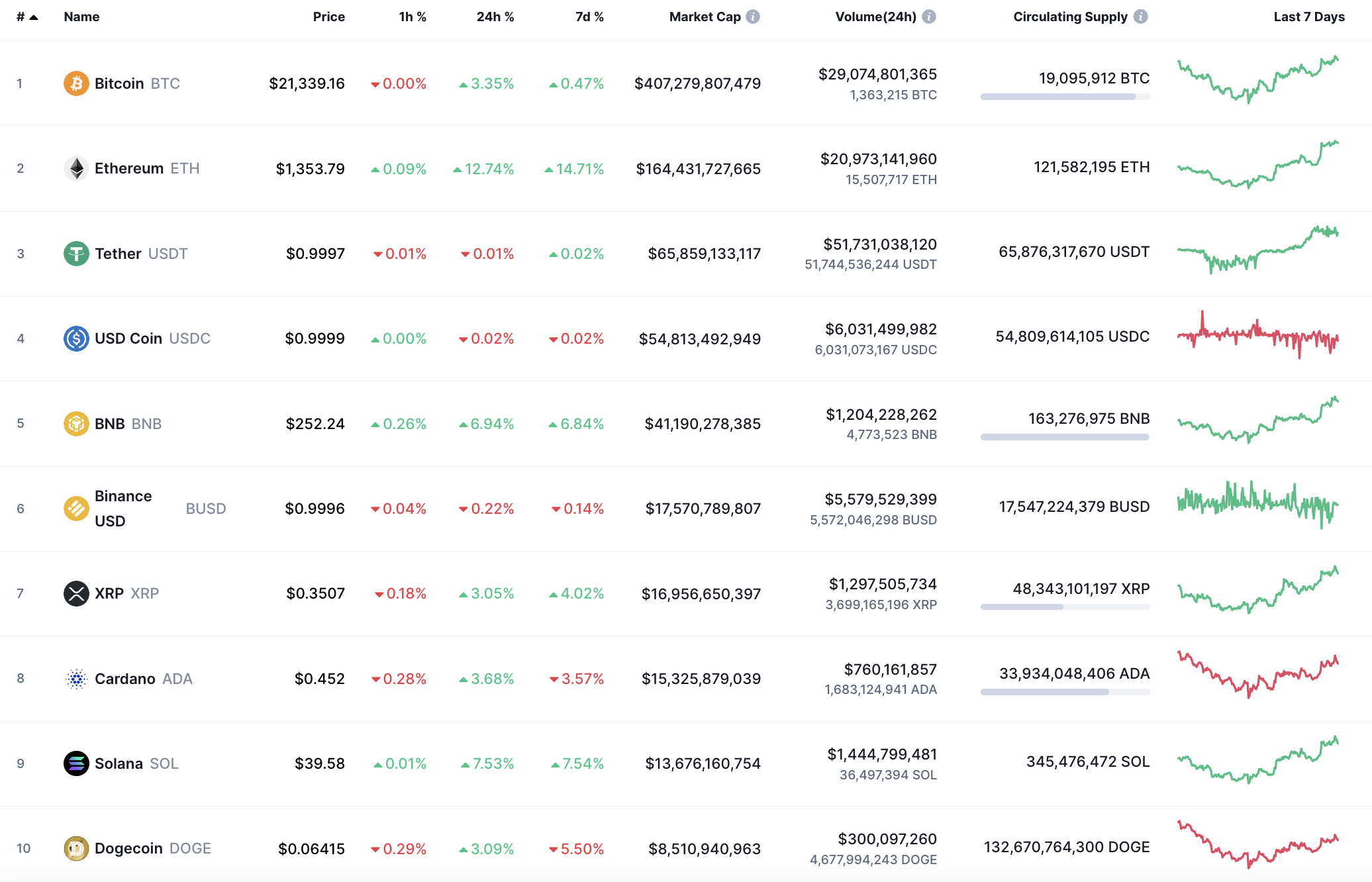

Buyers keep setting new local peaks as the top 10 coins are in the green zone.

ETH/USD

The rate of Ethereum (ETH) has risen by almost 15% over the last week.

In the local time frame, Ethereum (ETH) is stuck between the support at $1,313 and the resistance at $1,386. The price is closer to the upper level at the moment, which means that bulls are more powerful than bears.

If the pressure continues, there is a chance to see the leading altcoin near the $1,400 mark by the end of the day.

On the daily chart, Ethereum (ETH) is fixed above the vital level at $1,281. While the price is above it, bulls control the situation on the market. In this case, the more likely scenario is sideways trading between $1,300 and $1,400, so bulls could accumulate energy for a further upward move.

From the midterm point of view, Ethereum (ETH) is looking bullish as the price has broken the $1,300 mark. Thus, the buying volume is rising, which means that one can expect an approximate rate of $1,500 within the next few weeks.

Ethereum is trading at $1,356 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin