Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

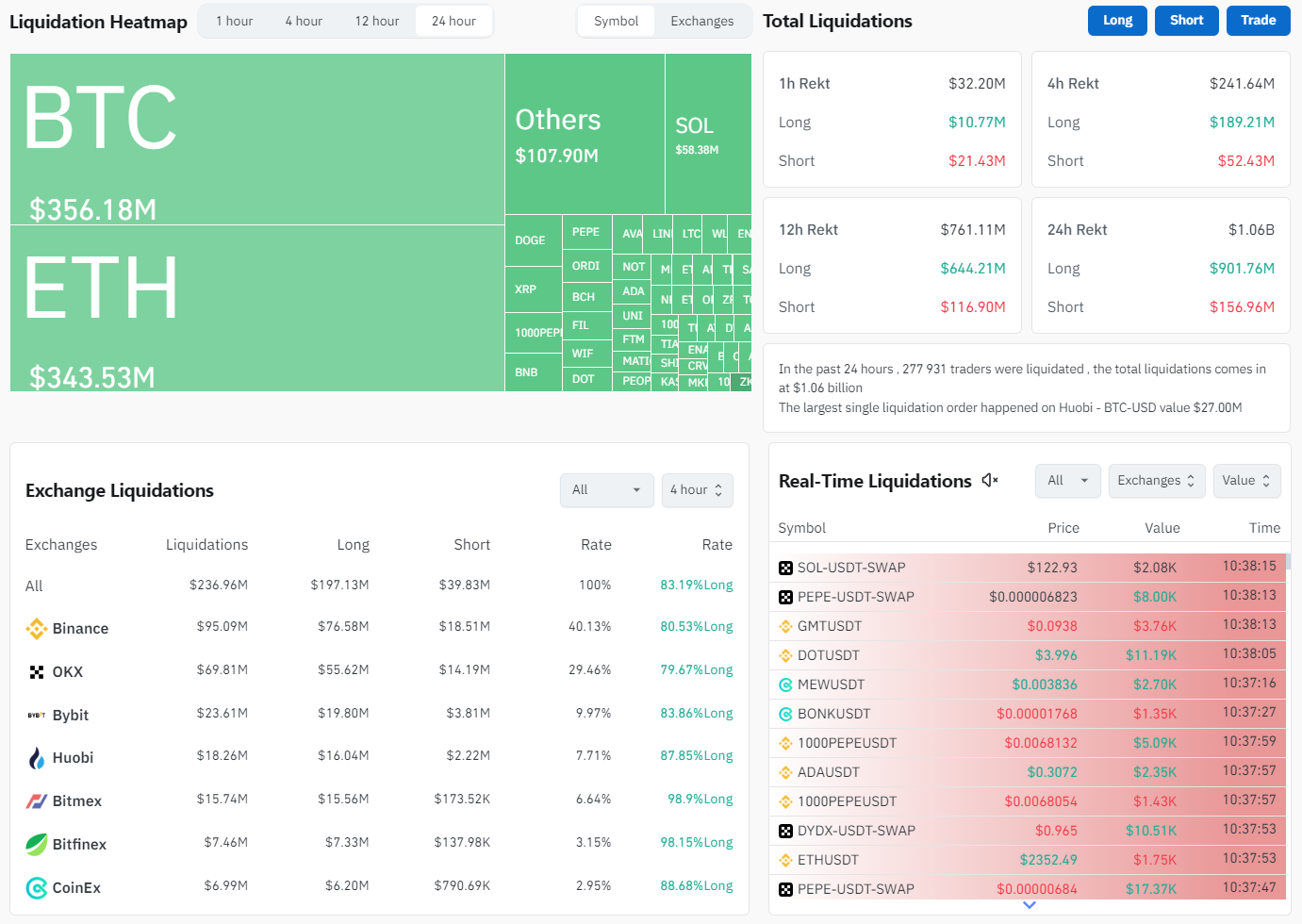

A catastrophic day for financial markets, resulting in the astonishing loss of $1 billion, is here. This unrest stemmed from a combination of key factors. A total of 74,729 cryptocurrency traders were liquidated in the last day, bringing total liquidations to $1.04 billion.

The market is under tremendous selling pressure as a result of this wave of liquidations, which is escalating the downward trend. Liquidations totaling $356 million and $343 million were recorded for Bitcoin (BTC) and Ethereum (ETH) alone. Warren Buffett has been selling stocks at an unprecedented rate as part of a selling frenzy, which has added to the chaos.

Buffett's actions have caused investors to become extremely alarmed. He has dramatically changed his investment approach and shown a lack of faith in the state of the market, as seen by his $277 billion cash holdings. A notable move that has shocked the market is Buffett's selling of shares in Apple, one of the most valuable companies in the world.

The problems facing the cryptocurrency market are not unique. The leading stock market index, the NASDAQ, is down nearly 6.5%, indicating wider instability on the financial markets. The situation is even worse in Japan. The Nikkei 225 index has dropped more than 10%, putting Japanese stocks on course for their largest fall in more than eight years. It highlights the severity of the unexpected crash that originated in a matter of days, leading to the biggest losses in the industry since the FTX situation.

With its price now down into the $50,000-$60,000 range, Bitcoin is holding onto the crucial $50,000 support level, which has already been broken. This breach suggests that the bull run may be coming to an end, which is concerning, due to the lack of returns we saw this cycle. Ethereum is having similar difficulties as a result of institutional investors selling off large amounts of their ETH holdings.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov