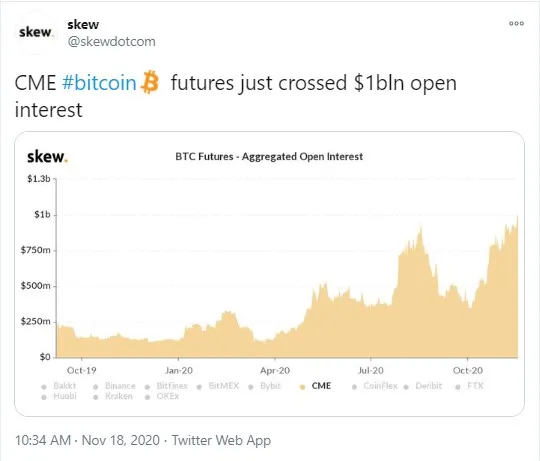

According to a tweet from Skew analytics firm, the total value of open interest in Bitcoin futures settled in cash has soared beyond a new all-time high level of $1 bln on Chicago Mercantile Exchange run by CME Group.

Bitcoin futures OI on CME spikes to a new ATH

CME was the first platform to launch Bitcoin futures for institutional players in December 2017. A rise above the $1 bln mark has been achieved after the recent spike of Bitcoin.

An inflow of funds from financial institutions is likely to show their positive attitude to the continuation of the current Bitcoin rally above the $18,000 level.

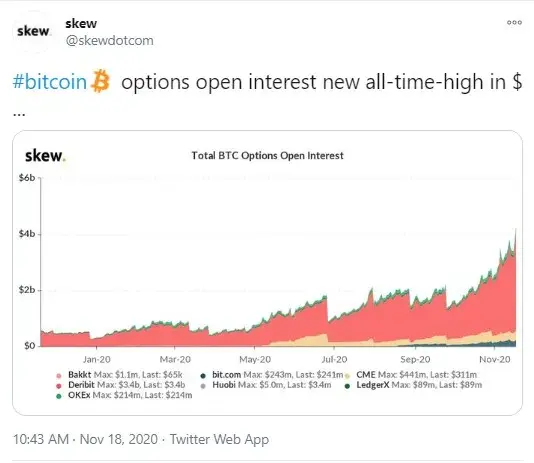

Bitcoin options OI on Deribit exceeds $3.4 bln: almost 200,000 BTC

Skew has also spread the word about the new all-time high scored on Deribit by the new volume of open interest in Bitcoin options.

It has hit an ATH of over $3.4 bln, which is almost 200,000 in Bitcoin at the current exchange rate. The chart shows that the figures demonstrated by Deribit are higher than OKEx and other exchanges.

As well as that, Deribit boasts a 24-hour close on BTC option volume near the $1 bln mark, which is a new high too.

At press time, the flagship cryptocurrency has declined to the $18,000 zone from $18,325 earlier today, according to data from CoinMarketCap.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin