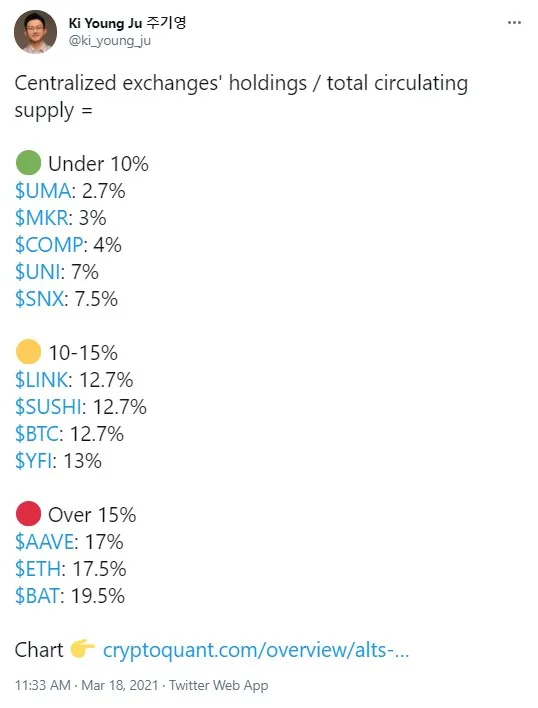

Ki Young Ju, CEO of analytics data provider CryptoQuant, has shared some recent data from the company about the amount of crypto held by centralized digital exchanges.

It turns out that it is not Bitcoin that those crypto trading platforms hold the most of; it is Ethereum and two other popular altcoins.

Meanwhile, the total value of assets locked in the Ethereum 2.0 deposit contract has hit a new all-time high above 55 million ETH.

Exchanges hold 17.5 percent ETH—that is more than the BTC stored

According to data shared by Ki Young Ju, centralized digital exchanges hold a total of 17.5 percent of ETH's circulating supply, as well as 17 percent of AAVE tokens and 19.5 percent of Basic Attention Token (BAT).

As for Bitcoin, it is in the "10 percent-15 percent" category. As per the data, centralized exchanges like Binance and Coinbase hold only 12.7 percent of Bitcoin's circulating supply, the same amounts of SUSHI and LINK and 13 percent of yearn.finance (YFI) tokens.

Such coins as UMA, COMP, UNI, MKR and SNX are in the "under 10 percent" category.

Coins that are held outside centralized exchanges are utilized in staking, traded on DEXes or held in cold storage by financial institutions.

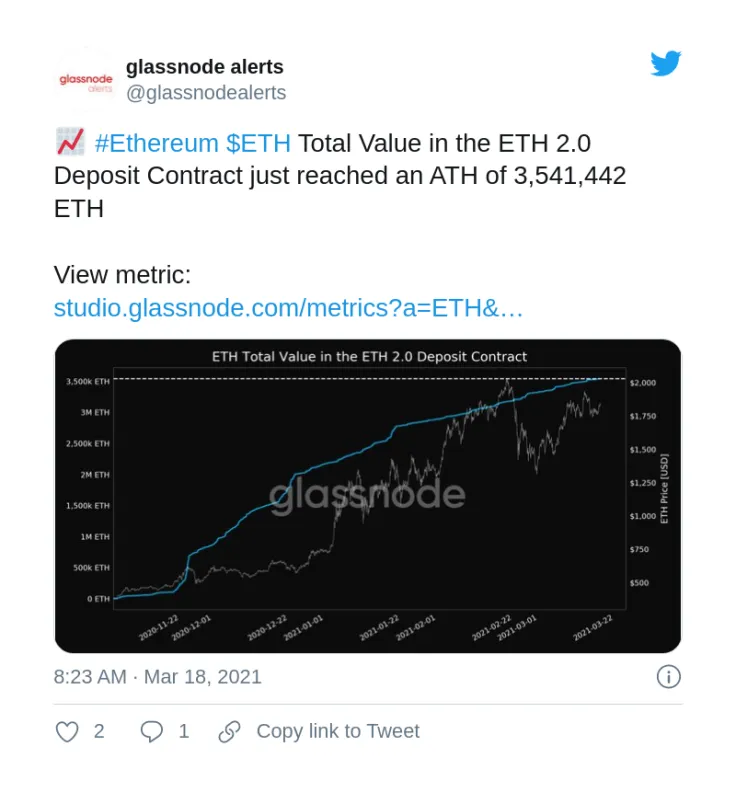

3,541,442 ETH now locked in ETH 2.0

Data shared by Glassnode shows that the total value of Ether locked in the ETH 2.0 deposit contract has hit a new all-time high and reached 3,541,442 ETH.

New validators keep coming in and locking their coins in the ETH 2.0 contract, looking forward to the second-largest blockchain platform shifting to a proof of stake (PoS) consensus algorithm.

On March 9, U.Today reported that a new milestone was passed in terms of the total value locked in the contract: three percent of the entire circulating ETH supply (3,442,946 ETH).

By that time, over 670 new validators had been joining the ETH 2.0 staking mechanism on a daily basis.

The minimum amount to be staked is 33 Ethers ($59,809 at press time).

Also, Glassnode has spread the word about a rise in non-zero ETH balances; the value of this metric has reached an all-time high of 55,678,794.

Ethereum is back above $1,800

After hitting an all-time high of $2,036 on Feb. 20, the second largest cryptocurrency, Ethereum, rolled back to touch a low of $1,357 on Feb. 28.

By now, it has reclaimed the $1,820 level, according to CoinMarketCap data, after the news about EIP-1599's inclusion into the coming Ethereum upgrade, Berlin, was announced.

However, later it was confirmed that EIP-1599 will not be included in the upcoming hard fork. Berlin is scheduled to go live on the Ethereum mainnet at block 12244000.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov