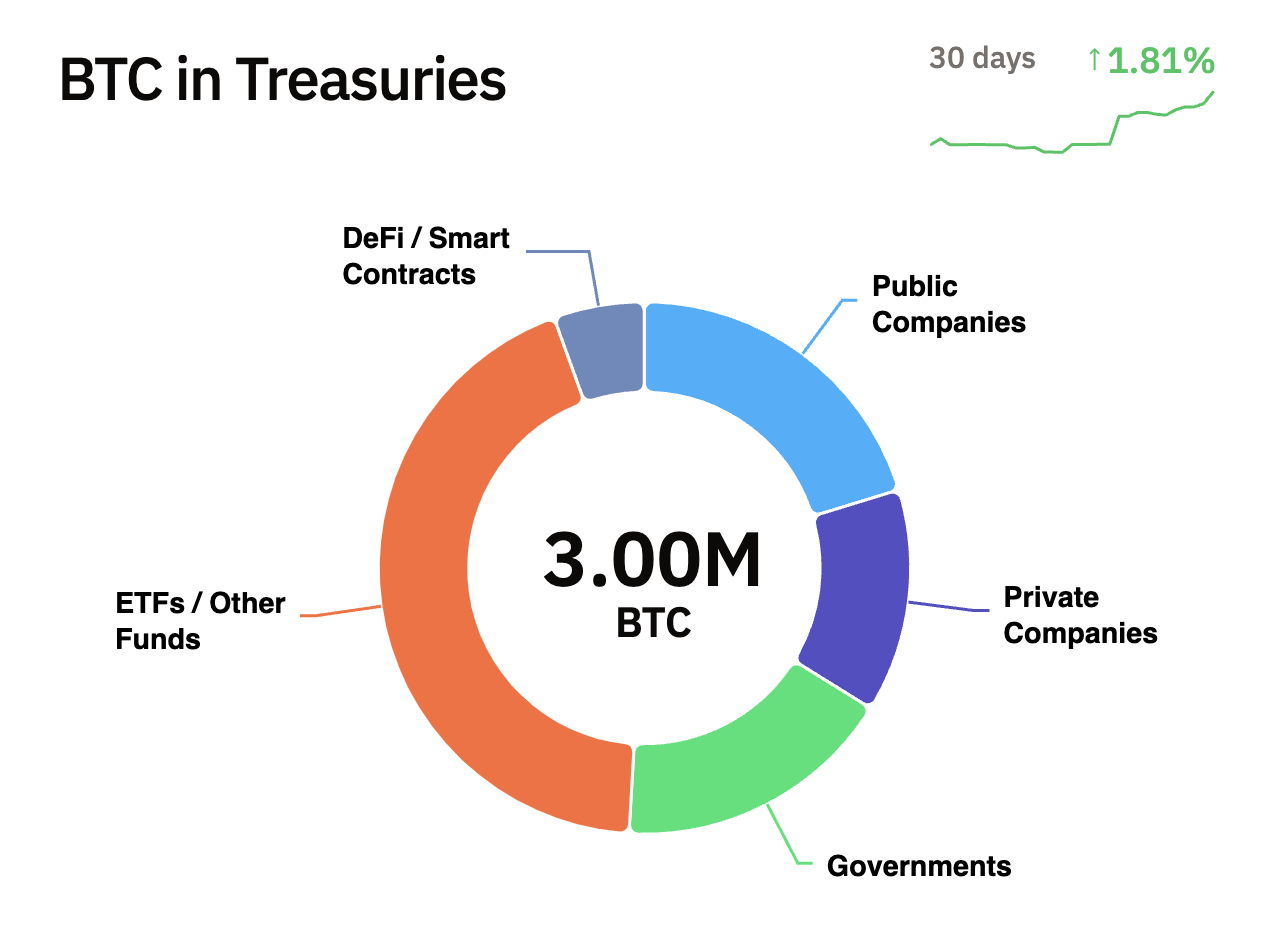

Institutional adoption of Bitcoin (BTC) continues to accelerate, with treasuries now collectively holding 3,000,000 BTC valued at $317 billion. This represents 14% of the total supply that will ever exist, reveals self-proclaimed Bitcoin historian Pete Rizzo.

MicroStrategy remains the largest single corporate holder, having recently acquired an additional 11,000 BTC for $1.1 billion at an average price of $101,191 per BTC. The company’s total holdings now stand at 461,000 BTC, worth approximately $29.3 billion, with an average acquisition cost of $63,110 per BTC.

Other notable holders include MARA Holdings, a prominent Bitcoin mining company, which ranks second, with 44,893 BTC valued at $4.65 billion. Riot Platforms, another mining firm, follows in third place, with 17,722 BTC worth around $1.84 billion.

A broader analysis shows that the structure of these institutional holdings is diverse. Spot Bitcoin ETFs account for 1,307,868 BTC, with BlackRock commanding a significant portion of this category, holding 563,134 BTC valued at $58.29 billion. Public companies, including MicroStrategy, collectively hold 608,381 BTC.

Governments, such as those of China and the United States, own 513,199 BTC, with each holding at least 190,000 BTC. Additionally, 407,212 BTC are held by private companies like Block One, and 165,677 BTC are locked within DeFi protocols as wrapped Bitcoin.

The fact that Bitcoin is becoming more popular as an investment is shown by the fact that institutions are getting into it. Large entities are playing a key role in the market's growth, whether they are investing directly, using it as collateral or diversifying their treasury.

As this trend continues, the long-term impact on Bitcoin's adoption and its price dynamics could be huge.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov