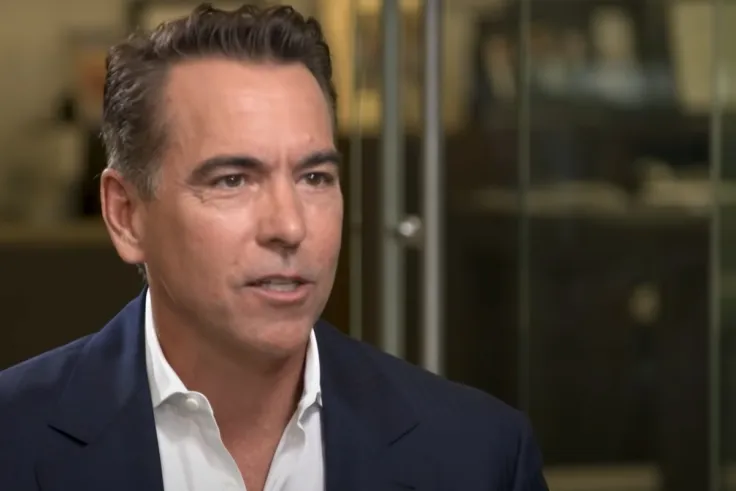

Orlando Bravo, the co-founder of Thoma Bravo, a private equity and growth capital firm, stated that he is "very bullish" on the cryptocurrency market and Bitcoin in particular. The co-founder sees more people using digital assets in the future in addition to institutional interest.

Bravo likes the idea of the limited supply of cryptocurrency which, in some cases, makes it a deflationary asset. Currently, the only major cryptocurrency that might reach the status of a deflationary asset is Ethereum, which implemented the fee-burning mechanism.

The co-founder of Thoma Bravo believes that institutions are just starting to find their way in the digital assets industry and are yet to embrace all of the advantages it presents compared to traditional financial assets or derivatives. Once full adoption is achieved, the industry will attract even more demand, Bravo believes.

While more billionaires and personas from the financial world believe in Bitcoin and the cryptocurrency market, the industry is not doing well in September and is losing around 20% of its value and $500 billion in market capitalization.

In addition to questionable market performance, the fundamental background of the industry was not pleasing due to the full crackdown on the cryptocurrency industry in China initiated by the People's Bank of China. The cryptocurrency market is expected to recover only after Chinese investors or traders find a way to invest their funds back into digital assets.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team