Santiment analytics team has tweeted that to jump back to the $34,000 level despite the massive FUD floating in the air, Bitcoin price has used the power of crowd fear and also followed a regular rule markets move by - failed to meet expectations.

Meanwhile, Bloomberg’s leading commodity strategist believes that “we see a more-enduring bull market”.

Traders ponder if Bitcoin will dive below $30,000 again

Santiment has tweeted that while traders’ opinions whether Bitcoin may drop under $30,000 again have split, FUD (fear, uncertainty, doubt) remains on a high level.

Bitcoin’s move back to the $34,000 level after hitting $28,000 was made on crowd fear, company analytics team stated, since markets tend to move opposite to where the crowd expects them to move.

“Bitcoin’s $30,000 is similar to $4,000 one-two years ago”

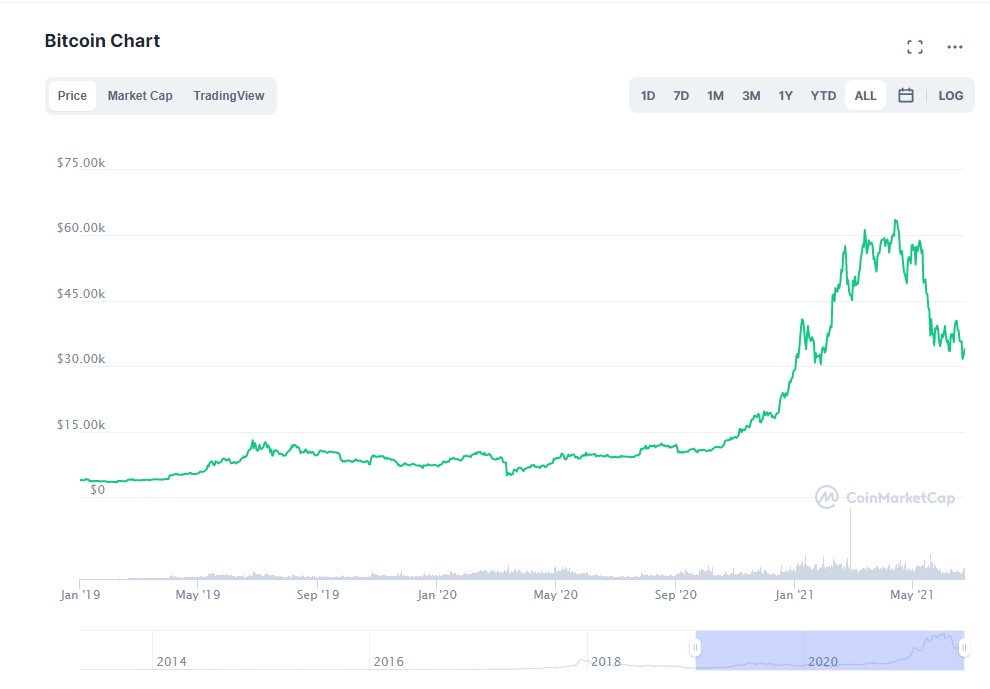

Chief commodity expert of Bloomberg, Mike McGlone, believes that the price level Bitcoin is holding by at the moment - $30,000 – could be similar to $4,000 in 2020 and 2019.

In March last year, Bitcoin dropped below $4,000 for a short while, losing about 50 percent of its value in just twenty-four hours.

Following both March 2020 and March 2019, when Bitcoin was exchanging hands at approximately $4,000, BTC started to rally, ultimately coming to the $13,000 peak on 26 June in 2019 and to the $27,000 high on December 28 in 2020.

The latter exceeded the ATH of $20,000 hit in December 2017 prior to the start of the “crypto winter” that lasted about two years.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin