Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

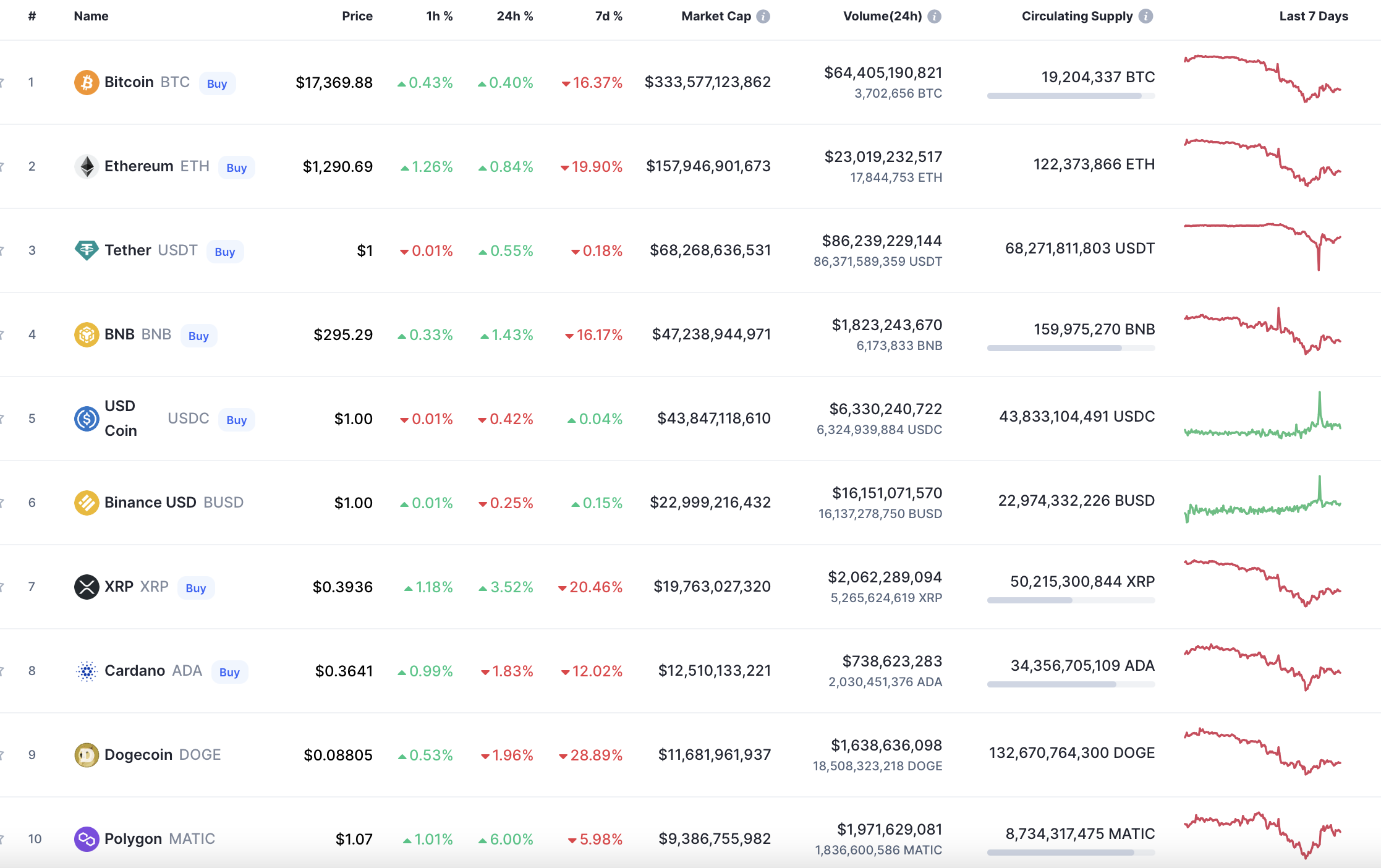

Even though the day started with a market bounce back, the rates of some coins are still falling.

BTC/USD

The rate of Bitcoin (BTC) has risen by 0.40% over the last day.

On the hourly chart, Bitcoin (BTC) started the day with the false breakout of the local resistance level $17,964. At the time of writing, the price is stuck in a range where $15,722 serves the support level.

If the rate comes back to it, the fall may continue to the $15,000 zone.

On the daily chart, the situation is bearish as the price could not keep the rise after yesterday's bullish candle. If the drop continues to $16,000, there are high chances to see the breakout of the recently formed support level at $15,632 soon.

From the midterm point of view, Bitcoin (BTC) is on its way to the next support level at $13,880 if the bulls cannot seize the initiative soon. However, if a bounce back above the $18,00 zone happens, one can expect the test of the mirror level at $21,000.

Bitcoin is trading at $16,890 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov