Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

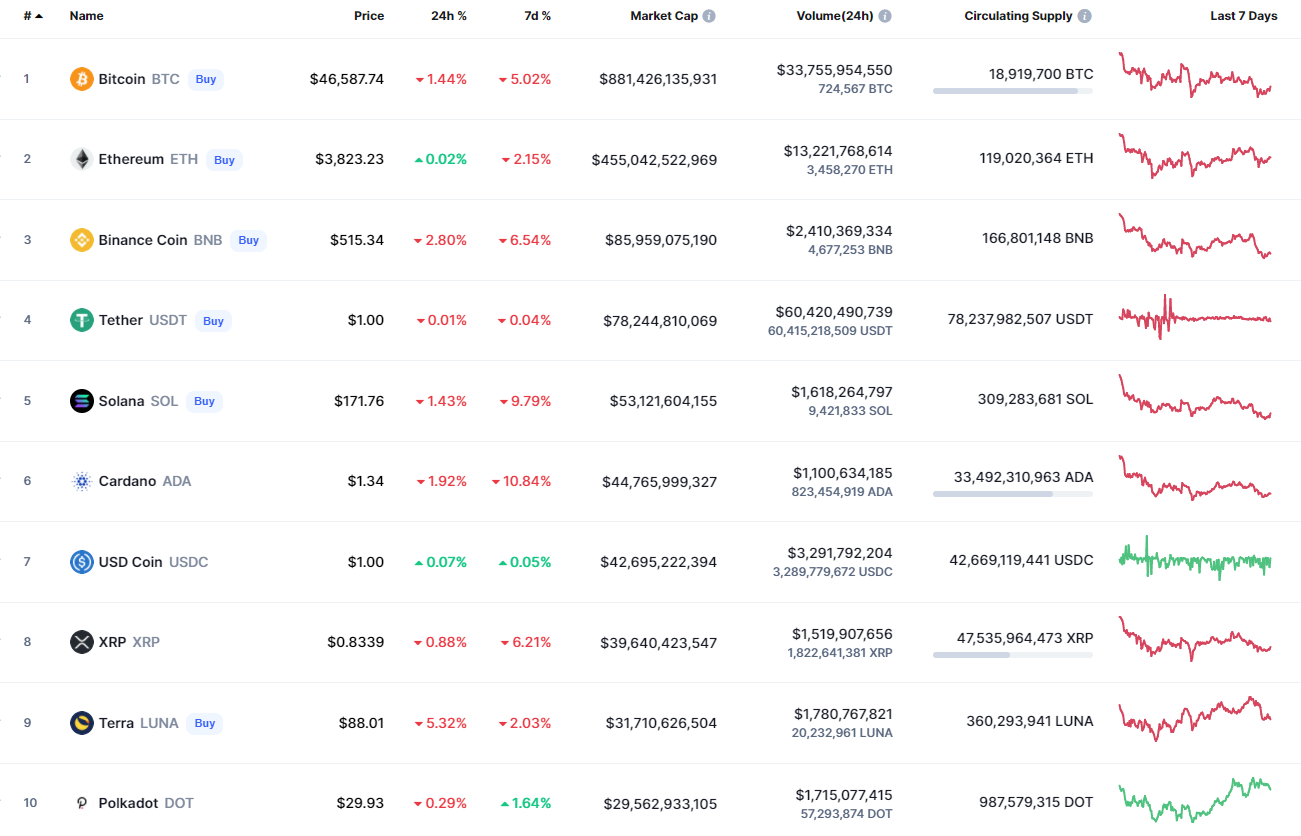

The cryptocurrency market is facing a correction today as most of the coins are in the red zone.

BTC/USD

Yesterday, the Bitcoin (BTC) price could not overcome the resistance of the two-hour EMA55 and again rolled back to the support of $46,000.

The price tested the zone of December lows tonight but remained above $46,000 by morning.

The strengthening of the bearish onslaught and the breakout of the support might lead to the implementation of our negative scenario, in which the Bitcoin price can retrace to the $42,447 level.

Bitcoin is trading at $46,891 at press time.

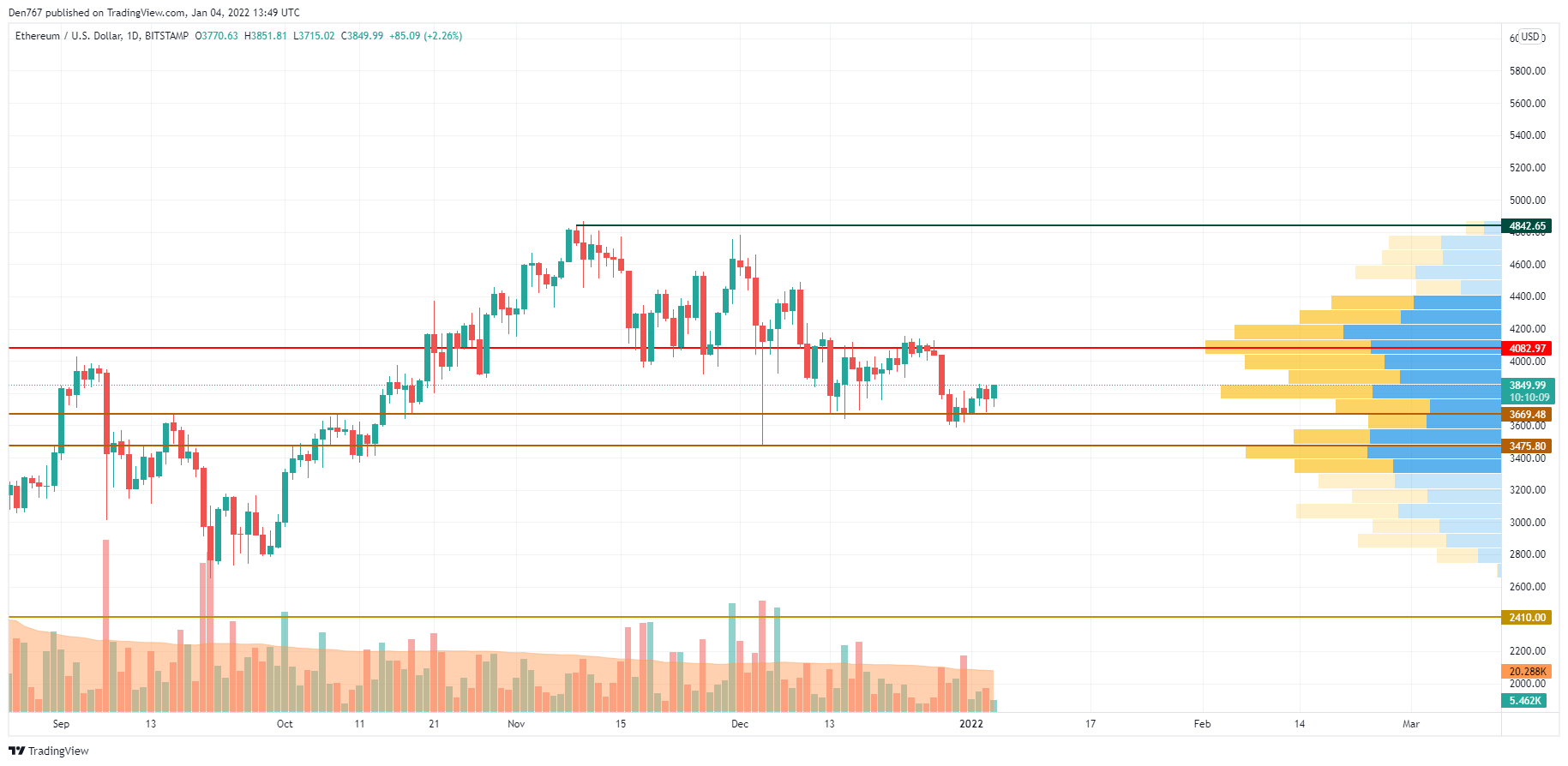

ETH/USD

Ethereum (ETH) is the biggest gainer today with a growth of 0.31%.

Ethereum (ETH) has successfully bounced back to the support at $3,670 on the daily chart. However, despite the ongoing growth, the rise is not supported by a high trading volume, which means that traders may not have accumulated enough energy for a sharp move.

In this case, if bulls can hold the gained initiative, one may expect the smooth price rise to the vital mark of $4,000.

Ethereum is trading at $3,851 at press time.

ADA/USD

Cardano (ADA) is the biggest loser from the list with a drop of 2% over the last 24 hours.

Cardano (ADA) is still located in a wide channel despite today's price drop. However, the buying trading volume seems likely to rise, which would be a prerequisite for possible upward movement. If such a situation occurs, there is a high possibility to see ADA around the purple resistance at $1.479 by the end of the week.

ADA is trading at $1.342 at press time.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin