Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

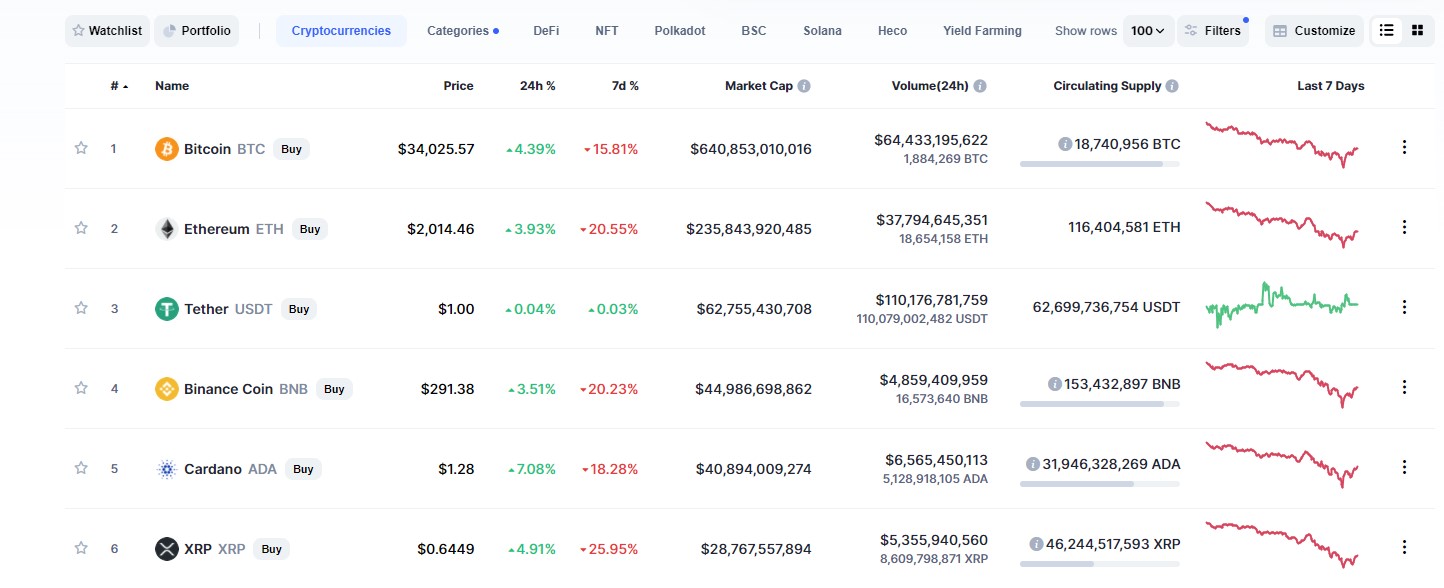

Bitcoin is again trading above the $34,000 level (4.39 percent up), Ethereum recaptures the $2,000 price mark (3.93 percent up).

Both currencies dropped below these crucial support levels of $30,000 and $2,000 on Tuesday, along the other major cryptocurrencies – BNB, ADA, XRP and the others.

Bitcoin and other top cryptos are gradually recovering

Right now BNB is showing a rise by 3.51 percent, Cardano’s ADA is 7.08 percent up and Ripple-affiliated XRP token has grown almost 5 percent, trading at $0.6449, according to the data provided by CoinMarketCap.

Altcoins, including Ethereum, have been following Bitcoin’s decline caused by the recent crackdown on Bitcoin miners and crypto trading platforms initiated by the Chinese government and covered by U.Today earlier this week.

Bitcoin hashrate suffered a massive decline due to miners having to close down in China or starting to move to friendlier jurisdictions, like Kazakhstan or Canada.

Major BTC sell-offs have also contributed to the price fall.

Some, however, are using this period to stock up on BTC on the dip. Investor and entrepreneur Robert Kiyosaki (author of the bestselling “Rich Dad, Poor Dad” non-fiction book on financial literacy) and ARK Investment Management spearheaded by Cathie Wood have recently tweeted they were buying the dip.

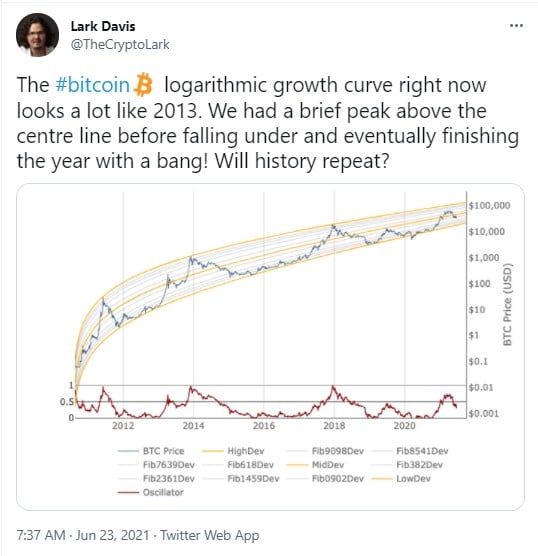

A model similar to 2013 fall and rise

Crypto trader Lark Davis has posted a tweet in which he points to a similarity between the current Bitcoin behavior and that noticed in 2013.

Back then, the flagship digital currency (only promoted by enthusiasts and geeks) also dropped heavily after a rally to a bigger high of above $1,000 per coin after that.

The trader ponders whether history will repeat itself now.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov