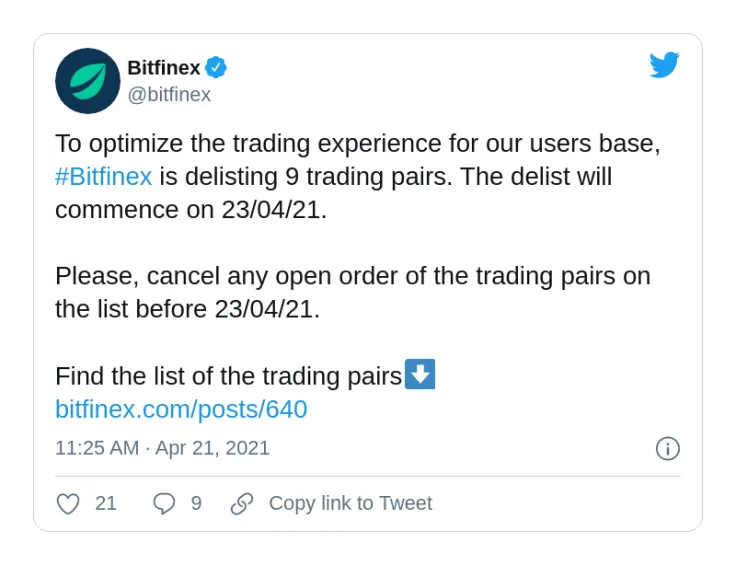

Leading cryptocurrency exchange Bitfinex shared an announcement of the upcoming delisting of some trading pairs with Bitcoin (BTC), Ethereum (ETH) and Tether (USDT).

Bitfinex ceases trading for MKR and GNT against Bitcoin (BTC), Ethereum (ETH) and Tether (USDT)

According to the official announcement on the Bitfinex website, starting from April 23, 2021, trading for nine asset pairs will cease. These measures affect Golem Network Token (GNT), MakerDAO (MKR), Loopring (LRC), Nectar (NEC), CryptoFranc (XCHF), Wrapped Bitcoin (WBTC) and Native Utility Token (NUT).

GNT and MKR will be delisted against both Bitcoin (BTC) and Ethereum (ETH); NEC, WBTC and XCHF trading will cease in Ethereum (ETH) pairs only; Loopring (LRC) holders will be restricted from exchanging it into Bitcoin (BTC) and NUT is going to be removed from Tether (USDT) pairs.

The Bitfinex team admits that all tokens are delisted "due to low levels of liquidity." Bitfinex periodically adjusts its spot trading suite to ensure maximum performance and resource efficiency.

Meanwhile, trading of all tokens mentioned will be left untouched in other pairs.

Novel scalability solution integrated for USDT transfers

Amidst all tokens affected, blockchain veterans Golem Network Token and MakerDAO were the most popular. GNT (now GLM) is a core native coin of Golem decentralized computational network, while MKR was a backbone of the pioneering DeFi protocol.

Yesterday, on April 20, Bitfinex announced that it is integrating the Hermez Network Layer 2 scalability solution to advance the technology of U.S. Dollar Tether (USDT) transfers.

Hermez zk-rollup techniques will reduce the costs of USDT deposits and withdrawals. Like many other L2 designs for Ethereum (ETH) scalability, it merges the data of multiple transactions into a single one.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin