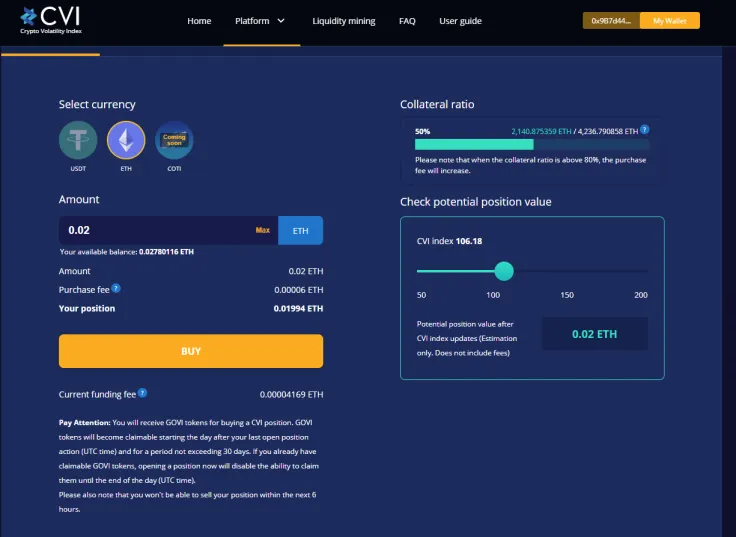

Users of Crypto Volatility Index (CVI), a unique decentralized financial instrument by COTI blockchain network, are now able to deposit Ethers seamlessly with their Metamasks. Also, new liquidity provision options are activated.

Seamless ETH deposits are live in COTI's CVI

According to a press release shared with U.Today, COTI Network has accomplished its most ambitious milestone of Q1, 2021. Namely, its Crypto Volatility Index (CVI) now interacts seamlessly with the Ethereum (ETH) network.

Thus, all CVI users can connect their Metamask wallets (or any Ethereum wallet of a similar type) and interact with all CVI mechanisms directly with regular 0x-addresses.

Shahaf Bar-Geffen, CEO of COTI Network, outlines the crucial importance of new release for top-tier traders:

When we launched the first decentralized and permissionless crypto market fear index, also known as Crypto Volatility Index (CVI), our goal was to enable sophisticated traders to profit from the crypto market volatility or to hedge themselves against it. Adding ETH is another step towards our goal of bringing the best possible tools to the CVI platform users, and this is just the beginning.

Thus, Ethereum (ETH) wallet owners can buy or sell CVI positions with their Ethers. Holders of the second cryptocurrency have yet another opportunity to benefit from spikes in volatility on the crypto market.

The team stresses that all Ether holders who buy or sell CVI positions are eligible for double-digit gas fee discounts:

We expect to cut down an additional 18% of the gas costs, which brings us to 60% in total.

GOVI rewards for stakers are introduced

To outline its DeFi bet, COTI Network implemented "yield farming" tools in its latest release. Users can stake their CVI-ETH-LP tokens in order to obtain rewards in COTI's governance assets, GOVI tokens.

Also, COTI Network introduced the groundwork for margin trading that allows sophisticated market actors to trade their positions with leverage.

As covered by U.Today previously, COTI recently launched its Staking 3.0 phase for COTI tokens. Then, due to collaboration with Simplex, COTI can now be purchased with fiat money in the Apple Pay system.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov