As the sparkling ETF-triggered cryptocurrencies rally is taking a breath, the thriving segment of AI cryptocurrencies is among the worst sufferers. While almost all micro- and low-caps are in the red, some assets manage to capitalize on other trends.

AI crypto market is down today, cap dips below $20 billion

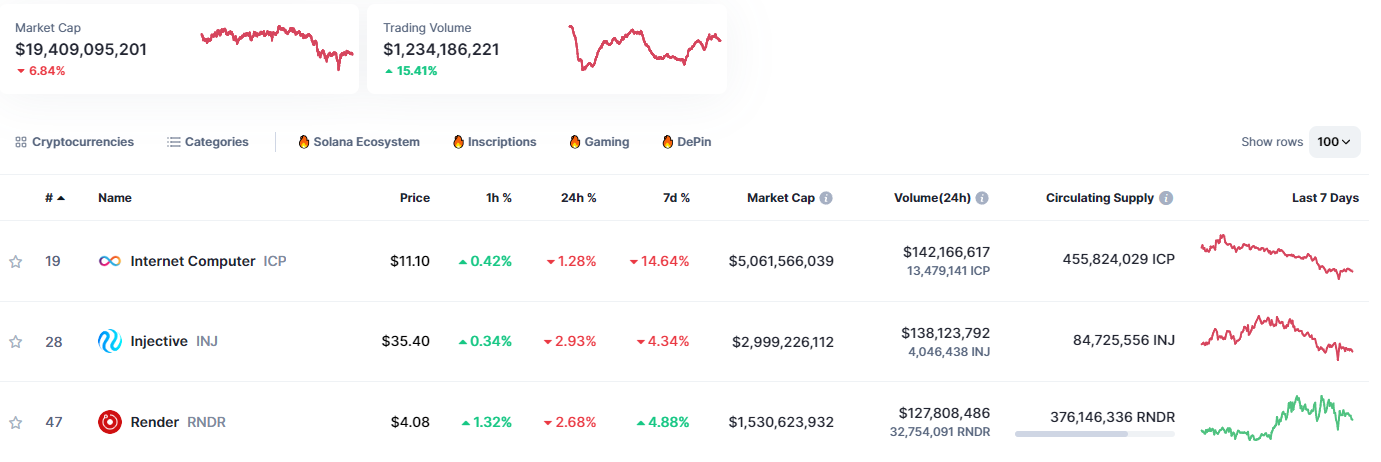

The net capitalization of the AI/ML and Big Data crypto coins segment on CoinMarketCap lost over 6.8% in the last 24 hours. The indicator plunged to multi-week low at $19.4 billion. Cryptocurrencies with sub-$100 million capitalization suffered the worst, data says.

All the largest AI cryptocurrencies, including Internet Computer (ICP), Injective (INJ) and Render Network (RNDR), are also in the red, but with less painful losses.

At the same time, other mid-caps — Theta Network (THETA), Bittensor (TAO) and The Graph (GRT) — soared by 2-3% in the last 24 hours.

Meanwhile, "classic" AI cryptocurrencies that went mainstream during the 2023 AI frenzy, are performing well. Numeraire.AI (NMR) and iExec RLC (RLC) are up by 21%, while Akash Network (AKT) added 10% overnight.

Akash Network (AKT) also became the best performer in CMC's top 100 cryptos by market cap.

The aggregated market cap of all cryptocurrencies lost 3.38% and slipped below $1.6 trillion, CoinMarketCap data says.

This AI coin jumps by 60% following "oracles rally"

At the same time, veteran AI cryptocurrency DIA, the core asset of the eponymous Web3 oracles platform, added almost 60% and jumped to levels unseen since the Terra/Luna crash in May 2022.

The token is affected by the growth of other oracles-associated coins. For instance, core Chainlink (LINK) rival API3 almost doubled in price in the last 24 hours, while Uma (UMA) more than tripled yesterday.

On the announcement of an anti-MEV solution, the UMA price jumped from $1.9 to $6.3, but then slightly retraced.

The segment's heavyweights Chainlink (LINK) and Band Protocol (BAND) are also in the green.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin