Interesting flippening happened behind the scenes of Dogecoin (DOGE) as the main indicator of whale activity, Large Holders Netflow, has turned from overbearish to extremely bullish in this lightning 24 hours. But first things first.

The beginning of the week on the crypto market was more of a roller-coaster ride than what people usually understand by the words "financial market." Coin prices soared and plunged by double-digit percentages in a matter of hours, and as a result, the TOTAL index, which summarizes the market capitalization of all cryptocurrencies, first lost more than $500 billion in three days and then recovered by $300 billion.

Behind scenes of DOGE

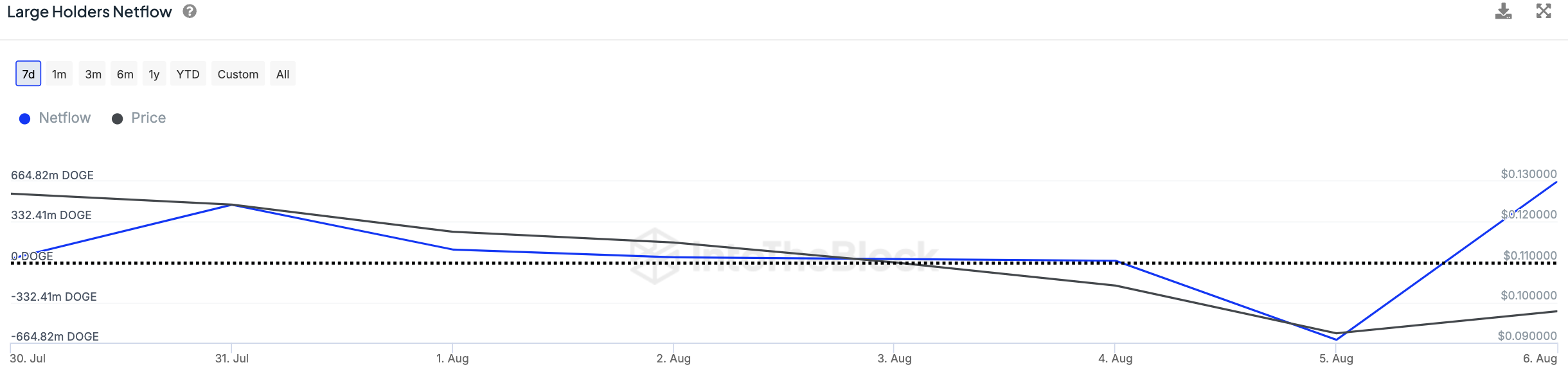

The same kind of action happened with DOGE. Thus, as IntoTheBlock's on-chain data shows, the net flow of large holders dipped deep into the negative zone Aug. 5 with a figure of -641.69 million DOGE.

However, 24 hours later, the spike in this metric literally shattered the chart and brought the large holder netflow to the top at 664.82 million DOGE. This is clearly a bullish sign because, to put it simply, it was 1.3 billion DOGE more going into the large holders' wallets than going out.

The separate charts for inflows and outflows prove the same. You can see how inflows spiked amid the general decline in outflows. However, in the 24 hours from Aug. 4 to Aug. 5, both indicators spiked. This may indicate a redistribution of Dogecoin capital among the largest market participants.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov