Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

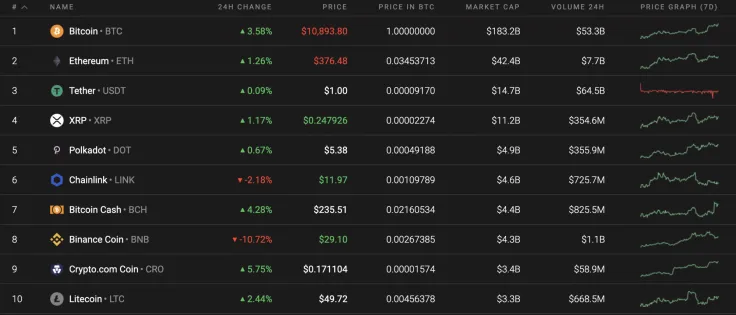

Most of the coins have followed the bullish mood of the market, however, there are some exceptions. Mainly, Chainlink (LINK) and Binance Coin (BNB) are the only losers among the Top 10 cryptocurrencies.

The key data for Ethereum (ETH), XRP and Bitcoin Cash (BCH) today:

|

Name |

Ticker Advertisement

|

Market Cap |

Price |

Volume (24h) Advertisement

|

Change (24h) |

|

Ethereum |

ETH |

$42,322,833,036 | $375.83 | $18,876,442,978 | 0.47% |

|

XRP |

XRP |

$11,147,301,746 | $0.247485 | $1,940,522,653 | 0.66% |

|

Bitcoin Cash |

BCH |

$4,363,353,604 | $235.62 | $3,484,976,436 | 4.22% |

ETH/USD

Yesterday, Ethereum (ETH) buying volumes exceeded average and, during the day, buyers retraced the price from the 2HEMA55 to an uptrend. In the morning, volumes decreased; therefore, it has not been possible to overcome the green trend line yet.

If buyers continue the bullish onslaught, then they can test the target level of $400 and gain a foothold in the green upward channel. In the event that resistance at the lower border of the channel reverses the price downward, with low market activity, the pair may hold at the level of $360. With a jump in volatility, the decline may reach the support of $320.

Ethereum is trading at $373.47 at press time.

XRP/USD

Yesterday, buyers were able to continue recovering from the level of average prices and came close to the resistance of $0.25. On the daily time frame, the Stoch RSI indicator lines show potential for the continuation of the recovery to the $0.265 area. Thus, the probability of a breakout of the $0.25 level is still relevant.

However, while we do not see a major buyer who could continue this rise, and if the pair fails to gain a foothold above the $0.25 mark, then the XRP price might roll back to the $0.23 support.

In the event of strong bearish momentum, sellers can break through the September low level and renew it to the support area of $0.213.

XRP is trading at $0.2468 at press time.

BCH/USD

Bitcoin Cash (BCH) is the main gainer today. The rate of the altcoin has increased by 4.22% since yesterday, while the price change over the last week has risen +6.22%.

On the daily chart, Bitcoin Cash (BCH) has just started getting out of the consolidation phase after bouncing off the support at $205. The trading volume remains low, which confirms the high potential of a false breakout rather than continued growth. The falling lines of the Bollinger Bands indicator support such a scenario. To sum up, the local peak to which bulls may move the rate is $245.

Bitcoin Cash is trading at $235.66 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin