More than $150 million worth of Wrapped Bitcoin (wBTC) is now on Ethereum. It indicates the user activity on Decentralized Finance (DeFi) protocols is surging.

WBTC allows DeFi users on Ethereum to utilize Bitcoin as collateral for loans and many other services. It is an ERC20-compliant version of Bitcoin, which reflects the value of BTC at a 1:1 ratio.

DeFi market is exploding, and wBTC demand shows it

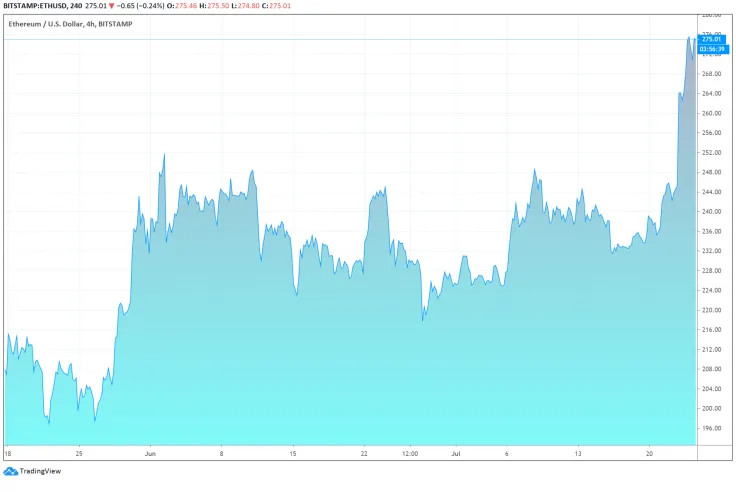

Since June 1, the total value locked in DeFi increased from $1.04 billion to $3.54 billion.

Data from Defipulse.com shows the amount of capital in the DeFi market rose by 240% within two months.

As the user activity in DeFi protocols surged, the number of wBTC in the DeFi market began to increase naturally.

A researcher at Messari wrote:

“BTC on Ethereum is blowing up. After starting the year with <1,000, there is now over 16,000 ($150 million) This is in large part due to wBTC which is on its way to become the ‘tether of pegged bitcoin.’”

A group of key DeFi organizations and companies, including Compound and MakerDao, launched wBTC, an open-source project in early 2019.

Since wBTC is used for various financial services in the DeFi space, growing wBTC usage indicates a rise in Bitcoin holders leveraging DeFi.

A confluence of rapidly increasing wBTC user activity and value in the DeFi space reflects significant growth potential in DeFi.

Due to the success of wBTC in holding its peg against Bitcoin, Purdy said wBTC would likely maintain its dominance. He said:

“For these reasons, wBTC is poised to continue its dominance in the short to medium term. That being said, there’s still the looming threat of government intervention once these assets grow large enough to catch the regulator’s attention.”

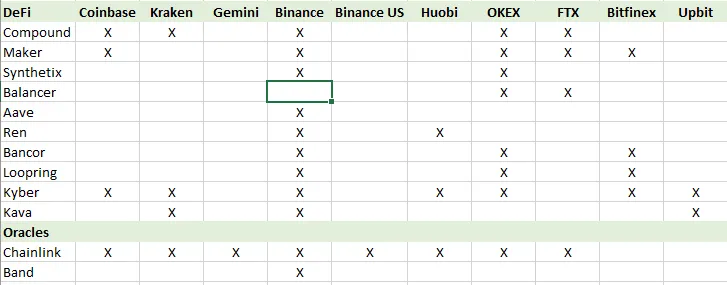

Exchanges continue to facilitate demand for DeFi

Major cryptocurrency exchanges are seemingly responding to the DeFi craze.

The largest cryptocurrency exchanges in the global market, like Binance, FTX, and OKEx, are increasing listing DeFi tokens.

The trend shows that major trading platforms are acknowledging the rapid growth in the DeFi sector, responding to customer demand.

Kelvin Koh, a partner at The Spartan Group, said:

“OKEX has listed $BAL and $SNX. The listings of DeFi tokens continues. Binance now only missing $BAL from this list. Huobi now lagging significantly vs. Binance and OKEX.”

In comparison to other Ethereum applications, such as layer-two scaling solutions, the market cap of DeFi tokens remains relatively low.

Based on various metrics, including the fast growth of wBTC and increasing Ethereum network fees, the DeFi market’s uptrend potential remains large.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov