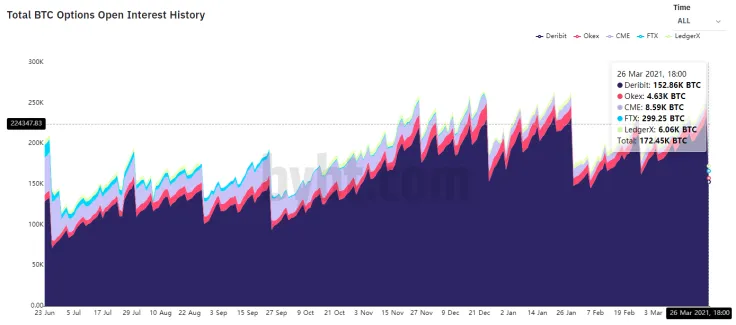

$6 billion worth of Bitcoin options has expired earlier today, which was the largest expiry in history.

Yet, the flagship cryptocurrency remained unfazed, reclaiming the $54,000 level after a two-day sell-off. Trader Scott Melker took notice of this resilience in his recent tweet:

In a SHOCKING turn of events, 6B in options expired and Bitcoin did not drop to 44K in the "max pain scenario," because narratives are stupid and just because it happened once does not mean it would happen again.

According to Bybt data, roughly $4.5 billion in Bitcoin expired on Panama-based Deribit exchange, which moved out of the Netherlands last year due to regulatory pressure.

Seychelles-based OKEx comes in a distant second place with $333 million.

Traders have high hopes for April

Bitcoin has had a turbulent week. The cryptocurrency was a hair's breadth away from dipping below $50,000 on March 25 during a prolonged sell-off.

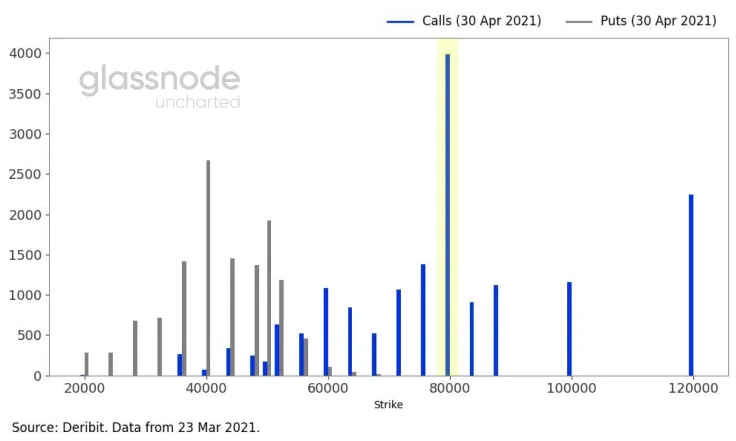

Nevertheless, options traders remain bullish ahead of April, which is historically a very positive month for Bitcoin.

In fact, they are betting that the cryptocurrency could reach as high as $80,000 next month.

Bitcoin has managed to soar 80 percent since its previous record-breaking $4 billion expiry that took place at the end of January.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin