Total value locked in DeFis, a crucial metric for programmable blockchains, is rallying in the segment of Ethereum-based second-layer solutions. Despite general market apathy, the net TVL of 30 leading platforms added 32% in the last four months.

Ethereum L2s set new all-time high in TVL

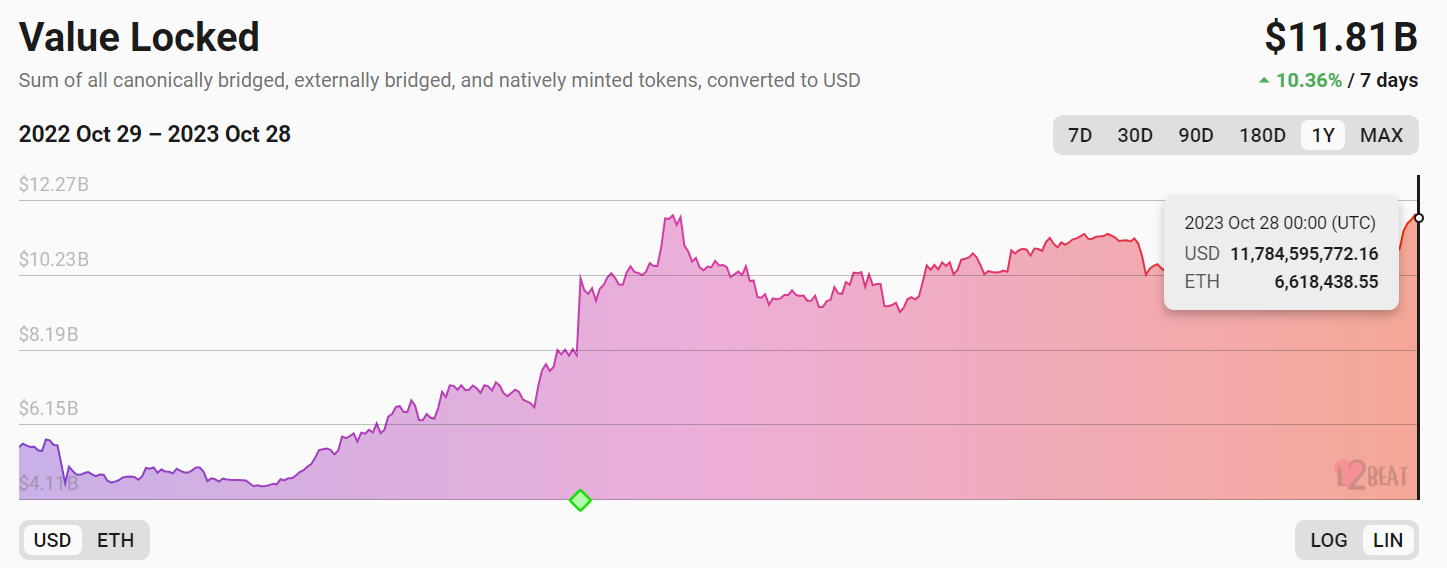

Yesterday, Oct. 27, 2023, the aggregated value of cryptocurrency locked in all Layer-2 platforms on Ethereum (ETH) reached a new all-time high. It briefly touched $12 billion, but then stabilized near $11.87 billion. The previous historic high was registered on April 17, at $11.85 billion.

In the last hours, it slightly retraced to $11.81 billion. As such, in USD-denominated value, it added over 114% in the last 12 months despite the pale performance of the cryptocurrency market.

In terms of Ether-denominated value, the record was registered on Oct. 11, 2023. The ecosystem reached 6.72 million Ether (ETH) locked, while it barely surpassed 3.5 million Ether (ETH) a year ago.

In the last seven days, the ecosystem of L2s added 10.36% of dollar-denominated TVL. An array of the largest L2s — Arbitrum, OP Mainnet (formerly Optimism), Starknet, ImmutableX and Loopring — posted even more impressive gains.

Ethereum (ETH), the most crucial asset for L2s, is up by 10.14% in the corresponding period. It revisited a multi-month low over $1,836 two days ago.

Arbitrum, OP Mainnet remain undisputed, rivalry rages for #3

Meanwhile, the sphere of L2s on Ethereum (ETH) remains highly "whale-dominated." The two largest networks — Arbitrum and OP Mainnet — are responsible for over 90% of TVL in the ecosystem.

Base, the fastest-growing L2, is protecting the third position with 4.83%. It is followed by zkSync Era and dYdX with 3.8% and 3%, respectively.

As covered by U.Today previously, dYdX made the most anticipated announcement this week: It is migrating from the L2 model to being a standalone Tendermint-based Layer 1.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin