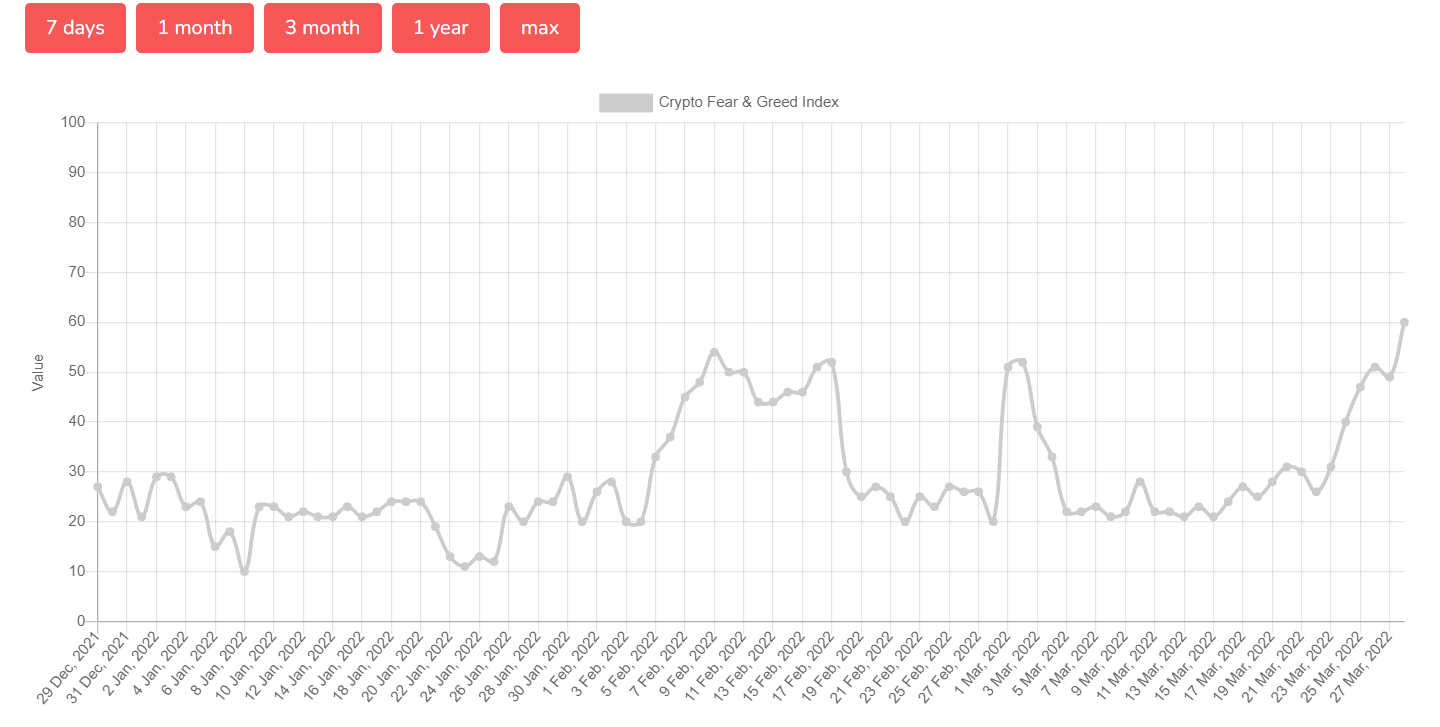

The Crypto Fear & Greed Index, a complex market sentiment indicator tracked by the Alternative.me portal, has witnessed the most aggressive upsurge in the last six months.

From fear to greed in six days

Today, on March 28, 2022, the "Fear and Greed" index for cryptocurrencies added 11 points overnight. It is now estimated at 60/100; this means that traders are getting greedy.

As such, the index spiked to the highest levels in more than four months. In fact, it was that high when Bitcoin (BTC) was over $69,000 and crypto market capitalization stayed over $3 trillion.

This run looks really rapid: the index doubled in less than one week and tripled in one month.

The rally is the most remarkable since September-October 2021, when the indicator spiked from 20 to 71 in one week.

Bitcoin (BTC) revisited 2022 highs in unmatched rally

The Crypto Fear & Greed Index is an integral metric that considers volatility, market momentum, social media sentiment and search engine trends.

Primarily, traders turned bullish amid the spike in the Bitcoin (BTC) price. Today, the first cryptocurrency jumped over $47,500, which is the highest daily close in 2022.

Also, this rally looks special on the one-day timeframe. Today, Bitcoin (BTC) printed its seventh green candle in a row, adding more than 15%. The last time that seven green candles were registered was in July, when BTC rocketed from $29,000 to $42,000.

Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin Dan Burgin

Dan Burgin Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya