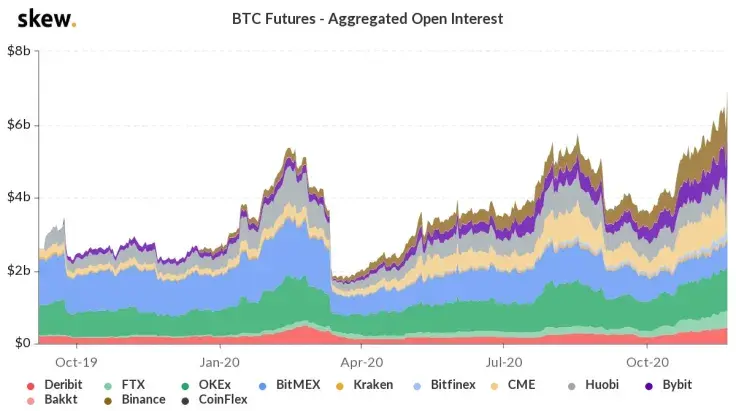

Aggregated open interest (OI) on Bitcoin futures has surpassed $7 bln for the first time, according to U.K.-based derivatives data provider Skew.

Four exchanges (OKEx, Binance, Bybit, and CME) have more than $1 bln worth of outstanding derivatives contracts.

Earlier this week, OI on Bitcoin futures contracts traded by CME Group notched a new lifetime high of $1 bln, highlighting growing institutional demand for the world’s largest cryptocurrency.

Futures funding rates are soaring

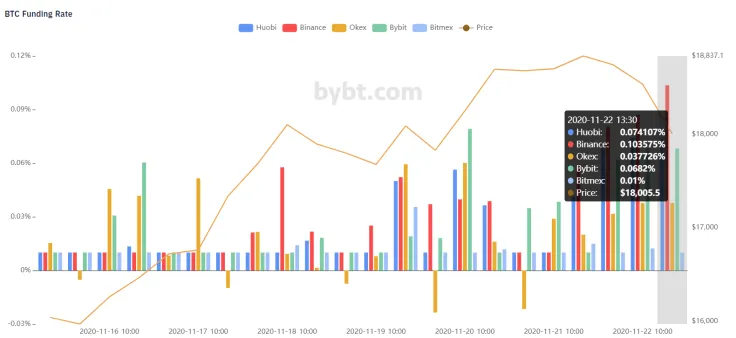

As reported by U.Today, Binance.US CEO Catherine Coley claimed that the massive crypto rally was driven by spot traders, which was evident based on the relative low funding rates of perpetual futures.

However, the derivatives market is now heating up. Bybt data shows that futures funding rates spiked to their highest level since Aug. 18 when Bitcoin plunged over four percent.

Market uptrends that are led by derivative products usually show less resilience and tend to falter as soon as traders close their overleveraged long positions.

Bitcoin on the ropes

Bitcoin rallied to a new 2020 peak of $18,977 on Nov. 21 before retracing back to $18,100 the following day.

The cryptocurrency is down over three percent during its first major correction since Nov. 14.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin