Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bulls are trying to seize the lost initiative as most of the coins are back in the green zone.

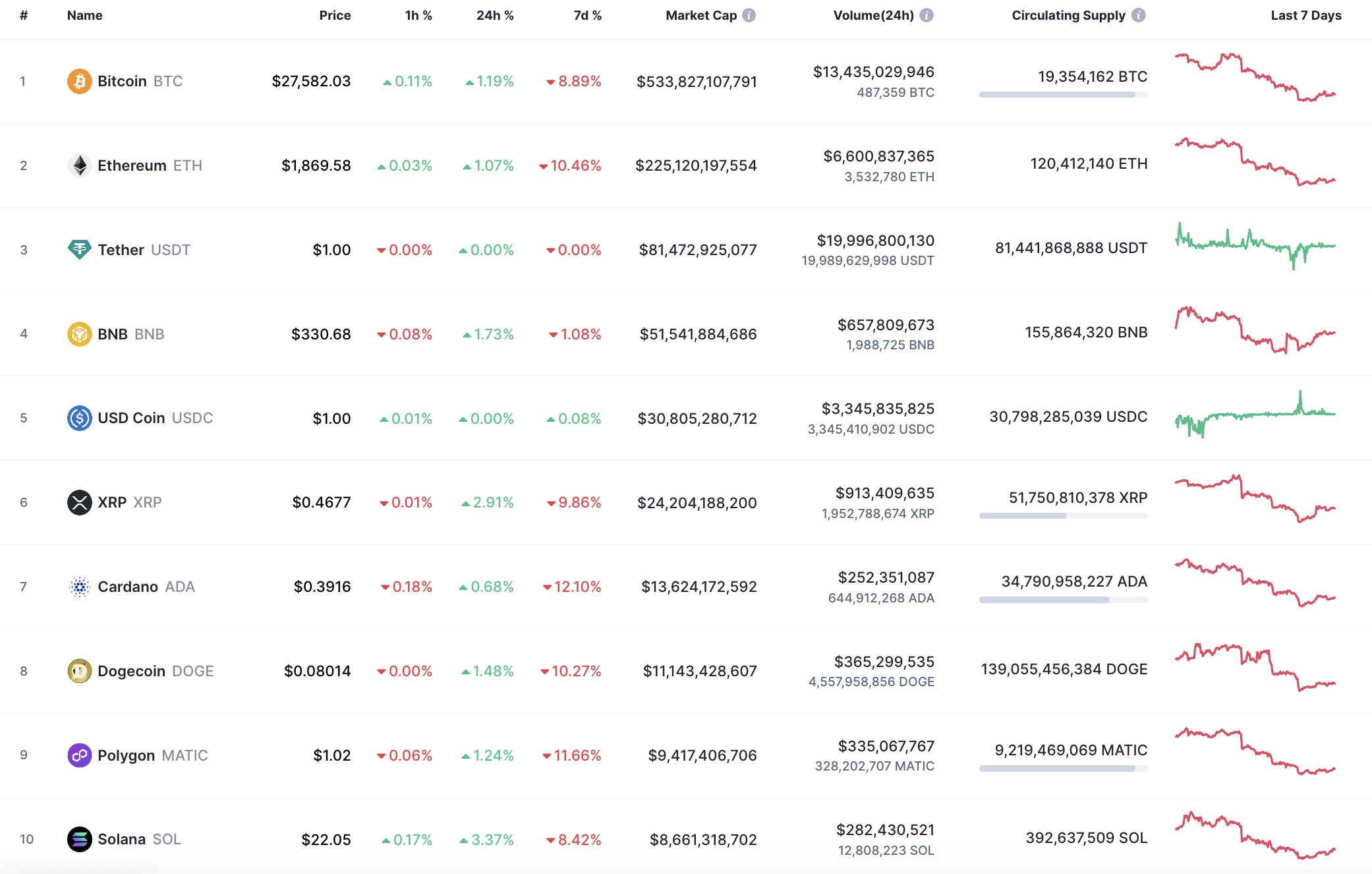

Top coins by CoinMarketCap

SHIB/USD

The rate of SHIB has risen by 1.67% over the last 24 hours.

Image by TradingView

Despite the slight growth, the price of SHIB has made a false breakout of the local resistance level at $0.00001045. If the daily closure happens below the $0.000010 mark, there is a high chance to see a drop below the support at $0.00001031.

Image by TradingView

On the bigger time frame, the drop continued after the price had fixed below the $0.000011 zone. The volume remains low, which means that bulls are not ready to buy the coin at the current levels.

If sellers' pressure continues to the important level at $0.00001, the accumulated energy may be enough for a further decrease to the $0.00000950 zone.

Image by TradingView

On the weekly chart, the price is on the way to the interim support level at $0.00000965. If the closure happens below it, traders are likely to see the rate of SHIB near the next vital area around $0.000008.

SHIB is trading at $0.00001039 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov