Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Uniswap (UNI) has dusted off some of its accrued losses and is currently leading an altcoin resurgence at the time of writing. Priced at $6.2 after a 16.33% surge over the past 24 hours, the propensity to hit the $10 mark is high, a move that requires about a 58% surge to attain.

Uniswap (UNI) catalyst to watch

Uniswap currently has many bullish upticks to watch out for, including but not limited to its whale transaction count, active addresses and daily volume. By working in tandem, these three catalysts have the propensity to reposition UNI as the decentralized finance (DeFi) superstar it once was.

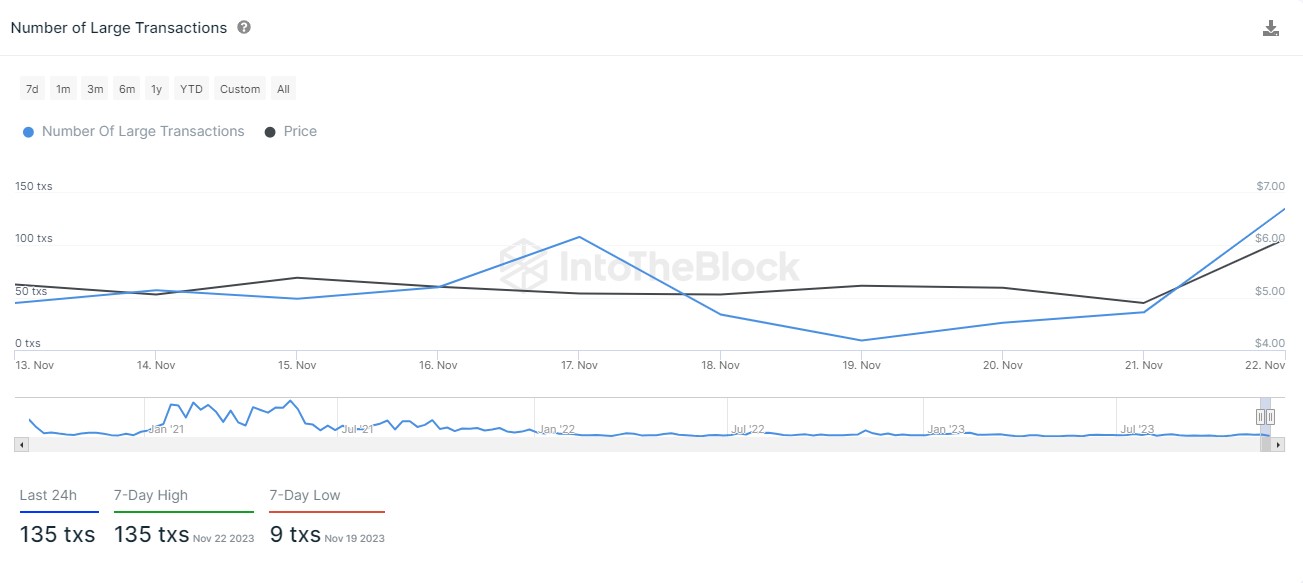

Data from crypto analytics platform IntoTheBlock (ITB) shows a 175.35% surge in large transactions on the Uniswap network valued at a volume of $41.61 million.

By definition, large transactions are those worth over $100,000 or more. Per the data, UNI whale transactions jumped from 36 on Nov. 21 to 135 within a 24-hour time span.

Likewise, there is a visible uptick of 60.15% in the number of Daily Active Addresses associated with the UNI ecosystem. Per the figures, a total of 1,700 UNI addresses are active, with 701 addresses reacted recently. Of the total, 456 addresses hold zero balances, a figure that increased slightly recently.

Balancing with retail push

The potential of Uniswap to climb the projected height toward $10 in the midterm will not be possible unless the third element aligns. This is the action of its retail holders as showcased in the overall trading volume, which has soared by 56.06% to $456,406,192.

Should this trading volume and other highlighted metrics continue to soar, the bullish sentiment surrounding UNI will heighten and might eventually translate into more growth. Despite the plausible setbacks it might face ahead, these on-chain metrics and other fundamental trends can help UNI regain its lost momentum.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov