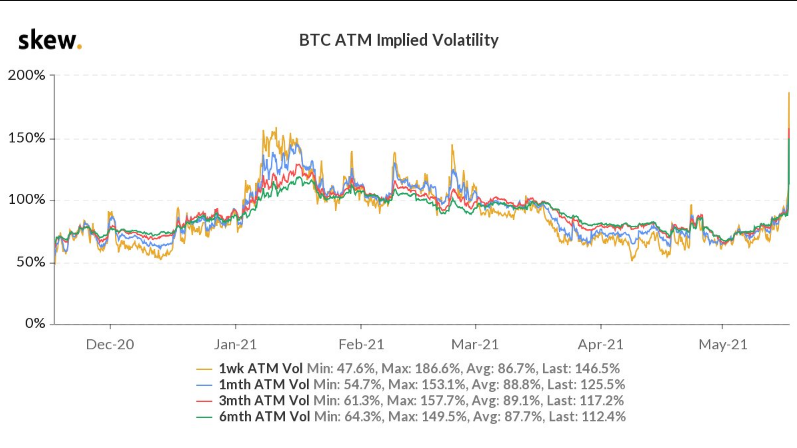

Bitcoin's implied volatility spiked to its highest level in 2021 over the weekend after a series of tweets by Tesla CEO Elon Musk caused a ruckus within the cryptocurrency community, according to data provided by Skew.

The mercurial centibillionaire came up with a scaling proposal for Dogecoin, criticized Bitcoin's alleged centralization, called out "obnoxious" Bitcoiners, implied that Tesla might have sold all of its Bitcoin and then clarified that that was not the case the day after tanking the market.

One-week implied volatility for Bitcoin has now spiked to a whopping 146.5 percent.

The largest cryptocurrency dropped to its lowest level since Feb. 8 earlier today before clawing back some of the losses. It is currently trading at $44,778 on the Bitstamp exchange.

As reported by U.Today, the Crypto Fear & Greed Index also plunged into the "extreme fear" territory for the first time since the start of the year.

More turbulence ahead?

Implied volatility, as the name suggests, reflects the options market's expectations regarding how volatile Bitcoin is going to be over a certain period of time.

The recent spike suggests that traders expect the roller coaster ride to continue. On the other hand, falling implies volatility portends sideways price action.

Following Bitcoin's pandemic-induced 50 percent crash on March 13, implied volatility soared 50 points and went on to reach its highest level since Skew started recording it together with the Cboe Volatility Index.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin