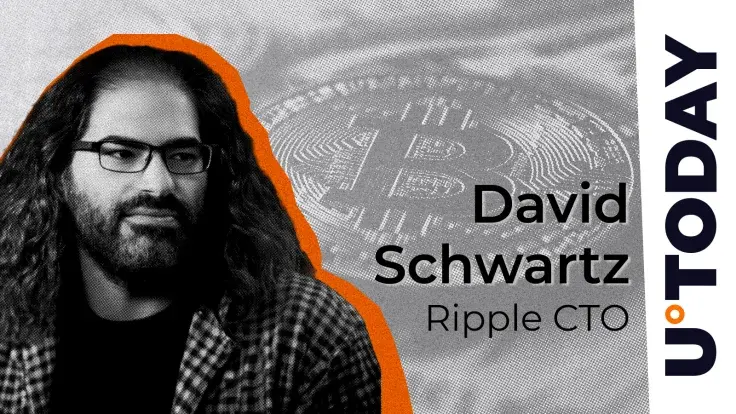

David Schwartz, Ripple’s chief technology officer (CTO) and one of the creators of the XRP Ledger and XRP token, has published a post in which he critiqued the Federal Reserve and its chairman for placing sanctions on United Texas Bank over its operations with cryptocurrency users.

This bank is a member of the Federal Reserve System, and the Fed issued it with a “cease ad desist” order.

Fed takes dig at Texas bank

David Schwartz commented on an X post published by Dennis Porter, president and cofounder of Satoshi Action Fund. The latter shared a screenshot of a document that contains the Fed’s ruling about United Texas Bank.

The part of the document shown in the screenshot states that an examination found “significant deficiencies related to foreign correspondent banking and virtual currency customers, specifically risk management and compliance with applicable laws, rules, and regulations relating to anti-money laundering (AML), including the Bank Secrecy Act.”

“When will it end?” Porter commented.

Ripple CTO bashes Fed for indirect regulation practice with crypto firms

Citing this tweet, the Ripple CTO disagreed with this method of the authorities trying to control the cryptocurrency industry, calling it indirect regulation. Schwartz stated that this is “an end-run around due process” and urged courts to put a stop to such things practiced by the Federal Reserve and other regulators.

Schwartz stated outright that should the U.S. government decide to punish cryptocurrency companies, it should just make cases against them. However, the CTO continued, this way, it is crypto companies’ business partners that get punished for doing business with them, while there is no direct action against crypto firms – crypto exchanges, etc.

This way, according to Schwartz, the government punishes digital currency companies by depriving them of future business relationships “without giving you any of the normal rights due process demands.”

In the meantime, Ripple continues to fight against the SEC in court, while many even in the U.S. Congress already believe that the regulator and its boss, Gary Gensler, are exercising an excessive overreach of their powers. Still, after major wins celebrated by Ripple last year and in August 2024, the chances of the SEC making an appeal in this legal case have increased.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov